Inventory audit is a vital process to maintain accurate stock, spot causes of shrinkage, and make sure you have the right available stock on hand. Understanding stock flow will help your business run smoothly and fulfill customer orders quickly. In this article, we’ll walk you through the 9 procedures of stock audit, how to conduct an audit, and the best practices to apply.

What is inventory audit?

An inventory audit cross-checks a company’s financial records against its inventory records and ensures these records match its physical inventory count. It is a vital process to ensure inventory accuracy and identify any discrepancies in stock counting or financial records.

In physical counting, you will go through every item in the warehouse to record the number of available products, usually with the assistance of technology. Audits take it a step further to confirm the correct quantity, as well as the quality and condition of your stock.

Importance of inventory audit

Stock audit is crucial in retail management due to multiple reasons:

- Identify discrepancies. If there are differences between the actual stock quantity and the accounting records, you can spot where to investigate further to resolve the issue.

- Reveal overstocking or understocking situations and help with asset management and inventory forecasting. Auditing stock informs you of which items are hanging over the shelves for too long, and which items are running low in stock. From there, you can take proper actions, such as offering a discount to push stale products faster and purchasing more items that generate higher revenue and profit margin.

- Detect losses resulting from theft, damage, and obsolescence. The losses often lead to a root cause of poor management procedure. For instance, your high-value products are placed too close to an unmonitored exit, or some fraudulent activities happened.

- Determine the efficiency of your logistics and warehouse workflows. Inventory shortage can occur in the logistic process, such as missing items during transferring from the container to the warehouse.

9 procedures to audit inventory

Here are the 9 audit procedures for inventory that you should apply:

1. Physical inventory count

The inventory count audit procedure is to take physical counts of inventory in your warehouse and compare the numbers to what is shown in your system. You can use a barcode scanner to support you count the items physically. This is convenient for businesses that follow a just-in-time inventory method or regularly compute their economic order quantity.

For example, your inventory management software shows you have 1,000 products, but you only count 950 units in your warehouse. You should check what causes the difference as soon as possible.

2. Cutoff analysis

Cutoff analysis means halting all operations during the physical inventory count. There will be no receiving or shipment of products during this process to avoid mistakes from uncontrolled variables. At the cutoff time, all transactions before that shall be reported properly in the financial period. Auditors will check the documents of receipt and shipment to verify the recorded stock movement is accurate.

For example, you plan to conduct a cutoff analysis from 9:00 AM to 3:00 PM on 1st December 2022. All activities that move inventory in and out of the warehouse are paused during this period.

3. Finished goods inventory analysis

Analysis of finished goods cost is ideal for manufacturers and producers. When inventory goes through the production process, it becomes a “finished good” to be sold. Then, you can calculate the inventory value of the finished products to make sure the financial statements are correct and better control inventory.

For example, you create 100 T-shirts with $600 cost of fabrics, embroidery, T-shirt buttons, etc. It means each T-shirt costs $6 for raw materials to produce.

4. Freight cost analysis

Analysis of freight cost measures the shipping costs to transport products from one location to another, and instances of items getting lost or damaged during transit. It also accounts for losses and damage incurred during transit.

For example, you transfer the products from your warehouse to your stores and monitor how much it costs, such as carrier by truck.

5. Overhead analysis

Overheads are the business expenses that exclude the direct materials and labor required for production, such as rent, electricity, or other “hidden” costs associated with inventory. When analyzing overhead costs, you want to see how they affect the overall inventory cost so that you can plan your budget properly.

For example, your indirect costs are $5,000 per month with the capability of producing 2,000 T-shirts per month. If you want to scale up to produce 4,000 T-shirts, your overhead will be $7,000 per month. Together with the variable cost, you can use the economics of scale to find the optimal point.

6. Inventory in transit analysis

When transmitting materials between different locations, you need to track the lead time for the products to arrive. This audit analysis will ensure nothing is lost or damaged during transportation. Inventory auditors will review the transfer documentation to identify any problems.

For example, you need 1.5 days to transport your products from your warehouse to 3 different locations. Monitoring the time can help you define when you should prepare to get the products to the store on time.

7. High-value stock tests

The high-value inventory item tests, also known as the ABC analysis, involve classifying your products based on their profitability. Group A consists of high-value items, group B is the mid-tier, and group C is the low-value products. If some products in group C have a high selling volume, you can place them near the entrance to speed up trips to the sales floor. In contrast, the high-value, low-volume items in group A should be secure safely to prevent costly theft.

For example, you can divide your products into the 3 groups like this: the top 20% of high-value products belong to group A, the next 50% is to group B, and the last 30% is to group C.

8. Direct labor analysis

Direct labor is the cost of labor needed to manufacture a specific product. It can be considered as the cost of working hours, shift differentials, and overtime hours of employees. In addition, you can add in payroll taxes, bonuses, or other benefits costs that are spent for employees to get the full picture.

9. Inventory count reconciliation

At the end of the process, you need to check the physical count matches your company’s books. Inventory reconciliation is an essential part of cycle counting. If you detect issues during your inventory count, investigate further to reconcile products. This way allows you to track any SKU numbers which are error-prone in the future.

If there are differences between the inventory records and the actual number on your warehouse shelves, you must figure out the reason and modify the records to reflect this analysis.

How to audit inventory?

Carrying out your audit periodically will increase your visibility of how inventory is moving through the supply chain. There are 3 phases of an inventory audit: planning, execution, and analysis. Let’s explore the checklist to audit stock.

- Evaluate which items to audit: Inventory items with a higher risk should be assessed more frequently. You can use SKUs and barcodes to sort out and prioritize your goods.

- Schedule your company audits: Next, plan an auditing schedule. To minimize the disruption to your business flow, you should choose times that are not too busy, but still have a good frequency to get the high-value items into the audits. Note that your shipping policies may also affect your audit schedule, especially if you promise fast delivery to customers.

- Collect the necessary documents: Collect all important documents in advance and make sure they can be assessed easily and securely.

- Conduct the audit: There are various types of audits as mentioned above. You decide which one is essential based on the nature of your business. Furthermore, make sure you have an unbiased internal auditor and understand how to perform the audit.

- Record the findings: The purpose of audits is to find gaps and search for ways to improve the operational processes. Therefore, you must record what happens during the audits and keep track of the results year to year or cycle to cycle.

- Report the findings: When the audit is completed, create a report highlighting key findings and suggestions. In future audits, you can recheck the previous report and see if things are improved.

How to optimize the inventory audit procedures?

Here are the 5 best practices to plan for a successful audit of inventory:

Choose the right timing

Since all operations are frozen during the physical count, you need to plan the time for the audit carefully. The audit should take place when paused operations have the least impact on fulfillment.

For instance, if you want to do an audit for the end of the year, you shouldn’t pick December directly. Since this is usually a busy month with holiday shopping, you can use roll forwards and rollbacks to run the physical count before or after year-end.

With roll forwards, you can calculate the ending inventory by this formula: (Inventory of the last full physical count) + (purchases and other direct costs) – (cost of goods sold).

For example:

- Your ending inventory last year is worth $6,000.

- This year, you’ve purchased $10,000 of stock, and the sold inventory values $12,000.

- Your ending inventory for this year will be: (6,000+10,000-12,000)=$4,000. This is also known as your inventory reserves in the balance sheet of the year.

For the rollbacks method, you set a cutoff date for the audit. It can be the end of your financial reporting period. Therefore, when you conduct the physical stock count, disregard any transactions that happened after the cutoff date to get the full-year number.

Organize your warehouse

Before the audit, arrange your warehouse logically to easily identify the location of the audit stock. Minimize the number of mixed pallets and keep similar products close to each other. You should have a consistent approach to storing and counting items.

In addition, check for the damaged, obsolete, or returned inventory sitting around randomly in your warehouse. You should deal with them before the audit, such as writing them down, throwing away, repairing, or reshelving them to lower your inventory carrying cost.

Identify your focus

Go through the overview of what makes up the inventory and determine the highest value and risk. That’s where you should spend most of your time.

Check for outlier items and review reconciliations to see where management is having difficulty. This information will help you make the most of your audit to come up with valuable insights into your inventory management process.

Prepare suitable staff

Assign 2 different teams to perform inventory count audit to minimize errors and fraud. You should choose your most detail-oriented and attentive warehouse staff. Otherwise, you can use external inventory counting services to help you.

In addition, arrange knowledgeable warehouse employees to assist the auditors during the counting observation. The personnel will expedite the auditor’s assessment of the inventory condition, as well as locate and identify items selected for audit test counts.

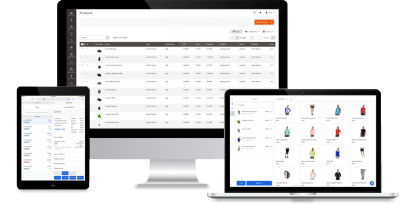

Embrace technology

Technology can speed up and facilitate audits so they have less disruption on your company. A must-have software for businesses is an inventory management system (IMS). When choosing an IMS, make sure these features are available for audits:

- Show inventory data in real time;

- Customize criteria to perform inventory cycle counts, including frequency and counting strategies (ABC analysis, opportunity-based, etc.);

- Set up regular cycle counts based on triggering events to minimize discrepancies rather than waiting for a complete physical count.

Furthermore, equipping a warehouse management system (WMS) will control countings more efficiently and reduce human errors in data entry. Here are some benefits of a WMS:

- Run on mobile devices for portability;

- Connect with barcode scanners to scan bins and items to make sure they’re in the right place;

- Automatically record inventory from every scan and add it to the database;

Compare the data in the WMS to inventory records and highlight any issues for further review.

To sum up

Above are the 9 audit analytical procedures and the advice to carry out your audit. With the right strategy and execution, audits play an important role to ensure your inventory is correct and up-to-date. From there, you can be confident to run your business, sell more, and expand your market.

FAQs:

1. What are the 3 types of audits?

There are 3 main types of audits including external audits, internal audits, and Internal Revenue Service (IRS) audits.

2. What are the risks and challenges of inventory audits?

Some of the most common challenges that auditors confront are:

- Damaged inventory that needs to be adjusted to reflect its actual value;

- Miscounted inventory that can raise or lower the reported earnings;

- Mistakes in shipping and receiving goods cause incorrect cutoff inventory records;

- End-of-year liabilities with suppliers aren’t accurately recorded;

- Consignment inventory errors, where inventory in your warehouse may be shown as “on consignment”, or vice versa.