Have you ever looked at the checking account at a bank or credit union? If you have either of these two, you’ll receive a monthly statement showing the account’s beginning and ending balances. It also has all the monthly transactions. You may also find a transaction type that has the label POS. So, what does POS mean in banking?

What does POS mean on a bank statement?

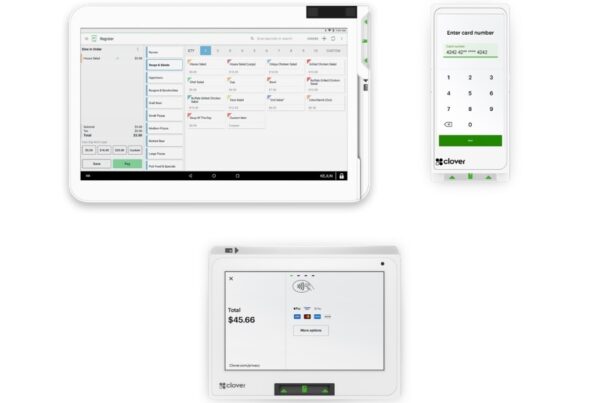

POS in banking means that you use your debit card to purchase at a point of sale (POS) location, such as a store’s cash register or POS system. In addition, POS on bank statements is the transaction type labeled “POS”.

You may wonder here, “What is a POS purchase?”. If so, you need to understand POS and how it works. A POS system combines software and devices that merchants use to record and complete sales transactions. And here is the process of using a debit card in a POS transaction:

- Cashiers insert your card into the reader.

- You enter the 4-digit personal identification number (PIN) on a terminal.

- POS checks your entry by validating the PIN stored on the card’s chip.

- POS verifies online with data on the chip if your bank account has enough money to complete the purchase, and if so, updates the account with the purchase information.

What is POS debit?

POS debit means a point of sale debit in banking terms. A POS debit card transaction means that you use your debit card with PIN to purchase.

However, there is still one more important thing you need to keep in mind with the question “What does POS debit mean?”. It’s different from direct benefit transfer (DBT) purchases, which means that no PIN was required when you swipe or insert your debit card for that purchase.

Any such transactions that you make get posted to your account immediately. Then, you can review your POS transaction meaning on your bank statement by the spending amount and sometimes even the merchant’s name.

What is the difference between POS and debit?

POS transaction includes all purchases made by either an ATM card or a debit card with an access device, whether authenticated using a PIN or a signature.

On the other hand, debit card transactions can include POS transactions completed with a debit card, as well as signature-authenticated purchase transactions that are switched via the national credit card networks.

The decrease in cash transactions after COVID-19 and the needs to understand product demand have led to the adoption of advanced POS systems that can help merchants track and reconcile credit card transactions.

How do you reconcile a POS transaction?

After explaining “What does POS mean in banking?”, we’ll discuss one of the tasks that every retailer and customer should do – POS reconciliation – to ensure that your financial activity is recorded correctly and that the amounts are accounted for.

POS reconciliation is an accounting task that compares two sets of records and sees if the figures match. It, in other words, confirms whether the amount left in the account is the same as the amount spent or received. By conducting POS reconciliation, retail businesses and customers can achieve greater accuracy and consistency in their financial records.

Read more: POS reconciliation – What is POS reconciliation?

The benefits of POS reconciliation are clear; it’s time to explain how.

The POS transaction on bank statements appear with the label POS to differentiate them from other types of payment methods. Thus, you can check your bank statement every month if you want to verify POS transaction lists by scanning for POS transactions among all instances of your debit card. If you don’t recognize any transaction, you can report the problem to your bank for investigation.

Here are 5 steps to reconcile your POS transaction:

- Compare internal records with your statements

- Identify transactions that you can’t cross-reference

- Verify incoming funds on both documents

- Contact your bank for suspected errors

- Maintain a balanced set of books

FAQs

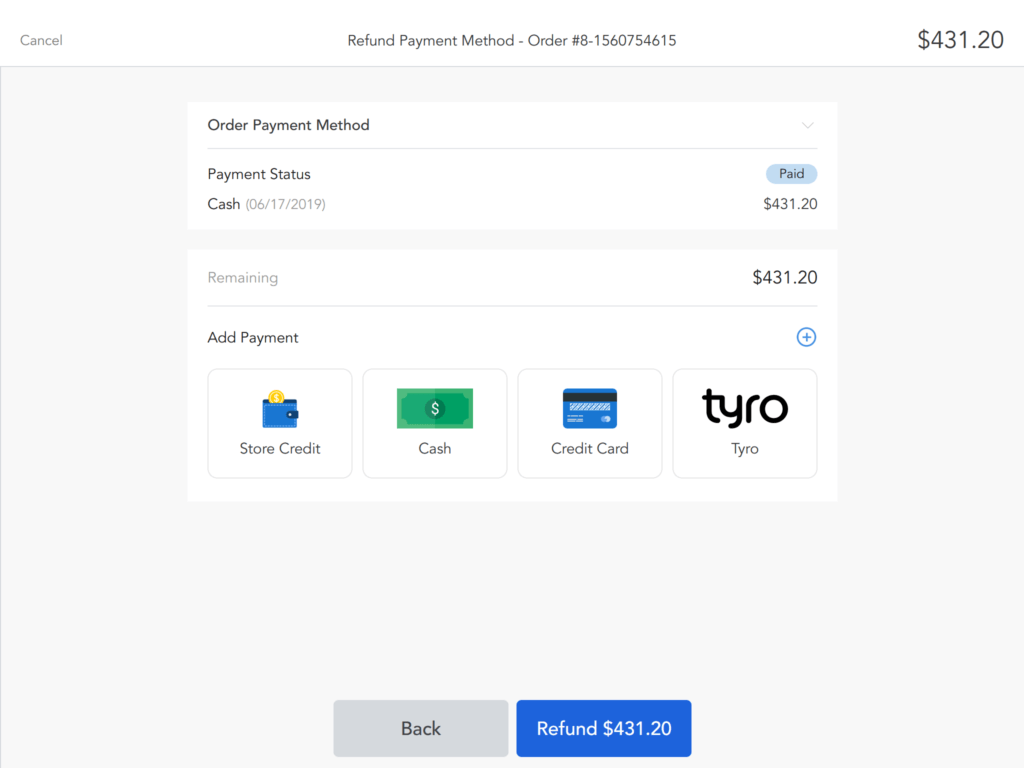

What is a POS refund?

A POS refund is a refund of a credit card payment at a point of sale when customers return purchased products or sometimes when cashiers make a point of sale adjustment to correct input errors. Usually, POS refunds must be made for the exact amount of the original transaction. It takes between 7–10 business days to process a debit card refund. In the best-case scenario, it takes up to 3 days, depending on your bank.

How do you withdraw money from a POS machine?

Some people may wonder, “What is a POS withdrawal?”. It means that cardholders can withdraw cash by debit and prepaid cards at POS terminals. However, it depends on the mechanism issued by banks, and the buyer’s bank designates POS terminals.

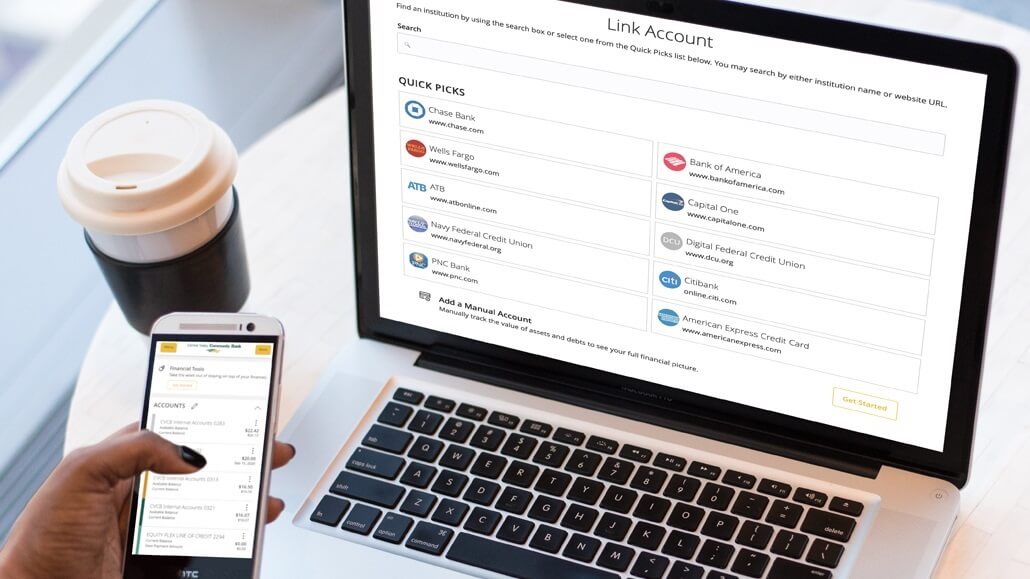

Can a POS transaction be traced?

Yes, you can trace a POS transaction on bank statements. For example, if your transfer isn’t within the promised period, you can request a trace on your transaction using the bank’s SWIFT code. A SWIFT code is an ID that banks use when sending wire transfers. With this number, your bank can determine whether the deposit is on hold or in progress.

In general, here is how you can track a money transfer:

- Check your receipt: Look for a reference, confirmation, order, transaction, or similarly named numbers.

- Contact the merchant: Call, go online, or visit POS locations where you make payments and provide your tracking number.

- Sign up for notifications: Get notifications on each step of your transactions.

Final thoughts

Now that you are clear about “What does POS mean in banking?” you may want to take more advantage of it and meet global POS market trends.

For merchants, the benefits of using POS for your business are:

- Accept MasterCard and VISA transactions of any value

- Confirm transactions in real-time

- Print transaction receipts so you scan barcode to track POS transactions

- Reduce costs and risks of cash handling

- Centralize in-store and online payment transactions with eCommerce POS integration

- Generate reports for POS reconciliation

For customers, it’s a much quicker and more comfortable payment method than cash and check or withdrawing cash from POS.

It’s a safe system, and you can reconcile your POS transaction on bank statements without any hassle. If you don’t recognize any transaction, you can report this discrepancy to your bank for investigation. Go cashless and enjoy the benefits of the POS system, as it helps you keep track of all your spending.

Great article! I found the comparison between POS and debit transactions really insightful. It’s helpful to understand the differences in terms of convenience and fees. I never realized how much the choice of payment method could impact my budgeting. Thanks for breaking it down!