Store credit is not a new term to business owners since it has been applied widely by almost all retailers in recent years. It provides many significant benefits to both retailers and customers in improving sales and customer purchasing experience. Nowadays, with all standardized procedures managed by a system, it has evolved into a program or feature that all POS providers try to incorporate into their software to support retailers. So what is a store credit? And how to apply in a business? We will find out the answer in this article.

Store credit definition

What is a store credit?

Store credit refers to a program created for retailers to give some amounts to their clients after they make purchases or return things. Those amounts are not real cash but stored in the customer account for the next purchase.

Is store credit the same as cash? And is store credit considered a refund?

Store credit is not cash because it is just valid in the issuing retailers. But it has a value that can be exchanged for a cash equivalent amount to purchase new stuff.

There are four types of store credit that retailers normally use, including return and exchanges, store credit cards, gift cards, and loyalty rewards. Store credit can be considered as a refund when it is applied for the return and exchanges of products. The retailer will offer the store credit as a full refund for the returning items.

What is a store credit example?

Let’s say you go to Home Depot and return a hammer because it is not the right stuff you need or you want to find a better one. They will not refund your money, but they will give you a receipt that you may use to apply the payment to your next purchase, and you will only have to pay the difference.

How does store credit work?

Store credit works in a simple procedure with the following steps:

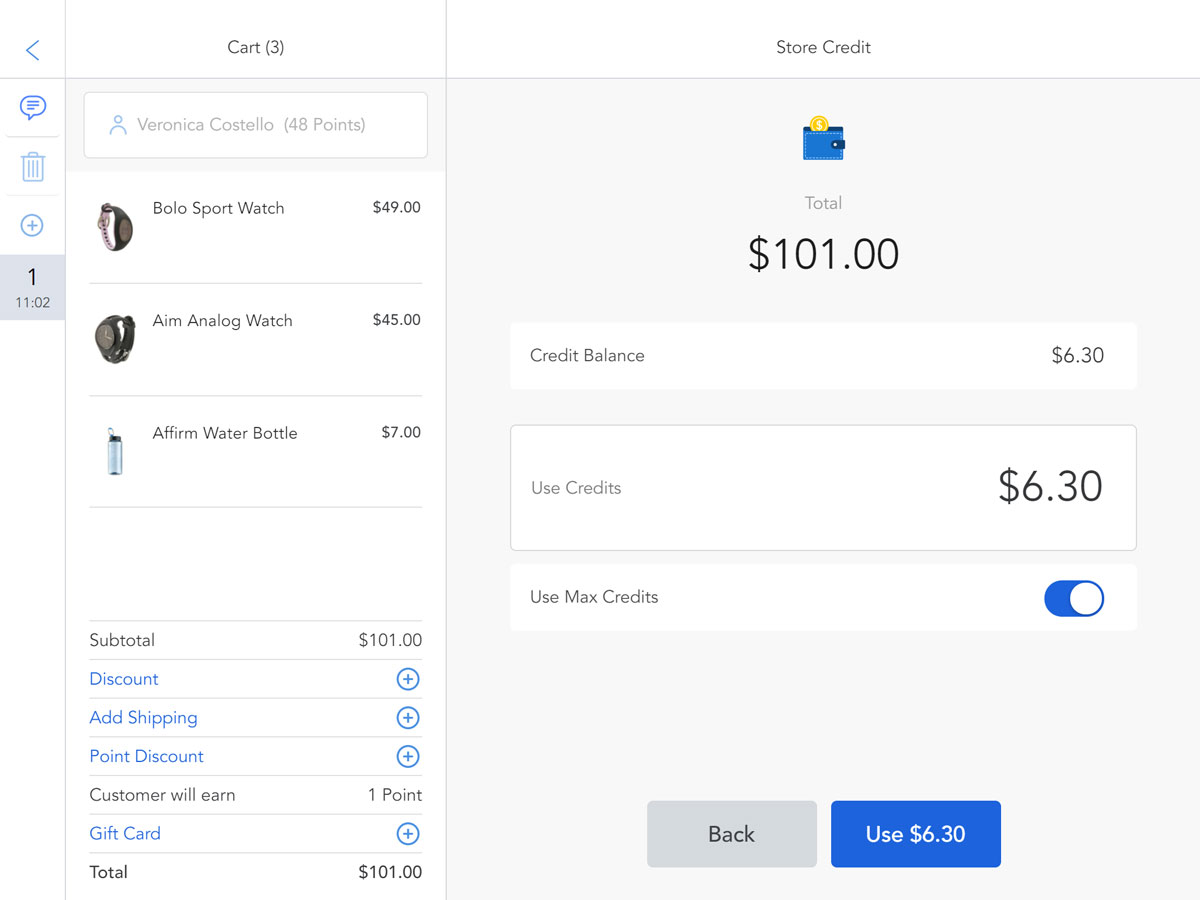

Step 1: Log in to the customer account

Customer logs into account or presents a store credit card, gift card before beginning the checkout process.

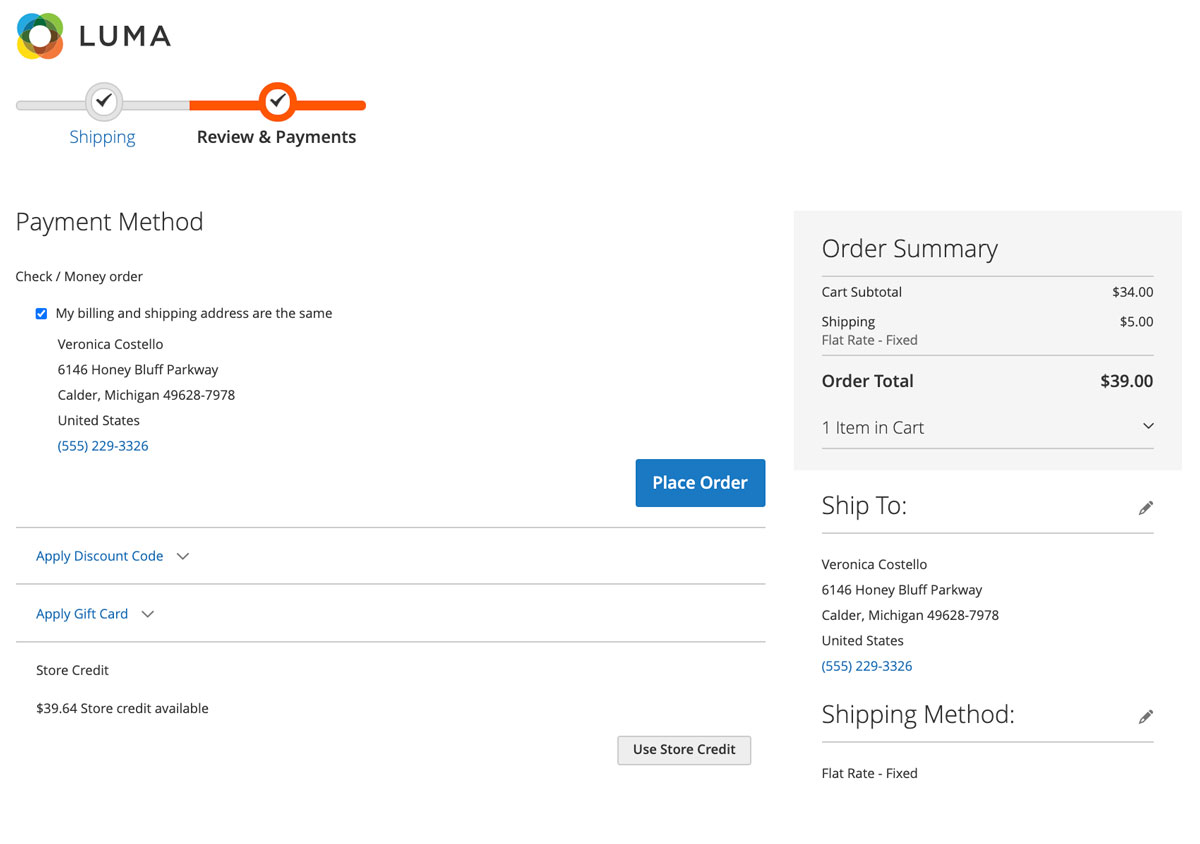

Step 2: Choose “Use Store Credit”

The consumer chooses “Use Store Credit” as a payment option during the “Review & Payments” step of the checkout process. In parenthesis, the available balance is shown. The other payment options are no longer visible if the available balance is larger than the order total.

Step 3: Apply the store credits

The amount of store credit applied to the order is shown alongside the order total and deducted from the grand total.

Step 4: Adjust customer balance

Once the staff completes the order, the customer’s available balance is changed.

What are the advantages and disadvantages of store credits?

Store credit advantages

Store credit policy brings a lot of benefits to the retailers including:

Improve customer retention and loyalty

With provided store credit for the next purchase, customers are encouraged to come back to your store to make another purchase. This will help retailers to boost customer retention and also increase customer experiences. Besides, store credit allows you a second chance to impress your consumers and incrementally create customer loyalty.

Encourage customers to spend more

Customers normally feel more comfortable with a reasonable store credit policy than not accepting returns. In reality, store credit cards or gift cards have been shown to encourage customers to visit the store more frequently. Furthermore, when shoppers are enticed by other things inside the store, they tend to spend more than their store credits. Retailers who take advantage of this opportunity will be able to increase sales.

Lose less revenue on returned goods

When customers want to return the products, it is quite a headache for the retailers to ensure both customer satisfaction and revenue. However, Store credit can allow you to avoid losing revenue due to returns by converting sales into exchanges, but still not destroying customer purchasing experience.

Store credit disadvantages

On the other hand, store credit does not always benefit retailers. It also has some drawbacks that retailers may not recognize. It can harm a retailer’s reputation. Since the store credit is just valid in the same store, customers may feel worse rather than better if they are “forced” to continue purchasing at a retailer. Therefore, store credit just works well for the retailers who have a wide range of products for choosing from.

How to apply a store credit program to your Magento business?

- If you have a business that’s running on Magento Commerce, Store Credit is an out-of-the-box feature that you can configure and run immediately.

- If you use Magento Open Source edition or want more advanced features, all you have to do is acquire a Magento store credit extension and integrate it into your platform to manage all of your online purchases and store credits.

Most Magento 2 Store Credit extensions automatically turns refund amounts into Magento store credit, which consumers may utilize to make future purchases, resulting in increased sales and customer retention. Many Magento 2 Store Credit extensions also allow the administrator to manage store credits from the backend and alert consumers when their credit balance changes. You can use the module to reward clients with cashback and encourage them to return to your business.

However, the majority of Magento store credit addons just work well with Magento stores. What can you do if you have both physical and online stores?

It’s necessary to install a system that can sync both online and offline data to manage all online and in-store sales and returns. Few available systems in the market can work well for both online and offline businesses. Magestore POS is a software designed for Magento users but can be an all-in-one system for both online and offline stores. In particular, it offers a store credit feature.

Magestore Store Credit is a simple and quick way to add a credit system to your Magento website. It improves client interaction and brings in new customers to your physical store. Meanwhile, your customers can easily manage and redeem their store credit balance, whether online or in-person. Consumers can also share their credits with others, which attracts new customers and boosts sales.

Conclusion

In short, once you can grasp the question of “what is store credit”, you will realize that store credit can be used for a variety of purposes. It’s more than just another payment option for retail customers. It has the potential to increase customer retention and brand loyalty for your business. By using store credit in more creative and purposeful ways, you may increase spending and grow your store’s revenue.