The success of a retail business relies on carefully managing cash flow, supplier relationships, and customer expectations. However, keeping this balance is difficult for most retailers especially when payment issues emerge.

For example, tracking a large volume of invoices can keep you so busy that you may miss out on many early payment discounts and significant savings.

Late payments are more risky, even if they seem common with 92% of business owners admitting to paying suppliers late. However, suppliers might set stricter terms if this happens too often. Consequently, consistent payment delays lead to stock shortages and frequent stockouts surely chase customers off.

The solution for this math is payment terms. This article will help you understand their definitions, types, and how to choose the best invoice payment terms for your business.

- What are payment terms?

- What is included in payment terms?

- Payment term examples on an invoice

- Different types of payment terms

- Where should you place the terms of payment on an invoice?

- How do you set the best invoice payment terms and conditions?

- How to negotiate payment terms with your suppliers?

What are payment terms?

Payment terms are detailed conditions that the seller and the buyer agree on how, where, and when the buyer pays.

Here’s how payment terms for invoices work for retailers, the bridge between suppliers and customers.

- With suppliers: Payment terms set the timeline and process for retailers to pay for the inventory they order.

- With customers: They specify how customers pay retailers for purchases.

Why are payment terms important?

Having well-defined and mutually accepted terms of payment is critical because they assist in the following:

- Improved cash flow management: PwC highlighted that shorter payment terms contribute to more predictable business planning, elevating cash flow. On the other hand, uncertainty about payment timelines can result in high operational costs or payroll issues.

- Dispute reduction: By creating standard payment terms at the onset, both sides have a mutual understanding of when payments are due. This clarity prevents disagreement over missed deadlines, thereby reducing arguments.

- Stronger ties with clients: Clear and adaptable terms can evoke satisfaction and trust from clients, making a business more appealing than those with rigid policies.

Who decides the payment terms?

The business providing the product or service determines the payment terms. They usually set the conditions before any transactions take place. If you’re not the one deciding, don’t worry. There can be room for negotiation with the decision-maker, especially for bulk orders. Once both sides agree, the seller writes them on the invoice to ensure everyone’s on the same page.

What is included in payment terms?

The following are major components of payment terms in an invoice:

- Total amount: The complete product or service value to which both parties agree.

- Invoice date: The day of invoice issuance that begins the entire payment procedure period.

- Early payment discounts: Incentives for the buyer in cases of paying ahead. If the buyer settles the payment within a specific timeframe, they could grab a small discount.

- Payment period: The agreed-upon timeframe for settling payments, starting from a particular date like the invoice or delivery date. Depending on industry norms and client relationships, this period can range from 7 to 90 days.

- Due date: The payment deadline. The seller anticipates receiving payment on this day.

- Due upon receipt: Payment is due as soon as the customer receives the invoice.

- Late payment penalties: If the buyer does not comply with the termination date, they’ll incur a penalty. This term explains what will occur if payment is late.

- Payment methods: The buyer’s possible means of payment, such as bank transfers, credit cards, and digital wallets. They also feature more modern options like buy now pay later and split payments.

Payment term examples on an invoice

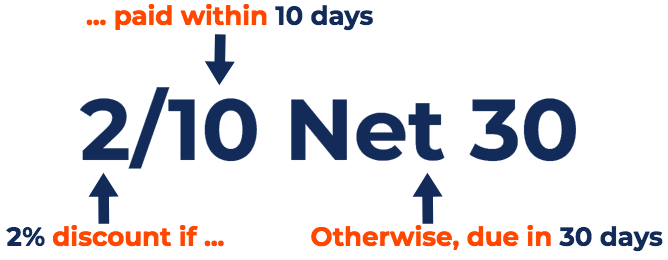

Let’s say that you, a retailer, have been able to place a $5,000 purchase order with your supplier. They issued you an invoice on January 1, including a 2/10 Net 30 term. What does it mean?

You can break this term into smaller parts. Net 30 means the payment period will last 30 days, starting from January 1. 2/10 refers to a type of discount payment terms, meaning you’ll receive a 2% discount if you pay within the first ten days. And there can be three possible scenarios:

- Early payment: Under the discount term, you need to pay only $4,900.

- On-time payment: If you miss out on the discount, don’t panic. You can still pay $5,000 before the due date with no additional fees.

- Late payment: Skipping the January 31 deadline equals receiving a late fee. Let’s say 1.5% of the overdue amount. So, you would owe $5,075 starting February 1.

Though the example of payment terms on an invoice explains the retailer’s payment to a supplier, it can be flipped when customers are the ones paying retailers.

2/10 Net 30 explained

Different types of payment terms

You’ve got the basics of what are payment terms on an invoice, but that’s only the tip of the iceberg. Dive deeper and you’ll find more categories, not just in invoices but also in purchasing and international trade. Each offers unique conditions you can use to your advantage.

In purchasing

Payment term abbreviation | Payment term name | Description |

CIA | Cash in advance | Before receiving a product or service, the buyer must pay for it. |

COD | Cash on delivery | At the time of delivery, the buyer pays for the item or service. |

LOC | Line of credit | An agreement with a financial institution that permits borrowing up to a specific amount. |

Net 7/ Net 10/ Net 30/ Net 60/ Net 90 | Net payment terms | The number of days the buyer has to pay after an invoice is issued. |

X/Y Net Z | Net terms with discounts | The buyer gets an X% discount when paying within Y days. If not, they pay the full amount by day Z. |

CND | Cash next delivery | When the next product is delivered, the buyer pays in cash. |

In international trade: Buyer responsible for shipping costs

Payment term abbreviation | Payment term name | Description |

EXW | Ex works | The seller makes the products ready for pickup, then the buyer takes care of logistics entirely. |

FCA | Free carrier | The seller gives the products to a delivery company, then the buyer takes over. |

FAS | Free alongside ship | The buyer is responsible for putting the goods onto the ship and transporting them once the seller delivers them to a designated port. |

FOB | Free on board | The seller loads the products onto a designated ship, then the buyer is accountable for the transportation cost and risk. |

In international trade: Seller responsible for shipping costs

Payment term abbreviation | Payment term name | Description |

DAT | Delivery at terminal | The seller delivers the products to a designated terminal, then the buyer takes responsibility from that point. |

DAP | Delivery at place | The seller delivers the products to a specified location, then the buyer is in charge of unloading or extra costs. |

DDP | Delivery duty paid | The seller pays for costs and handles the delivery. |

Where should you place the terms of payment on an invoice?

Of course, payment terms and conditions should be stated on an invoice because these components matter. You can think about putting into two suitable places:

- Below invoice details: Buyers often double-check transaction information whenever they receive invoices. This way, your payment terms will be noticed.

- In the payment method section: When buyers are ready to pay, they go through the payment method section. It creates an opportunity for you to remind them about the terms and persuade paying without delays.

How do you set the best invoice payment terms and conditions?

Which will be your guiding factors when you set business payment terms? If you’re still confused, consider these helpful tips for appropriate options:

- Keep cash flow in check: You should choose payment terms that support you in maintaining a healthy cash flow for smooth operations, such as managing inventory. If you’re regularly short of cash at the end of the month, changing a payment deadline to the 15th can spread out the money coming in. As a result, you have enough to handle inventory needs.

- Follow industry standards: You can’t have a template for terms of payment because every industry has its standard payment terms. The food and beverage industry typically requires payment on delivery. Manufacturing and wholesale industries commonly use Net 30, while healthcare and construction often utilize Net 60. Thus, you should be aligned with your field’s common practices. Pushing yourself far from the norm implies that what you require is unreasonable, potentially harming your client relationship.

- Customize for larger invoices: Small orders are easy to tackle, but what about the bigger ones? They coexist with more financial risk. You should ask for a deposit or partial payment for big projects first to avoid later surprises. Breaking the payment into phrases also minimizes the risk of delays and sets clear expectations for both sides.

How to negotiate payment terms with your suppliers?

You can certainly create payment terms that work for your business, but what if you’re in a passive position with a supplier? Don’t stress. There are numerous ways to strengthen your position:

- Develop a win-win relationship: Offering a counter-offer in return for longer payment terms can create an equal-win scenario. For example, committing to a higher minimum order quantity or a higher-margin purchase can make the request more enticing to the supplier.

- Have a backup plan: If the supplier refuses your proposal, you’ll need plan B. And look on the bright side, researching different suppliers that are more open to payment terms can help you obtain an advantage on the negotiation table.

- Stay transparent: When you’re looking for better payment terms, explain the reason behind them to your partner. If the reason is tight cash flow, you should also share it openly. A supplier who values your cooperation will understand and create favorable conditions for you.

- Set realistic expectations: It’s essential to ask for reasonable and fair terms. You can go for a more moderate increase, such as Net 45 or Net 60 rather than pushing for extended payment terms that may be hard for the seller to accept.

- Talk to an appropriate contact point: Try to work with someone who has the power to decide on payment terms. A meeting with a national sales manager, COO, or CFO ensures your request is taken seriously and can be approved. If you’re a small or medium retailer, start by talking with a financial lead or a sales manager.

The bottom line

Practical payment terms and conditions are indispensable for all business owners to achieve the right balance of cash flow management, supplier relationships, and customer expectations. You’ll also need to identify the best conditions for your business, as well as reach favorable ones with your suppliers to keep every aspect stable.

So why don’t you start to review and optimize your payment terms or create new ones that work best for you? Smartly use this strategy and you can finally be on the road to sustainable success.

FAQs about terms of payment

1. What are standard payment terms?

The most common examples consist of Net 10, Net 15, and Net 30. Cash in advance – CIA payment terms or Cash on delivery – COD payment terms are also widely used.

2. When should you create payment terms?

Payment terms should be specified before any transaction occurs, preferably during the discussion stage or the creation of a new supplier or customer account. This ensures that all parties clearly know what is expected and avoids future disagreements.

3. Are there any unique acronyms for payment terms?

Yes, there are plenty! Different payment terms come with different acronyms so both sellers and buyers can understand them at a glance.

4. What is a net payment term?

A net payment term is a specific time frame within which payment is due. This term is written as Net X, where X is the number of days, like Net 60 or Net 90.

5. What does ACH mean in payment terms?

ACH, which stands for automated clearing house, is a popular payment method that aims to transfer money between two accounts, often within the same day.

6. What happens if an account payable’s terms of payment are not met?

In this case, the buyer has to pay the seller a late fee on the overdue amount. If this occurs repeatedly, the collaboration is likely to be affected. The seller will have to set tougher payment terms for future transactions.