POS offline mode allows businesses to process transactions without an internet connection. Merchants can process sales, accept payments, and keep their in-store operations running until connectivity is back online. In short, it lets you run your business normally even during an outage.

While this feature can be handy, offline transactions might fail to sync once the Internet is restored, leading to potential revenue loss. Additionally, storing data locally increases cybersecurity risks.

This article will explain how POS offline mode works, what merchants can do with it, and the risks involved with running an offline POS system —including financial losses and security vulnerabilities. Here’s what we will cover:

- What does a POS offline mode do?

- How do different POS systems handle offline mode?

- What can you do with a POS in offline mode?

- Some suggested POS with offline mode for your business

- The cybersecurity risk of using POS offline mode

- How to prevent the risk of payment when using POS offline mode

- Final thoughts

- FAQs about POS in offline mode

What does a POS offline mode do?

A POS offline mode creates a local backup of inventory, customer, and transaction data, storing it on the POS device (if it’s an app) or the browser (if it’s web-based). There are two main types of POS systems when it comes to offline mode: cloud-based POS and traditional POS.

If the connection to a cloud-based POS is unstable or the offline mode is turned on, the POS will switch to offline mode. This will create a local, temporarily stored database that the POS terminal can communicate with. Then, all the transactions, customer bases, and inventory data will be saved to the POS’s system memory. Once the connection is restored, all data syncs automatically with the cloud, ensuring nothing is lost.

On the other hand, traditional POS stores files locally on physical hard drives. Therefore, you don’t need to worry about internet connectivity, as all data is securely saved within the system itself. This type of POS has been the backbone of retail operations for decades. But, with the increasing demand for efficiency, retailers are adopting innovative solutions to stay competitive, splitting the legacy POS into two smaller branches: on-premise POS and self-hosted POS.

How do different POS systems handle offline mode?

On-premise POS

An on-premise POS system, or offline POS machine, is a common form of a Legacy POS. You will manage sales transactions and other business operations directly from the physical location of your business. It operates over a closed internal network, storing all data in the system itself. That being said, you will never have to worry about any internet connectivity issues. This is a significant advantage of the on-premise POS system, ensuring that business can operate uninterrupted.

However, one of the most significant drawbacks of the on-premise system is the initial setup cost. To explain, you need to put an upfront investment for all the necessary peripherals and software to keep the system running. Not to mention extra costs such as installation, configuration, and customization.

Self-hosted POS

The self-hosted POS system is an alternative version of the on-premise POS. It still involves maintaining physical computers on-site. However, merchants will move to the cloud some resources in the organization for a more agile system.

When the connection is lost, the self-hosted POS in offline mode will store transactions, customer data, and inventory data locally. The storage location depends on the platform type of the POS system itself: on the POS device if it’s an app and on the browser storage if the POS runs on a browser. This allows you to continue doing your business as usual even without a network connection. Once the internet connection is restored, the system will synchronize all stored data with the cloud or an external server, keeping your system up-to-date and accurate.

Cloud-based POS

This one stores all information in a digital database in real time. Furthermore, it allows access to data from

any POS device, as long as you have an internet connection. Thanks to the popularity of the cloud-based POS, more and more merchants can manage their business from virtually anywhere.

Most core functions of a cloud-based POS require a network connection. However, this doesn’t mean they can’t be used offline. In fact, many cloud-based POS systems come equipped with an offline mode that allows them to operate effectively without an internet connection. With offline mode, the system can switch from a cloud database to a system database, ensuring that business operations continue smoothly.

What can you do with a POS in offline mode?

POS offline mode technology supports most of the functionality of a POS with internet connectivity. Some common features include:

- Handle transactions: In offline mode, some POS systems allow you to check out items and complete transactions. For example, the Revel POS allows you to accept card payments, requests customers to provide their information for additional security, and warns you that the payment is being processed offline.

- Process Return/Refund/Exchange: A lack of network connection doesn’t mean poor customer service. With some POS systems in offline mode, you can process refunds for customers, allowing for a seamless customer experience.

- Print receipt: Receipts remain available, even in offline mode. That being said, both you and the customers can have proof of purchase, either in digital or physical form, without waiting for the system to reconnect.

- Backup data: Before entering an unstable network environment, activate the offline mode and your POS system will automatically download the latest data right to your device. This data will serve as the reference point for upcoming retail events, such as transactions and shift rotations. For instance, Magestore POS allows you to store data in the browser while in offline mode to ensure accuracy in inventory management, sales histories, and employee shift records. Then, it syncs the stored data with cloud data to avoid any unnecessary duplications when a connection is restored.

- Manage inventory: POS offline mode enables you to monitor inventory. By making a local copy of stock counts, the system will update the number of items in stock based on the number of transactions that happen. When you have the connection restored, it will automatically sync with the central database. Therefore, preventing stock discrepancies and stock reliability. For instance, LithosPOS offers inventory management features, enabling businesses to track stock levels, sales, and reorder needs, even without an internet connection.

- Manage customer program: Some POS allows you to manage customer details, gift cards, or loyalty programs in offline mode. However, this feature is less common compared to other functions such as inventory management or transaction processing.

- Manage employees: Some POS systems allow you to manage your employees even in the offline mode, with functions such as time tracking, managing schedules, and payrolls.

Some suggested POS with offline mode for your business

There is no such thing as “The Perfect POS”. This is especially true when it comes to offline mode functionality. In fact, the best POS system with offline capabilities is the one that meets your specific needs. A retail store with occasional outages will have different needs for offline capabilities compared to businesses operating in areas with inconsistent connectivity. To make your life easier, here are some of our suggested POS systems that support offline mode:

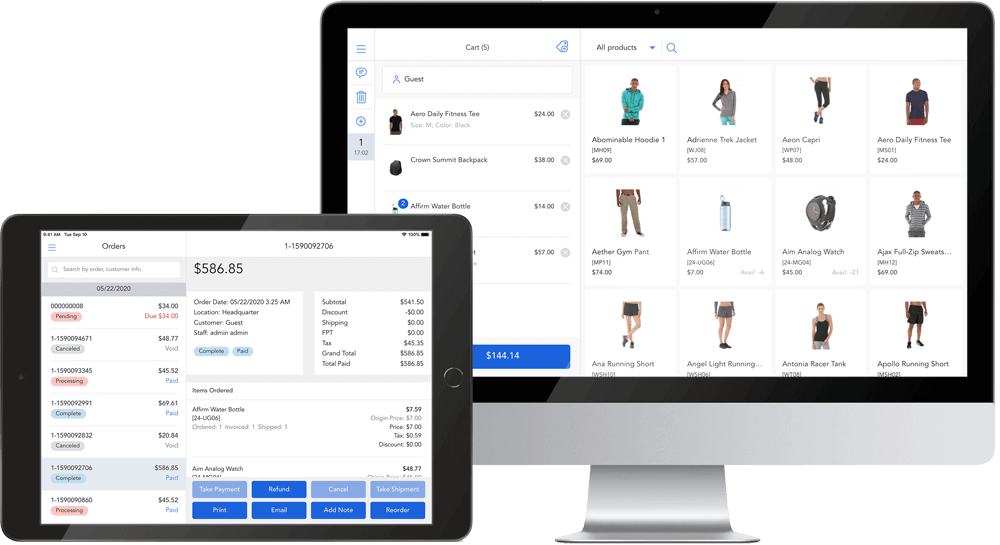

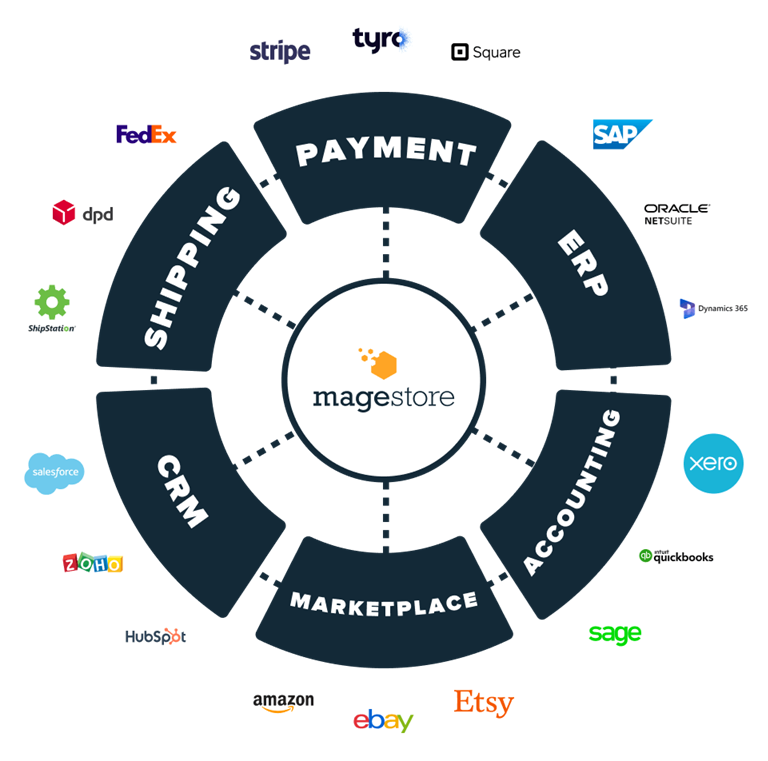

Magestore POS

Magestore POS is a remarkable all-in-one point-of-sale solution for retailers using the Magento platform, especially in offline mode. You can open the Main Menu button on the upper left corner of the screen. Then, go to Settings, click on General, and turn on the Synchronize data button. Depending on the amount of data, the system may take some time to create a local file for reference point. After that, all the events that happen will be based on this file. Once the connection is restored, these data will be synchronized to the Magento backend automatically.

With Magestore POS’s offline mode, you can:

- Check out as usual: Magestore POS allows you to complete checkout even without an internet connection. Moreover, you can also search for products using SKUs or names, as well as selling backorder products to increase sales. Plus, in offline mode, the speed of checkout is significantly increased as the POS doesn’t have to communicate with the server anymore.

- Manage multi-channel and multi-location inventory: This allows you to continue tracking overall inventory, even when one store in the entire chain experiences an outage.

- Enhance your customer experience: Magestore POS supports loyalty programs across channels, including reward points, gift cards, and store credits. If your customer wants a refund, Magestore POS allows you to process it easily, even in offline mode. You can also search for customer information by name, email, or phone. In case of high traffic, your customers can also opt for self-checkout options to reduce wait times.

- Offer flexible payment options: Magestore POS offers flexible integration with various POS payment gateway and payment methods. This provides customers with more payment options in case there is no internet connection, as long as the payment provider supports offline mode. Furthermore, there are no transaction fees from Magestore, you only pay fees to your chosen providers, if any.

As a Magento-native system, Magestore POS inherently works well with the Magento platform to sync online and in-store inventory, transactions, and customer data with minimal risks of data discrepancy. This allows merchants to deliver a truly omnichannel experience without the risk of data mismatch across systems.

Overall, Magestore POS is powerful when it comes to eCommerce solutions. The company is well-known for its excellent post-purchase service and serves as a top Magento-native POS for omnichannel retailers and merchants.

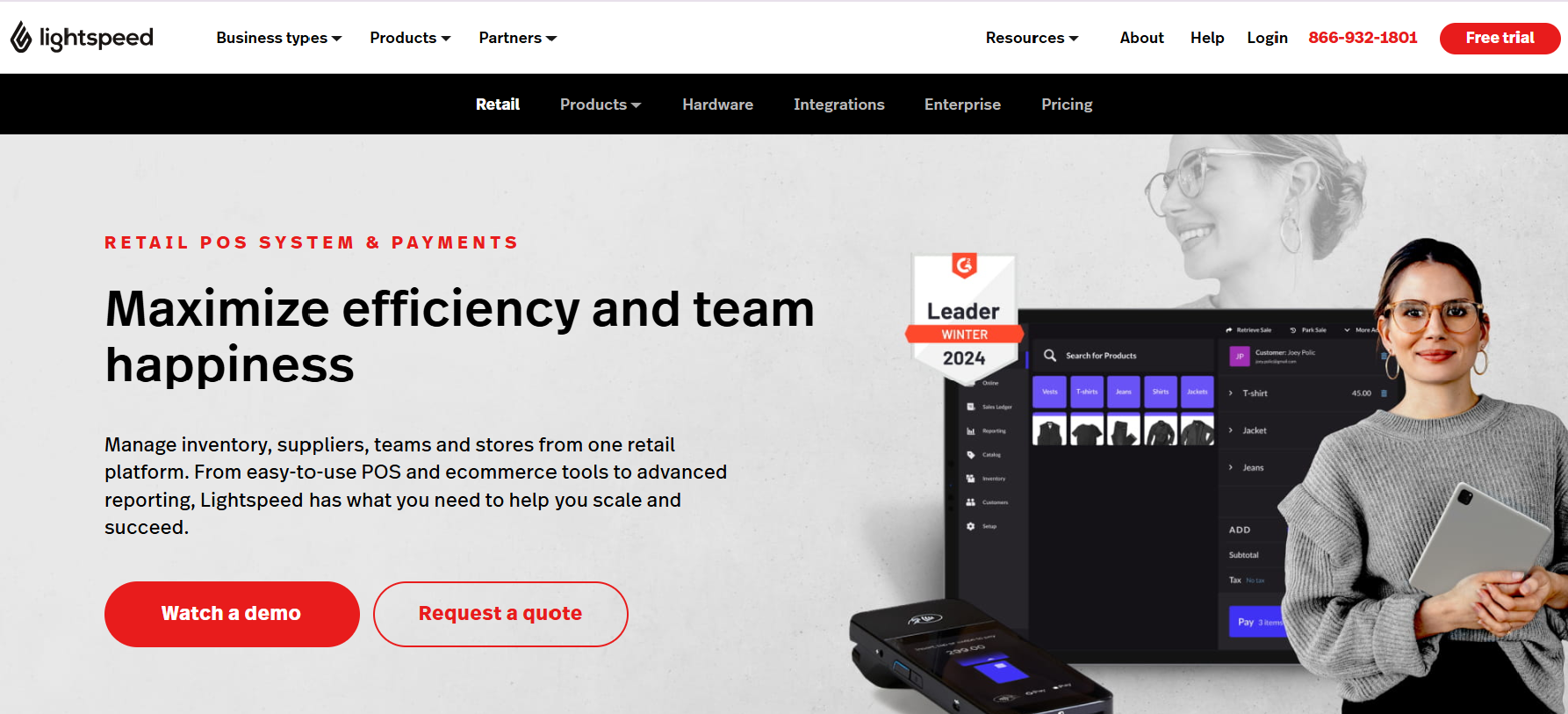

Lightspeed POS

Lightspeed POS offers several functionalities in offline mode. It even offers two versions for two different business types, Lightspeed Retail and Lightspeed Restaurant. Both versions have a robust offline mode that activates automatically when the internet is unavailable

When being activated in offline mode, Lightspeed POS allows you to:

- Process payment: Using their in-house WisePOS E payment terminal, Lightspeed POS lets your customers pay with credit cards in offline mode. Payments are stored locally until the internet connection is restored, at which point they will be processed.

- Inventory tracking: The system supports inventory tracking and management offline, ensuring that stock levels can be monitored and updated without interruptions.

However, their system has some limitations that merchants need to consider:

- No Sales Histories Sync: Payments made in offline mode are not linked to sales history and do not affect your inventory records. Furthermore, their back-end features like reporting and sales histories are not accessible in offline mode.

- No refunds and cancellations: Merchants can only process this once the terminal regains connectivity, through the Financial Services section.

- No Tax Calculation: Since the amounts entered in offline mode are the final amounts charged to cardholders, you have no other choice but to manually calculate taxes and other related charges for customers.

Lightspeed is an all-in-one POS solution ideal for businesses of any size, offering clear pricing and a comprehensive feature set, including its own payment service and eCommerce platform.

Square POS

At a glance, Square POS appears to be exceptional with a no-cost point-of-sale system, paired with built-in payment processing, basic inventory management, and reporting. To activate the offline mode of Square, simply open the Main Menu on Square Terminal. Then, tap Settings, then Checkout, and toggle on the Offline Mode.

The best thing about Square POS in offline mode is that it offers a frictionless customer experience. Although sellers receive notifications when processing offline payments, consumers enjoy a seamless checkout process without any interruptions. Additionally, you can establish your own limits for offline payments, managing the risk you are willing to take. The default limit is typically $100, but it can be raised to $50,000.

Square POS also provides a robust hardware system that supports offline mode. Currently, the Square Terminal, which is the credit card machine of Square, is the only piece of Square hardware capable of accepting all forms of card payments in the offline mode. At the same time, Register and Square Magstripe Reader can also take swipe, tap, dip, or scan payments.

However, the biggest limitation of Square POS when it comes to offline mode is its time limit to process offline payments. To be specific, you only have 24 hours to process pending transactions since you take your first offline payment. After that, all the unclaimed payments will expire and be counted toward revenue loss.

Additionally, Square POS users will not be able to process gift cards, and invoices, or manually enter card numbers, as well as issue any refunds and adjustments.

In general, Square POS is easy to use and ideal for merchants who want a quick setup to get started. With affordable pricing on a month-to-month basis and an excellent hardware system, it provides a great choice for small to medium-sized businesses.

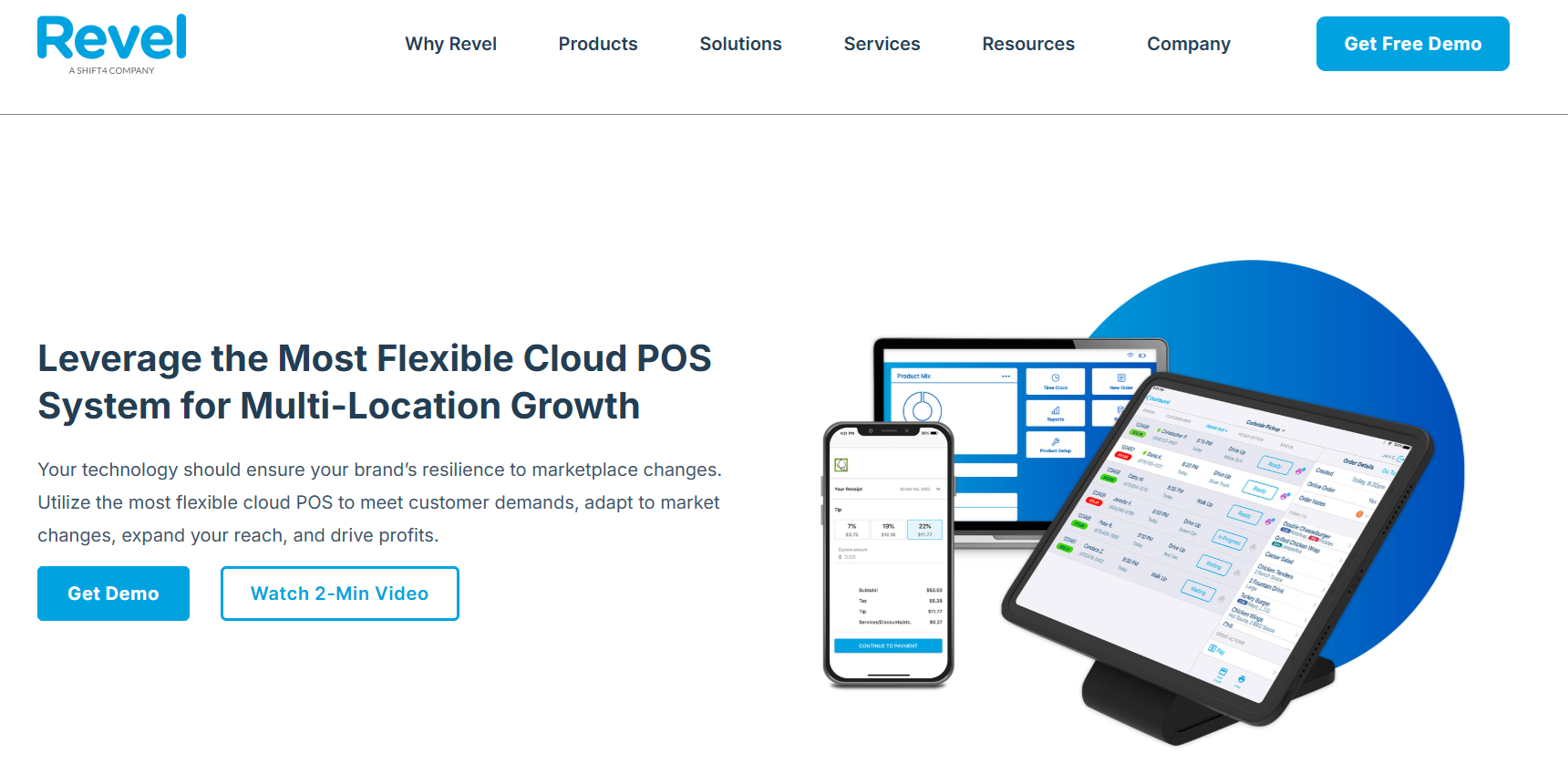

Revel POS

Revel POS’s offline mode ensures normal operation during internet outages by maintaining essential POS functionalities. To explain, Always On mode, which is the offline mode of the Revel system, will kick in when it senses that the internet connection is unstable.

In offline mode, Revel POS allows you to generate sales reports with offline transaction data. This enables businesses to track sales, revenue, and employee performance efficiently. Once the internet connection is restored, all offline data is automatically synchronized with the Revel cloud, ensuring your records remain up-to-date. You can create a threshold for offline payments and the system will display a warning that the payment is accepted while offline.

However, Revel System has a rigid price structure. You will have to sign a contract for at least 3 years with the system. Furthermore, the pricing of the system can be expensive for many small businesses, especially since they won’t need everything the POS offers.

The cybersecurity risk of using POS offline mode

Using a POS system in offline mode also contains significant cybersecurity risks. One of the primary concerns involves increasing vulnerabilities to data breaches. According to a report published by the Identity Theft Resource Center (ITRC), a record number of 1862 data breaches occurred in 2021 in the US, representing a 68% increase compared to the 1108 breaches in 2020.

When transactions are stored locally, fraudulent actors might take advantage of this to secretly install POS malware. This malware will then spread through an organization’s POS system memory to scrape and collect sensitive data, such as credit card details. Here are some common types of malware:

- Memory scrapers: This process starts by injecting malware into the system through phishing or weak security configurations. It scans the memory of the POS system for unencrypted data, such as credit card information, during transactions.

- Keyloggers: This malware will capture your keystroke trace as you type. It can subtly exploit not just your credit card information but also other sensitive data, such as your passwords and phone numbers.

- Backdoor malware: Attackers will create a hidden entry point into the system without authentication. Once installed, they can remotely control the compromised system, steal sensitive data, or spy on user activity.

For merchants and retailers, protecting customers’ information is one of the top priorities, as it fosters long-term customer loyalty and prevents unfortunate fraud. Some mitigation measures we suggest businesses to apply include:

- Encrypting data: The POS system enables integration with a payment processor that encrypts data instantly upon receipt. When customers input their card information, all sensitive information will appear as a series of asterisks. It only leaves the last four digits visible.

- Controlling access: Personnel is one of the most likely targeted entry points. Attackers often exploit them through phishing and social engineering attacks. Therefore, businesses need to make sure that user roles and permissions match their job responsibilities, limiting access to only those who need it.

- Auditing security system regularly: A security audit involves an overall evaluation of the security systems. By implementing measures such as penetration tests, businesses will uncover security gaps, thus creating a safer environment for customers and employees. This process also enhances loss prevention efforts and ensures compliance with regulations.

How to prevent the risk of payment when using POS offline mode

Most merchants generally use a payment terminal for point-of-sale (POS) transactions. However, if your terminal does not support offline mode, your customers will be unable to complete transactions during outages. Therefore, it is essential to verify whether your credit card processing company provides support for offline payments.

On the other hand, if your terminal supports offline mode, you should also check the duration and availability of your offline payment sessions. If you don’t go online to finalize the offline transactions within the allotted time, you will risk losing all the money for the products you sell. For instance, the built-in payment terminal of Square POS allows up to 24 hours from when you receive the first offline payment to accept offline payments.

Furthermore, when accepting payment in offline mode, you accept the risk of a declined or partial payment when the device is back online. When a credit card is used, it’s difficult to tell if it is expired or if the PIN provided is correct, which increases the risk of revenue loss. To explain, the payment gateway can only collect payment information in POS offline mode. The payment verification occurs only when a connection is reestablished. At that point, you will receive your deposits, and your customers will receive their receipts.

Most payment gateways will not provide support when an offline payment is declined or failed. So, you must know how to protect yourself with appropriate mitigation plans. Some of the recommended solutions are:

- Setting a transaction limit: This serves as an effective safeguard against financial risk exposure. By configuring the maximum allowable amounts for offline transactions, businesses can better manage their potential losses. That being said, you can customize the transaction limit to meet the specific needs of your business. Moreover, some system requires manager approval if the transactions are above the defined thresholds, adding a layer of security when financial exposure increases.

- Selecting an appropriate offline timeframe: Different businesses will have different connection access that requires them to stay offline longer. For instance, retail businesses in fixed locations with generally reliable connectivity may use offline mode in just a couple of minutes. In contrast, remote businesses such as food trucks or market vendors may require a payment gateway that allows extended offline transaction periods.

- Establishing operational protocols: It is better to prepare than to regret. Establishing clear instructions for offline periods will minimize the risks that attach to payment risks. For example, your employees should have a clear understanding of the risk of offline payments, as well as how to communicate honestly with customers about the situation. As an owner, you should also maintain a comprehensive offline transaction history for tracking and monitoring disputes.

Final thoughts

Most modern point-of-systems on the market come with an offline mode now. However, their functionality will vary. This requires you to understand your needs to pick the right one for your business. If you run a local food truck, a POS system with a long offline time allowance will be suitable. Conversely, a physical storefront with a stable network may require a robust payment system that can handle the worst-case scenario of a sudden outage.

Offline mode is a crucial feature for businesses with numerous daily transactions. Through this article, we hope you can find the right POS solution with an offline mode that brings you success.

FAQs about POS in offline mode

What is the offline mode in the point of sale?

The offline mode in the point of sale allows businesses to process transactions without an internet connection. Merchants can process sales, accept payments, and keep their in-store operations running until connectivity is back online. In short, it lets you run your business normally even during an outage.

Which POS system doesn’t require internet?

There are two types of POS systems that don’t require an internet connection: On-premise POS and self-hosted POS.

How much can a POS offline receiver receive?

The funds received depend on the capability of the payment processor, and the transaction limit of you and the customers’ issuing bank.

What is an offline POS machine?

An offline POS machine is a system of physical hardware that allows POS softwares to function properly. Offline POS machines can range from traditional computer-based system to portable devices like an iPad tablet or even an iPhone. Depending on the business’s need, you can integrate other peripherals into the system such as a receipt printer or barcode scanner.

What is the difference between offline POS and online POS?

An offline POS system stores files locally on physical hard drives. Therefore, you don’t need to worry about internet connectivity, as all data is securely saved within the system itself. Furthermore, you can also synchronize the data with the cloud or an external server.

On the other hand, an online POS system means that all data and functionalities are more or less stored via the Internet. However, this doesn’t mean that they can’t be used offline. With offline mode, the system can switch from a cloud database to a system database, storing data until the connection returns and syncing it back to the cloud.

How does POS offline work?

A POS offline mode creates a local backup of inventory, customer, and transaction data. Then, it stores those data on either the POS device (if it’s an app) or the browser (if it’s web-based).