Not all customers have enough funds to make necessary or urgent purchases for their daily lives such as personal care products, furniture, and household appliances. In these cases, consumers often seek financing for their purchases via credit cards, layaway plans, or buy now pay later (BNPL).

Also known as point of sale installment loans, BNPL offers users instant funds for their purchases without high interest rates and strict credit requirements. Therefore, it has become an appealing payment method for consumers. In 2022, BNPL accounted for 5% of the global eCommerce transaction volume. Juniper Research estimates that the number of customers using BNPL globally will increase from 360 million in 2022 to more than 900 million in 2027.

NerdWallet’s survey in April 2024 also reveals that 25% of American shoppers have used BNPL in the past 12 months and continue to use the method to make ends meet. In addition, eMarketer research predicts that total spending with BNPL in the U.S. will reach $80.77 billion in 2024, doubling the amount of $37.97 billion in 2021.

This post provides an essential understanding of BNPL, including definitions, pros and cons, how to implement it for your stores, and the best BNPL apps available. Let’s dive in!

What is buy now pay later?

Buy now pay later, or BNPL, is a credit solution that enables customers to pay for products and services in several installments over a fixed schedule. In other words, customers can spread out the expenses rather than paying the full price at the time of purchase.

Besides, BNPL loans require no hard check on credit history and charge no or low interest, making them more attractive to customers who regularly buy on credit. For example, if you want to buy a new TV that costs $1,000, you can pay four installments of $250 over 6 weeks rather than the entire amount.

Compared to other financing methods, BNPL is more rapid and convenient. It allows customers to access funding and receive items instantly. Given its wide adoption among customers, plenty of eCommerce retailers have incorporated buy now pay later into their checkout process to give shoppers multiple payment options, thereby boosting conversion rates and sales.

Many retail giants such as Adidas, MAC Cosmetics, Bloomingdale’s, Walmart, Target, and Nordstrom adopt buy now pay later. The list keeps adding up, indicating the growing popularity of this financing solution.

How does buy now pay later work?

Buy now pay later divides purchases into manageable amounts that consumers can pay off over time. We explain how it works below.

- Customers shop online, add items to the cart, and reach the checkout, where retailers display BNPL and other payment methods. Shoppers can also access the service provider’s apps to look for credit shopping websites and make purchases.

- After customers choose a BNPL service provider to pay for their items, they’re redirected to the provider’s app to register for an account or sign in.

- Customers provide personal information, including name, address, and social security number. With this data, the BNPL lender might conduct a soft credit check to evaluate customers’ creditworthiness, which normally doesn’t impact their credit scores.

- Customers accept or decline the terms of repayment plans for their purchases, which are often bi-weekly or monthly payment options. Subsequently, customers make down payments if required and complete the purchase.

- The BNPL provider pays the total transaction value to businesses after deducting some fees. After that, customers will pay off the remaining installments directly to the provider over an agreed schedule using credit cards, debit cards, or bank accounts. Some lenders charge late fees if customers don’t make payments on time.

BNPL: Pros and cons

BNPL is advantageous to both retailers and customers; however, it also comes with certain downsides. The information below clarifies the advantages and disadvantages of BNPL.

Pros | Cons |

Improve conversion and basket sizes: BNPL breaks a large transaction into more affordable segments, thus encouraging buyers to purchase higher-priced products or add extra items to their carts. | Risks of customers’ overspending: Due to its ease of use and light credit check, customers might make more impulse purchases with little regard for their financial status. |

No hard credit check: BNPL lenders only run a soft credit check or no credit check at all before making financing decisions. Therefore, customers don’t need good credit scores to qualify for loans. | Late payment fees: BNPL lenders apply late fees to customers who fall behind on scheduled payments. Add New |

Simple application: To apply for funding, customers only need to go through a simple online application process that asks for some basic information like names, email addresses, and social security numbers. Then they can get approval within minutes. | High interest for long-term plans: Customers who do monthly payment shopping are more likely to incur interest charges for their loans, which ends up in higher prices for their purchased items. |

Attract more customers: Adding buy now pay later helps businesses provide flexible payment options, thus enticing more customers, especially the young generations. | Lack of consumer protection: BNPL offers customers less protection in disputes with merchants or scams. |

No-interest payment plans: BNPL is highly beneficial to consumers who frequently need to shop on credit as it offers short-term loans, typically over 6 weeks, without interest charges. |

Understand key BNPL payment options

BNPL plans of PayPal

The buy now pay later options are diverse, so customers can choose the best plan for their installment payment shopping. In general, there are some key choices as follows.

Buy now pay later no credit check

Some BNPL providers don’t check your credit reports before approving the installment plans. These services give buy now pay later instant approval based on other factors like income, employment status, or current loans rather than credit scores. Customers only need to provide personal information like name and bank details, and the lenders will quickly assess their loan eligibility. For example, Splitit and Fingerhut are the two platforms that offer shoppers buy now pay later no credit check instant approval.

Buy now pay later no upfront payment (Buy now pay later no down payment)

There are BNPL programs that don’t demand an upfront payment. With these plans, customers don’t need to pay part of the purchase or total amount at the point of sale to get their products. For instance, AppToPay lets customers pay for their purchases in 3 installments with no upfront payment required.

Buy now pay later interest free

Many BNPL services are interest-free if customers pay in 3 or 4 installments over a short term, typically from 6 weeks to 3 months. Afterpay is one of many BNPL providers that enable customers to pay 4 zero-interest installments over 6 weeks.

Buy now pay later monthly

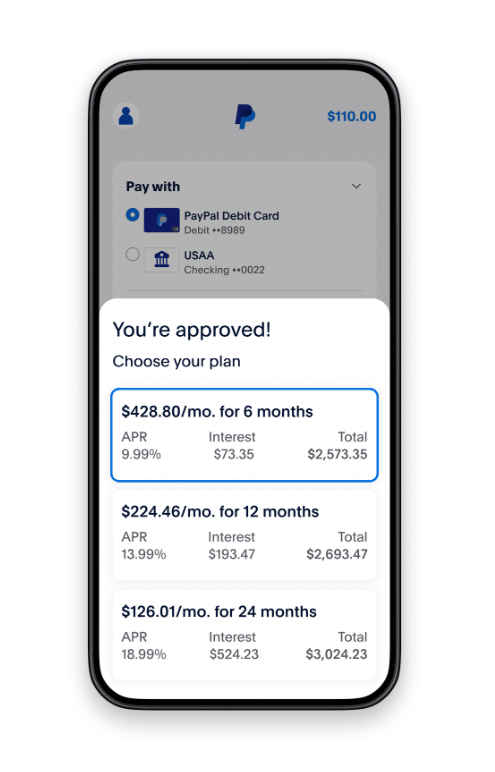

Customers can buy items and pay monthly for big-ticket purchases or large orders. Monthly repayment plans often come with high interest rates and longer terms. For example, PayPal allows customers to make monthly payments if they purchase from $199 to $10,000. Customers can pay back the entire cost over 6, 12, or 24 months with the annual percentage rate (APR) ranging from 9.99 to 35.99%.

Buy now pay later cash advance

A cash advance is a type of short-term loan that customers often use for emergencies. Customers can borrow from $50 to $1,000 from cash advance apps and pay off within hours or days. There are usually no credit checks and interest charges. For example, customers can ask for $500 from MoneyLion and repay the amount within 1 to 5 business days.

Buy now pay later in-store

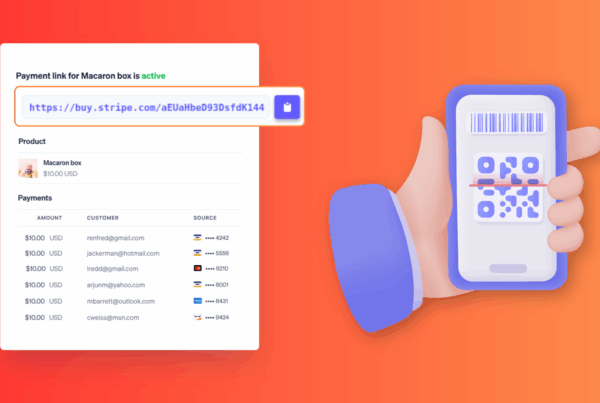

Many businesses facilitate BNPL in-store to improve customers’ checkout experience and increase sales. Most BNPL lenders like Zip and Afterpay enable shoppers to create QR codes or offer them one-time buy now pay later virtual cards to add to their digital wallets for in-store purchases.

Buy now pay later online store

The majority of BNPL transactions occur at online stores. After adding favorite items to the cart, online shoppers can opt for their preferred services at the checkout page. PayPal, Afterpay, and Affirm are the BNPL platforms that assist online shopping on credit.

Buy now pay later with debit cards

Depending on the service provider, customers can make BNPL payments using debit cards, credit cards, or bank accounts. Apple Pay Later, Affirm, and many other buy now pay later apps accept repayments with debit cards.

Buy now pay later catalogs with instant approval and no money down

With this option, customers don’t have to go through a hard credit check and make a down payment for their purchases. Many BNPL lenders like AppToPay and PayPal perform buy now pay later catalogs with no down payment no credit checks to attract more customers.

Alternatives to BNPL

BNPL is not an ideal option in all circumstances. Therefore, retailers can consider other options for BNPL as below.

- Credit cards: The major difference between buy now pay later vs credit cards is that credit card issuers often run a hard credit check to assess customers’ eligibility. Credit card companies also report payments to credit agencies, which can primarily affect customers’ credit scores. However, customers can receive rewards, cash back, or annual membership.

- Personal loans: Customers can flexibly utilize personal loans for different purposes, from paying bills to starting a business. Personal loans offer quick funding with fixed or variable interest and repayment terms ranging from a few months to several years.

- Layaway: Layaway plans also allow shoppers to spread out the payments over time. Nevertheless, customers can only get the items they purchase once they pay the total price.

- Split payments: This BNPL alternative permits customers to pay for a single purchase using a combination of payment methods like cash, credit cards, and gift cards. Split payments can help businesses foster sales, but they also generate higher transaction fees.

How can retailers provide BNPL for customers?

First, you should thoroughly analyze your business, including products, typical customers, average order values, and abandonment cart rates. These analyses help determine the most relevant and potential payment plans for your customers. On that basis, you can choose an appropriate BNPL partner that suits your customers’ needs and register for an account.

Then, you need to add BNPL to your stores. The popular way to activate BNPL options for online and offline stores is through payment processors like Stripe or PayPal. As a result, BNPL services should integrate with your existing POS and payment system to let customers buy with installments. Your POS should also connect smoothly with multiple 3rd-party payment service providers to process payment types like digital wallets or split payments to enable buy now pay later methods.

For example, Magestore POS with POS for Magento and POS for Shopify works seamlessly with multiple payment terminals to offer your customers various payment methods, including split payments.

You should also clearly communicate the availability and benefits of BNPL to your customers both online and offline. To promote BNPLs, you can place banners on your site, put signage in your stores, or execute marketing campaigns.

How to offer buy now pay later on Magestore POS?

Magestore point of sale supports both BNPL no down payment and with down payment. In the case of BNPL with down payment, customers can choose different payment methods such as cash, credit cards, or debit cards. Follow these steps to provide a smooth BNPL experience for your customers.

Enable the BNPL option on Magestore POS

If your Magestore POS doesn’t have the Pay Later option:

Step 1: Create Pay Later on Magestore POS:

Go to POS > Settings > Payment for POS > Add more payment

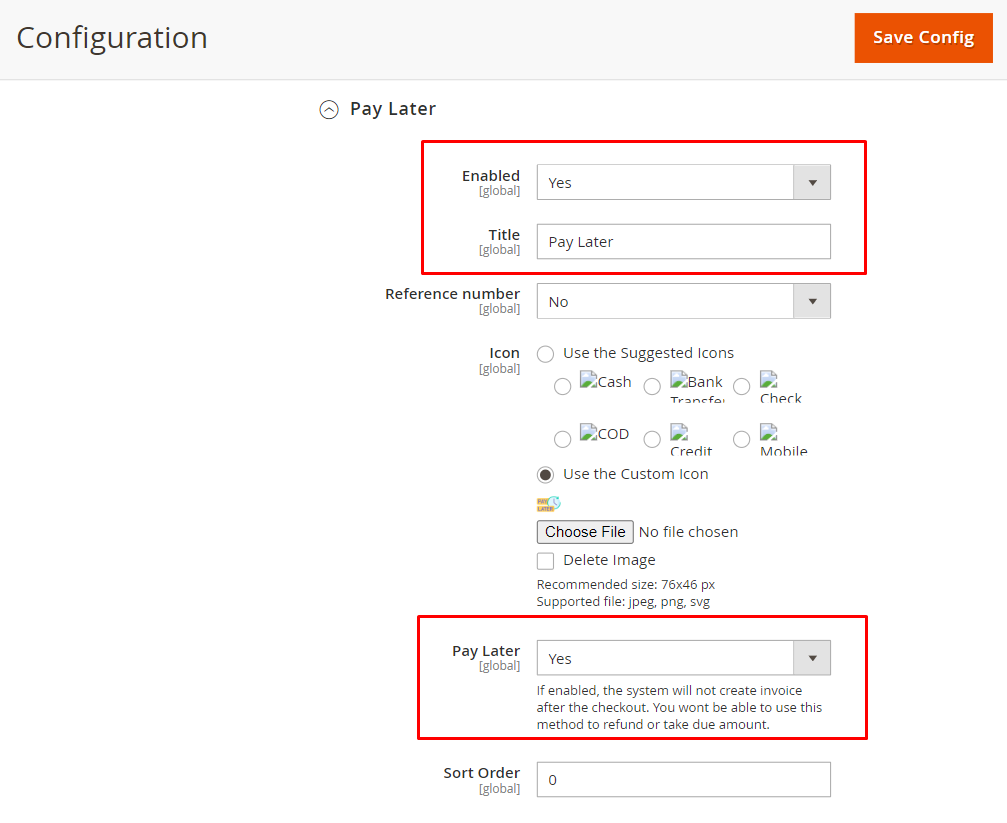

Step 2: Complete the following settings:

- Set Enabled to Yes

- Name the Title as Pay Later

- Set Pay Later to Yes so that the system will not create an invoice after checkout

Now, you can start providing the BNPL option for your customers.

If your Magestore POS already has the Pay Later option, proceed from Step 2.

Check out orders with BNPL on Magestore POS

When a customer adds products to the cart and requests BNPL, they can choose either to buy now and pay later with no down payment or to pay a part now and the rest later, depending on your buying policies.

Option 1: Customer buys now and pays later with no initial payment.

- The cashier selects Pay Later > Mark as Partial > Complete Order.

- The invoice will show the due amount the customer needs to pay later.

- In Order History, the order status will be Processing, Unpaid.

When the customer returns to the store to complete the payment, they can choose their preferred payment method. The order status will then change to Complete, Paid.

Option 2: Customer pays a portion of the order in advance with different payment methods and completes payment later.

- The cashier selects Pay Later and adds one or more payment options > Mark as Partial > Complete Order.

- The invoice will show both the unpaid and paid amounts with the payment method.

- In Order History, the order status will be Processing, Partially Paid.

When the customer comes back to pay the remaining balance, the payment will be completed, and the order status will change to Complete, Paid.

>>> Might you like: Buckaroo POS by Magestore allows you to checkout orders with BNPL

7 best apps for buy now pay later

To choose the most suitable buy now, pay later services for your business, you should evaluate the following critical criteria.

- Integration capability: If you want to add buy now pay later to your checkout flow, choose an app that seamlessly integrates with your existing eCommerce and POS systems.

- Payment terms: BNPL repayment terms can span several weeks or years. While customers use short-term loans for small purchases, they need a longer payment plan for higher-value items. Therefore, your chosen BNPL lenders should offer different payment plans so your customers can opt for the one that suits their financial situations.

- Credit limits: Credit limits vary from provider to provider. If your customers’ purchases are lower or higher than the set limits, they might not qualify for the payment plans. Consequently, you’d better assess your business’ average order values and ensure that the provider lends your customers enough funds to cover their purchases.

- Geographic coverage: Before selecting a service provider, you should define where your target customers concentrate and what BNPL services are easily accessible or popular there. You can also partner with multiple providers simultaneously to serve more customers across locations.

BNPL app | Best for | Annual percentage rate (APR) | Repayment terms | Fees | Payer location |

Affirm | Large retailers in the U.S. and Canada |

|

| None | Canada, the U.S. |

Afterpay | eCommerce retailers |

|

| Late fees: Up to 25% of the purchase price or $68 | Australia, the U.K., the U.S., Canada, New Zealand |

Apple Pay Later | U.S. retailers |

|

| None | The U.S. |

Klarna | Global eCommerce retailers |

|

| Late fees: £5 for orders larger than £20 and 25% of the purchase price if the total value is smaller than £20 | Australia, Austria, the U.K., the U.S., Belgium, Ireland, Italy, New Zealand, Norway, Poland, Portugal, Spain, Sweden, Switzerland, The Netherlands, Canada, Czechia, Denmark, Finland, France, Germany, Greece |

PayPal Pay Later | Small and medium retailers |

|

| None | Australia, France, Germany, Italy, Spain, the U.K., the U.S. |

Sezzle | Retailers selling in Canada, India, the U.S. |

|

|

| Canada, India, the U.S. |

Zip | Retail businesses in the U.S., Australia, New Zealand |

|

|

| The U.S., Australia, New Zealand |

FAQs

Is buy now pay later similar to taking a loan?

Yes, BNPL is similar to taking a loan. BNPL lends customers money to fund their purchases and allows them to pay back installments over time. Unlike traditional loans, BNPL often charges no interest and lasts short terms.

Is it safe for customers to buy now pay later?

Yes, BNPL is safe to use. BNPL providers employ security technologies, including data encryption and multifactor identification, to protect your information.

How does BNPL affect my credit?

As BNPL services don’t report payments to the credit bureaus, whether you pay on time or miss the scheduled payment doesn’t impact your credit. However, if you repeatedly fail to pay back money when it’s due, debt collectors might report your account to credit agencies, which can lower your credit score.

How does a BNPL provider make money?

BNPL makes money from both businesses and shoppers. On one hand, financing companies charge businesses with initial setup and processing fees for each transaction. On the other hand, customers have to pay interest for longer repayment terms and late fees if they miss the payments.

Are there any fees associated with BNPL services?

Yes, there are. While businesses have to pay processing fees for each transaction, shoppers might incur late fees for missed payments.

Can I buy now pay later if I have bad credit?

Yes, you can apply for buy now pay later even if you don’t have good credit. As BNPL lenders only run soft credit checks, bad credit doesn’t affect the service provider’s approval.