Cash flow is the backbone of any business. As business owners, your top concern is to maximize profits and generate more money. Managing cash flow effectively is the very first action you need to think of. In the scope of this article, we’d like to address explicitly the importance of cash flow management in physical stores and tips to monitor it right. Let’s see what’s in the name.

What is in-store cash flow management?

Cash flow is the amount of money going in and out of your business. Cash inflows come from customer purchases while cash outflows happen when business expenses incurred such as inventory replenishment, operating bills, staff salaries, etc.

Cash flow management refers to all activities involving receiving, collecting, analyzing, monitoring, and managing cash inflows and outflows.

When it comes to in-store cash flow management, the managing scope focuses on retail physical stores as its name suggests. A realistic plan for managing cash flow requires business owners to fully realize and understand the sources of cash flow in their stores.

Why is cash flow management essential?

Cash flow is the backbone or lifeblood of business. According to Investopedia, the top common reason a small business fails is financial hurdles which are mainly about poor cash flow management. Whether you are running a small or big business, you should never give careless consideration to it. As managing cash flow in offline stores is a part of managing cash flow as a whole, we’d like to first summarize the key reasons why cash flow management matters.

You need enough cash to cover business costs.

As business owners, you need to ensure to have money available at your disposal to pay for expenses when they are due. You should know that even lucrative businesses can break down if they fail to manage cash flow properly. If you don’t have enough money to pay for suppliers or employees, suppliers will stop supplying you with products and employees will leave you.

You need cash to grow your business.

Let’s take a typical example in the retail business. The holiday season is just around the corner and you want to increase sales by providing customers with the newest items or investing more in marketing activities.

However, your operation bills are due soon and you don’t have enough money left. In this case, effective cash flow management is more than ensuring you have money to balance the cash inflows and outflows. The effectiveness is about having idle cash for future purposes as well.

You need cash to survive in crisis situations.

COVID 19 pandemic is a harsh test on the global economy which sped up the classification of strong and weak businesses. No one can anticipate exactly when such severe situations could happen. As business owners, you should always be aware of the future and also have plans for crises. In other words, you need money to survive and then thrive in your business.

Why does in-store cash flow management matter?

Besides the central importance above, you should pay attention to other benefits the good in-store cash flow management can bring to your business.

You can ensure there are no or least cash differences between the system and reality.

If you see any cash differences, you can right away check the cash you have in stores with the system to spot the problem. Sometimes, your staff uses cash to pay for electricity bills and forgets to record the transaction in the system. That causes the cash differences. As your staff in physical stores works closely with the POS system, you can make use of the POS to record such transactions.

It helps you anticipate the cash flow trends in your stores.

In physical stores, you should look at the cash flow on day-to-day basics. For example, if you see that customers are more likely to visit your stores during lunchtime or late afternoon. You should assign more staff to those working shifts. Another example is, you’re going to have a negative cash flow at the end of the month. You want to figure out the root cause of it. And you find that it’s poor inventory management that you have a lot of old inventory unsold. You then need to immediately seek an on the spot solution.

You don’t have to always purchase goods on credits.

When sales seasons come, you want to replenish inventory with new items but lack money. Then you have to pay on credits. If you rarely encounter this situation, then congratulations, you are managing your cash flow properly. But if this case sounds often to you, you should give thoughtful consideration to in-store cash flow management.

Tips to manage cash flow successfully in retail stores

Managing cash flow is not an easy task. You can imagine that you are holding a scale with one side of cash inflows and the other side of cash outflows. As business owners, you prefer the inflow side to incline, don’t you? In this part, we would share with you tips to monitor cash flow in physical stores appropriately.

Review your current cash flow management

Before applying anything new, you’d better review your current managing tasks to see any possible issues. Let’s go through your sales reports, operating activities, financing activities, investing activities. Then pay attention to these vital components: cash, inventory, debt. Some questions you should ask yourself when reviewing are:

- How much money are you having? How long can you finance your business with such an amount?

- How much of your capital is laid in inventory? How long can you free up all inventory? What can you do to speed up inventory sales?

- How many of your debts are about to be due? Can you pay all that with your equity?

Increase cash inflows

It is obvious, isn’t it? After knowing how your in-store cash flow management is going, it’s now time to find ways to improve the cash flow. Cash inflows come from the customer’s purchases. Thus, the very first thing you can do is to generate more sales. You can induce your existing customers to re-engage and buy from you. In this case, a customer loyalty program can help you a lot. Or you can invest in the promotion to attract new customers. In fact, you should do both activities.

One thing you should notice is that your in-store service and decoration also helps boost customer shopping experience. The more you care about your customers, the more chances you can win their hearts.

Another notice is you should always follow the retail changes to better predict the sales trend. You’re about to have more sales in physical stores, meaning you’ll have more customers visiting your stores. You can consider assigning more staff to your stores to better serve customers.

Decrease cash outflows

Minimizing cash outflows is an inseparable part of in-store cash flow management. Let’s see how to handle it.

Carefully manage inventory: do you want to import new products just to store in your warehouses or pile up your inventory? Of course not, right? But if you don’t have a clever inventory management plan, you are doing that without notice. Noticeably, poorly managing inventory can breed you to the verge of debt. Remember to always keep an eye on your inventory on a daily basis.

Reduce fixed and variable costs: internet, phone, rent, staff salaries are some of the fixed costs incurred during the year. Besides, you also have to pay for variable expenses like shipping fees.

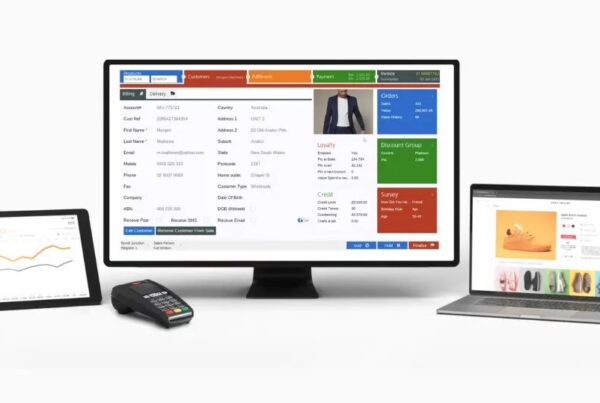

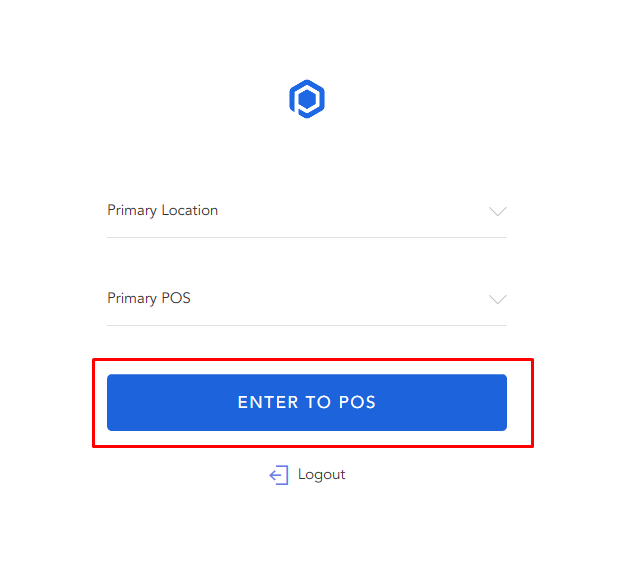

As your daily operations seem to tie closely with a POS system, you can surely take advantage of your powerful POS to manage inventory and staff performance. A POS system allows you to record and track inventory in real-time, separate staff log-in to measure each staff’s performance is a good fit for your business.

Make use of your unused assets

Let’s go around your stores to see if you have any unused or unneeded assets. If there is any, you can sell it out to make space for inventory storage and collect some free cash.

Conclusion

In-store cash flow management reminds you of reviewing, analyzing your current cash flow activities to adjust and have a better managing plan for your retail business. The earlier you start working on the more comfortable you feel when operating a business. If you need further discussion on how to design a good-fit plan for managing cash flow in your physical stores, our dedicated experts are always willing to help.