Cost of goods sold is one of the most essential metrics when you’re doing business. It is the direct cost of materials and labor involved in the production of your goods. This cost has a major impact on your profitability, therefore, you need to truly understand how it works and how to manage the cost of goods sold for your company. This article will cover the key knowledge on COGS, including its definition, formula, different accounting methods, and why COGS is vital for your retail store.

What is cost of goods sold (COGS)?

Cost of goods sold, or cost of sales, is the direct cost of manufacturing or acquiring the products that you sell during a period, such as quarterly or annually. These costs include core components that create your products like the materials and direct labor required in production.

For example, the cost of goods sold for a fashion boutique includes the fabric, the thread, the packaging, and the labor to produce a shirt if they do self-manufacturing. For a retailer, COGS mainly includes the cost of purchasing inventory from suppliers.

Since the cost of goods sold has a direct influence on your gross profit, it, in turn, affects your gross profit margin. According to research from BDC, the gross profit margin ratio in fashion retail can vary from 3% to 13%, while some restaurants in the F&B industry can achieve a 40% gross margin. Thus, efficient management of your COGS can lead to an improvement in your margin, and even a 1-2% improvement can be a big difference for retailers.

What is included in the cost of goods sold?

COGS only includes the costs that are directly tied to the production like raw materials, labor, and manufacturing overhead. It also includes the fixed cost of machinery, supplies, and consumables required in production.

Is COGS an expense?

Yes, the cost of goods sold is an expense. However, it excludes other operating costs, which are indirect costs that support the production process, such as rent, office supplies, sales and marketing, software, utilities, insurances, etc. In your income statement, cost of goods sold and operating expenses are recorded as 2 separated items, and will both be subtracted from your total sales figures.

Next time someone asks you “what does the cost of goods sold mean?”, you already have the answer. Now let’s continue with some calculations.

How to calculate the cost of goods sold?

Below is the simple cost of goods sold formula for physical products:

Cost of Goods Sold = Beginning Inventory + Purchases – Ending Inventory

If you’re a manufacturer with labor costs, you can include those as well, but that may not apply to all businesses.

Let’s take a closer look at each item:

- Beginning inventory: The total cost of your inventory at the start of your fiscal year. This number should match the ending inventory of the previous fiscal year.

- Cost of purchases: The total cost of products purchased during the fiscal year that’s available to sell, including raw materials, labor cost, and any other cost related like shipping freights of the inventory (if any). If you’re buying too much inventory and not sure which items sell best, the 80/20 inventory rule can help you.

- Ending inventory: The total value of the remaining inventory in stock at the end of the fiscal year.

Cost of goods sold example

Here’s an example of how to apply the cost of goods formula into business.

At the beginning of 2021, a sportswear retailer had $10,000 worth of inventory, including all shirts, shoes, sports equipment, etc. This is the same ending inventory number for 2020.

Throughout 2021, they purchased more items and added to their warehouse $15,000 of inventory. Therefore, the total cost of products ready to sell is $25,000, including the stock from the previous year and the newly acquired items.

At the end of 2021, the store counted their stock and found that they had $8,000 value left in stock.

We can summarize the information as follows:

- Beginning inventory: $10,000

- Purchases: $15,000

- Ending inventory: $8,000

Applying the cost of goods sold equation, cost of goods sold of the retailer in 2021 is:

$10,000 + $15,000 – $8,000 = $17,000

Accounting methods for COGS

Let’s explore the accounting methods for COGS. Depending on the accounting method of your business, the value of COGS can vary. Here are the 4 different methods you can use to measure inventory:

- First in, first-out (FIFO)

- Last in, first-out (LIFO)

- Weighted average cost

- Special identification method

First-in, first-out (FIFO)

First in, first-out (FIFO), is the management approach where items produced or purchased first are sold first. This is the best application if you’re selling perishable products or products with a short shelf life.

If prices are likely to go up over time, you should use FIFO when you plan to sell your products from the lowest to the highest prices. FIFO makes your closing inventory higher, and your COGS will be lower for the year. As a result, your gross margin, calculated by deducting COGS from revenue, will be higher. With lower COGS, your net income, or profit, will increase as well.

When prices are decreasing, you have the opposite impact.

In addition, a higher closing inventory under FIFO will contribute to higher asset value for your company. This is a great benefit if you’re trying to get a bank loan to expand your business, as your asset liquidity is an important factor for the bank to make their decision.

Last-in, first-out (LIFO)

The opposite of FIFO is LIFO, which stands for “last-in, first-out”. It means you first sell the items that you most recently purchased or produced. If prices are growing and the goods with higher inventory costs are sold first, your COGS will be higher. Therefore, the closing inventory will be lower, and the net income will decrease as well.

During a time of inflation, LIFO leads to a higher COGS on your financial statement, lowering your taxable income.

Weighted average cost

Weighted average cost is the method of taking the average price of all products in stock to calculate the value of goods sold, regardless of purchase date. It’s the best method for mass-produced items such as water bottles.

By using the average product cost over a period, you can avoid extreme costs for some of the temporary purchases or acquisitions, and give your COGS a smoothening effect. In addition, this method will average your inventory carrying cost and cost you less time and effort to manage inventory than the other methods.

Special identification method

The special identification method tracks the cost of each specific product to identify COGS and the ending inventory of each period. This method is used when a business knows precisely which items were sold and the exact cost. Some industries that prefer this method are cars, jewelry, real estate, and other luxury items.

Why is COGS important for your retail store?

Cost of goods sold is an important metric for a business to track, together with the inventory ratio. It’s the absolute lowest price to sell a product to break even. Other additional margins shall cover overhead and create profit. If you lose track of your COGS and your break-even point, you don’t know if you’re making or losing money.

Here are a few things to keep in mind when evaluating your COGS:

- Cost of goods sold has a substantial impact on margins. Manage your COGS to ensure it is low enough for you to offer a good price for customers and still make a reasonable profit.

- Look for underlying costs of COGS: When assessing your COGS, check for any opportunities you can save costs instead of only looking at the surface. Even a small reduction in COGS can lead to a much bigger return.

- Keep a long-term focus: Put COGS in a long-term strategy to run your business. Don’t make cost cuts that may ruin your product quality and hurt your customer experience. Instead, save costs where possible and still align with the business’ strategy.

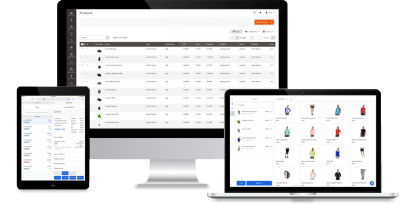

To help you manage your inventory and cost of goods sold easier, Magestore offers a highly customizable Magento POS system, where all data on inventory and sales are recorded in real-time. It helps you know the sales performance of each item, when to purchase more stock, and control the inventory movement from your warehouse to different stores.

To wrap up

This article has walked you through what the cost of goods sold is, how to calculate it, and different accounting methods you can choose for your company. Cost of goods sold has always been a key metric for companies, especially manufacturers and merchandisers. Knowing your cost of goods sold meaning and understanding other business costs will allow you to keep them under control. If you can manage these expenses well, you can find ways to work toward your goals and improve profitability.