If you are a business owner and you are wondering whether or not to start accepting payment by credit card, this is the right article for you to understand what it is and how to apply credit card processing to your business.

- What is a credit card?

- Why do people like to use credit cards?

- What is credit card processing?

- Which parties are involved in credit card processing?

- How does credit card processing work?

- How much is the credit card processing fee?

- How much is the credit card processing fee?

- How to choose a credit card processing company

- Top credit card processing companies for small businesses

What is a credit card?

Credit card is a plastic card issued by a financial institution or bank that allows people to purchase things on credit. In other words, you borrow cash to buy goods and later pay to the card issuer with added fees.

Why do people like to use credit cards?

Using a credit card gives people three main advantages:

- It is easy and convenient. People don’t have to bring cash everywhere or to avoid emergency cases when they need to buy something but they don’t bring cash. This advantage is chosen by 80% of people who have participated in research by Experian.com recently.

- People can keep track of their spending. When using a credit or debit card, people can see and check all their transactions recorded by the system and then can create a plan to manage their budget. 19% of surveyed people consider this as the most important pros when using a credit card.

- People can get rewards when using credit cards. All the credit card companies normally provide many different rewards to their customers to give them more incentives to use their credit cards. Some prominent rewards are cash back, travel rewards, etc. There are around 36% of candidates who think that this is an advantage for credit card users.

- It protects against fraud. Credit card networks with their own security system can make people feel more secure. Besides, there is no need to put a big amount of cash in the credit card account so there is less probability of cash being stolen. This reason is chosen by 15% of people in the same survey.

According to the same research, each American has an average of 3 credit cards because of all mentioned advantages. Obviously, credit cards are now widely used and become one of the main payment methods all over the world, so accepting payment by credit card is nearly a need for any business. All the sellers have to know how credit card processing works and what the best credit card processing companies are suitable for their business type.

What is credit card processing?

Credit card processing is defined as a set of procedures for accepting payments by credit card both physically and online.

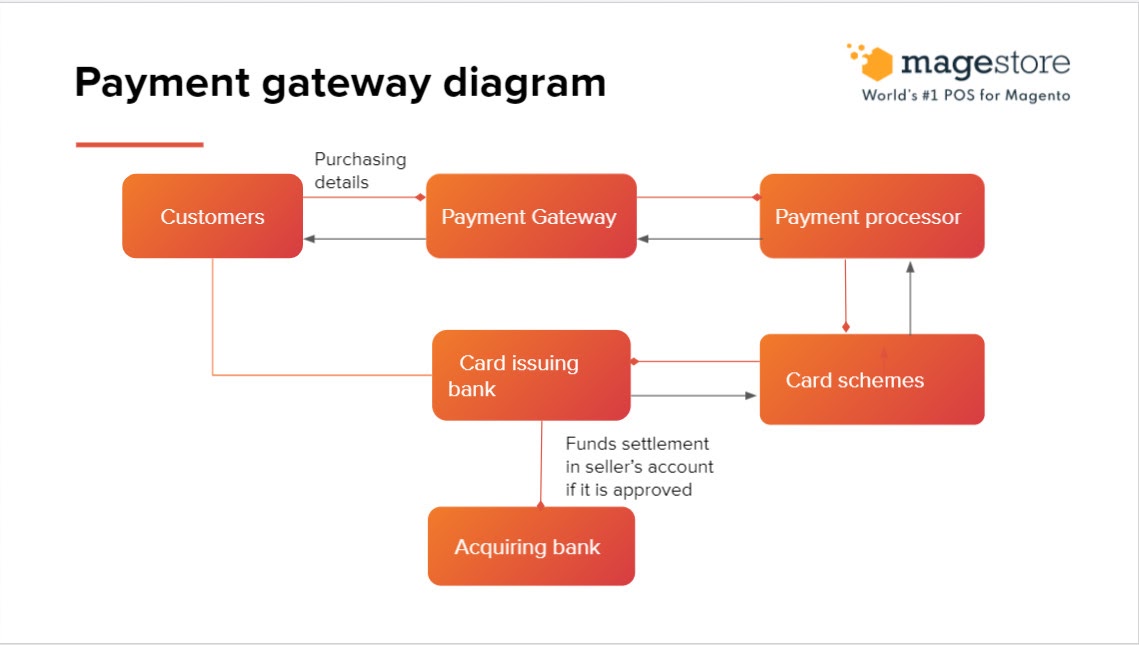

Which parties are involved in credit card processing?

- The seller: This is the one who sells the products and receives payment through credit card processing.

- The buyer: The one who purchases the products, the cardholder.

- Payment gateway: The software that connects the seller to the payment processor. Learn more about payment gateway overview.

- Credit card processor: The one who facilitates the communication among the sellers, credit card network, and the card-issuing bank.

- Card network/schemes: The brand of credit cards such as Visa, American Express, or MasterCard.

- Card issuing bank: The entity that has a function to determine whether the buyer’s account has enough funds to complete the transaction and release those funds for settlement.

- Acquiring bank: The seller’s bank that receives money from transactions.

How does credit card processing work?

- The customer initiates a payment with their credit card. It can be through a POS terminal in a brick-and-mortar store or via an eCommerce payment gateway. The payment information is shared with the sellers. The payment information includes transaction information and the customer’s information which is already encoded through the POS system.

- The sellers accept or collect payment information in one of these two ways: In-person (by POS terminal) or online (by payment gateway).

- The payment information is sent to a credit card processor or payment processor through the payment gateway and then will be sent to a card network (the brand of credit cards such as Visa, American Express, or MasterCard).

- The card network/schemes then pass the payment information to the card-issuing bank.

- The issuing bank will verify if the cardholder has sufficient funds or credit to complete the transaction, then approve or refuse the transaction, and finally send that information to the credit card processor.

- If it is approved by the issuing bank, the funds are released from the consumer bank to the seller’s account.

How much is the credit card processing fee?

Every credit card payment you take is usually subjected to processing fees from your credit card processor. In addition, depending on the pricing scheme used by your processor, you may be charged some other fees.

Processing fee includes 3 types: Interchange fee, service fee, and processing fee.

1. Interchange fee:

This fee is charged by the buyer’s bank. It includes the percentage of the total purchase value and the transaction fee which is determined by the card network. It is the largest fee in credit card processing.

2. Service fee:

This is a small percentage charged by the card network. It can be changed based on the transaction volume and risk level.

3. Processing fee:

Charged by the credit card processor based on their price model. There are three types of pricing models: Flat rate, interchange plus, tiered.

- Flat rate model: The processor simply charges a fixed rate for all debit and credit card transactions.

- Interchange plus model: The seller is charged a percentage of the transaction plus a fixed per-transaction fee.

- Tiered model: The processor charges a fee based on the card type used in the transaction, the transaction volume, and risks.

How to choose a credit card processing company

A credit card processing company can be a third-party processor or a seller account provider.

Third-party processors are suitable for small businesses with low transaction volume because you just need to pay the processor when you make a sale. However, since the transaction takes place outside of your network, you cannot completely manage the account, the processor can even hold the payment or terminate the accounts if the business violates some terms of service.

Seller/merchant account providers are more suitable for larger businesses. They provide more support, customization options, and solutions for businesses. Besides, the entire transaction occurs within the seller’s network, so it is easier to manage.

There are also some more important factors to choose the credit card processing company including price, customer service, etc.

For small businesses, choosing credit card processing companies is more complicated because the seller has to consider many different factors:

- Where the majority of your transactions occur?

- Do customers use an eCommerce site to shop?

- Do you have a physical shop?

- Or do customers purchase both online and offline?

You’ll want a credit card processing provider that’s adaptable and can expand with your business.

Top credit card processing companies for small businesses

- Payment Depot: This company is ranked as the best credit card processing company for small businesses in 2021. It provides a free virtual terminal, transparent price, and affordable monthly membership fees plus a fee per transaction.

- Fattmerchant: Fattmerchant offers quite a lot of hardware to assist you to improve your user experience, and its customer care is available 24 hours a day, seven days a week. For user convenience, the company also offers a mobile app that may be integrated with a variety of popular POS systems. It charges a flat monthly fee with an added small fee per transaction.

- Helcim: Helcim users can complete both in-person and online transactions for a single monthly cost. In addition, it follows an interchange-plus pricing model so the users have to pay both the buyer’s monthly bank fee and the fee per transaction. However, since the business grows, the fee per transaction can be reduced.

- Square: It has payment processing mobile software which is free to download and install. However, it will charge some cost to buy the square hardware. Square payment processors use a flat-rate pricing model, with no monthly fee but a small fixed percentage per transaction. It is really suitable for small businesses with a small volume of transactions.

- Dharma merchant services: This credit card processor follows an interchange-plus pricing model so it charges a monthly fee and fee per transaction with very good customer service. Besides, it also provides a competitive and transparent price.

In general, with multidimensional information provided in this article, credit card processing is no more difficult to grasp. However, choosing the right credit card processing company is critical since their charging cost, service and limitations will have a significant impact on your business.