Shopify payment gateways connect your Shopify store to customers’ wallets. Utilizing the best payment gateways for Shopify can help you enhance payment security, ensure a seamless shopping experience, and reduce cart abandonment. Thus, choosing the right payment gateway is essential for optimizing your eCommerce operations and boosting customer satisfaction.

In this article, we’ll walk you through the definition and significance of a payment gateway for Shopify, key factors to consider, and the top Shopify payment gateway integrations for your business.

What is a Shopify payment gateway?

A Shopify payment gateway is a payment gateway designated for Shopify merchants.

During eCommerce transactions, the payment gateway in Shopify acts as an online payment portal, securely transferring transaction data between your customers and the Shopify payment processors for authorization and settlement. It enables your eCommerce store to accept various payment methods, such as credit cards, debit cards, and digital wallets.

Shopify payment gateways are essential because they allow merchants to:

- Accept card-not-present (CNP) transactions and handle sensitive payment data online

- Reduce the risks of fraudulent transactions thanks to various payment gateway security measures such as data encryption, tokenization, secure socket layer (SSL), and secure electronic transactions (SET)

- Enhance customer trust and confidence to enter their payment details online as payment gateways for Shopify add an extra layer of security for online transactions

- Automate tasks such as verifying the credibility of the payment information

- Expand globally because payment gateways support multiple payment methods and currencies

7 key factors to choose the best payment gateways for Shopify

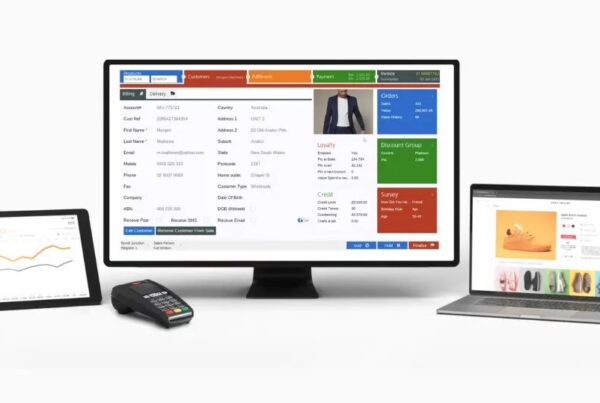

Ease of integration with Shopify and your business system

Shopify merchants should opt for Shopify-supported payment gateways to eliminate technical complexities from the business end and ensure frictionless payment experiences from the customer end. The payment gateway must also integrate with your existing business software, such as your POS terminals or POS for Shopify to minimize operational silos.

Your business type

Different Shopify payment gateway options offer distinct functionalities, processing fees, and price structures. Therefore, some payment gateways are suitable for small businesses, while others shine for global or high-volume merchants.

Transaction fees and monthly costs

Payment gateways typically charge a percentage of the purchase plus a small amount for each transaction. Some Shopify payment providers also require a monthly fee and other payment fees.

Besides, Shopify charges a transaction fee of 0.6%–2% (depending on your Shopify plan) when using a third-party gateway.

Thus, eCommerce retailers should understand Shopify payment gateway pricing structures thoroughly to ensure their bottom line.

Your target markets

Some payment gateways are available in certain countries only, so it’s important to make sure your chosen payment gateway can cater to your target market.

If your Shopify store targets a global market, your best payment gateway for Shopify should support multi-currency, various languages, and diverse payment methods.

Security and fraud detection abilities

A payment gateway is particularly crucial for eCommerce businesses, which are inherently more sensitive to fraud because it helps add an extra layer of security. Thus, you should scrutinize fraud detection features to secure Shopify payment processing, reduce chargebacks, and minimize fraud-related losses.

Frictionless shopping experiences

The best payment gateways for Shopify should have features that enhance the online customer experience, such as:

- Provide a user-friendly and consistent payment interface that matches your brand to increase trust

- Handle multi-currency, multiple languages, and payment methods, because 59% of consumers abandon their carts when their preferred payment method is unavailable

- Offer reporting and analytics tools or integrate with third-party analytics services, such as Google Analytics, to help you track your payments, refunds, chargebacks, etc.

Scalability and support

eCommerce businesses can undergo rapid growth, so make sure that your payment solutions can scale with your operations. Specifically, it should be able to handle increased transaction volumes, support multi-currency, provide integration options, and offer robust customer support.

Quick summary: Top 8 payment gateways for Shopify

This list includes both Shopify’s built-in payment gateway and third-party payment gateways. While the native streamlines the setup process, integrating seamlessly with your store for a smooth experience, third-party payment gateways provide greater flexibility and access to advanced features.

Important note: When using a third-party gateway, you have to pay an additional 2% transaction fee on top of the Shopify Payments fees. For instance, if you use Stripe, the total fee is 2.9% + 30¢ per transaction (Stripe’s fee) + 2% per transaction (Shopify’s fee).

Payment gateway | Payment method | Transaction fee | Monthly gateway fee | Best for |

Shopify Payments | Credit and debit cards, mobile wallets, buy now pay later (BNPL), cryptocurrency |

| No | Shopify merchants seeking native payment solutions, especially subscription-based Shopify businesses |

Stripe | Credit and debit card, digital wallet, BNPL, ACH direct debit | 2.9% + 30¢ per domestic transaction Others:

| No | Omnichannel merchants |

Skrill | Credit and debit card, wallet, instant bank transfer, cash, alternative payment methods | Custom pricing, varying from 0 to 4.99% depending on transaction types, i.e. international and domestic transactions, and payment methods | No | Merchants who largely function in Europe |

Adyen | Credit and debit card, ACH direct debit, prepaid card, gift card, virtual wallet, BNPL | €0.11 per transaction plus a payment method fee | No | Enterprise-level businesses |

Verifone | Credit and debit card, digital wallet, online banking, direct debit, cryptocurrency wallet | From 2.4% + 30¢ to 3.9% + 45¢ Additional 2% for cross-border transaction | No | Small and medium businesses |

Authorize.net | Credit card, debit card, eCheck |

| $25/ month | Small businesses |

Worldpay | Credit card, prepaid card, gift card, alternative payment | 1.5% per transaction (Visa and Mastercard card transactions) | £19.95/ month for online gateway | Global businesses |

Payflow (PayPal’s payment gateway) | Bank account, credit card, PayPal cash | 10¢ per transaction | $0 – $25/ month | Online store that needs to accept international payments |

8 best payment gateways for Shopify: Pros and Cons

1. Shopify Payments

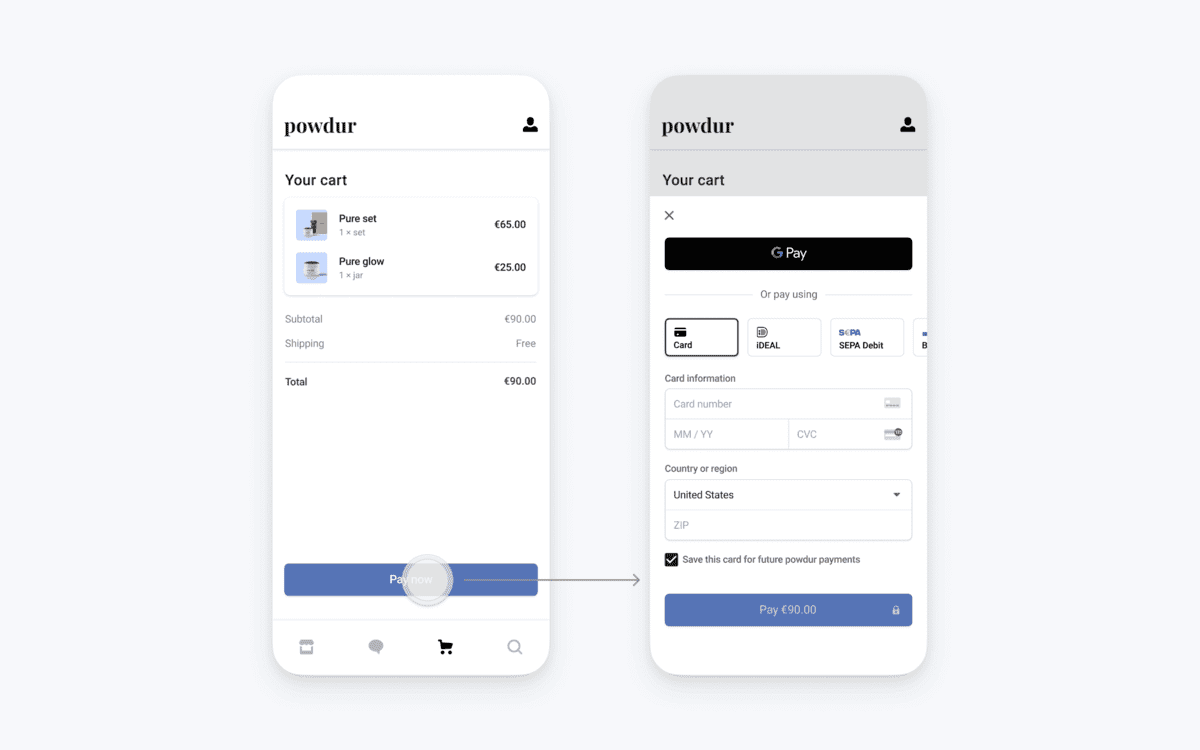

At the top of the Shopify payment gateway list is Shopify Payments, Shopify’s built-in payment gateway. For businesses, it eliminates the need for third-party payment gateways and streamlines the payment process. For Shopify shoppers, it enables a seamless and secure payment experience. This translates into lower cart abandonment rates and increased profitability for Shopify stores.

Note that if you’re a subscription-based business on Shopify, you should use Shopify Payments as your primary payment gateway.

Key features

- Accept all the best payment methods for Shopify, including major credit cards, debit cards, popular digital wallets like Apple Pay, Google Pay, PayPal, and cryptocurrency

- Allow customers to save shipping and payment information to speed up the checkout processes

- Offer built-in fraud prevention features such as fraud analysis, Shopify Protect, Shopify Flow, and Dynamic 3DS

- Function well with other Shopify features like inventory management and order fulfillment

Pros and cons

Pros | Cons |

Native for Shopify stores, no need to worry about how to integrate Shopify payment gateways | Exclusive to specific countries and regions

|

Seamless and easy setup in a few clicks | Lack many local payment methods |

Robust security features | |

Quick checkout process | |

Merchants using Shopify Plus payment gateway (depending on your location) might be free from third-party transaction fees when enabling Shopify Payments. | |

With Shopify Payments, Shopify Plus payment processing fees are lower than that of other plans. | |

No hidden or setup fees | |

You’ll receive chargeback fees from Shopify if you win the dispute depending on your locations. |

Fees

Shopify Payments charges tiered processing fees, depending on your Shopify subscription.

Shopify subscription plan | Basic | Shopify | Advanced |

Monthly price when billed annually | $29/ month | $79/ month | $299/ month |

Online processing fee per transaction | 2.9% + 30¢ | 2.6% + 30¢ | 2.4% + 30¢ |

In-person processing fee per transaction | 2.7% | 2.5% | 2.4% |

Currency conversion fee per transaction |

| ||

Refund fee | Custom | Custom | Custom |

2. Stripe

Stripe is a top-of-mind Shopify custom payment gateway for both online and in-person small businesses because it allows users to accept and process payments without a minimum monthly revenue requirement. Moreover, Stripe stands out for its customizability and scalability.

It’s also one of the best payment processors for Shopify, making it ideal for merchants looking for an all-in-one payment solution.

Key features

- Accept credit cards, debit cards, BNPL, ACH direct debits from bank accounts, and all major digital wallets

- Allow merchants to customize the checkout page and choose either embedded or Stripe-hosted checkout page

- Simplify the validation process with advanced KYC policies and AI-powered information scanning algorithms

- Allow businesses to build a fully API-based integration or only use their JavaScript library to tokenize your customers’ payment details

Pros and cons

Pros | Cons |

Easy setup with no setup fees | Only available to Shopify store owners in 46 countries including U.S., Australia, and Thailand |

Transparent flat-rate pricing with no monthly fees | Only available to Shopify store owners in 46 countries including U.S., Australia, and Thailand

|

Wide ranges of payment options and currencies | |

Highly customizable checkout flow | |

Outstanding customer service | |

Instant Payouts option available |

Fees

Stripe charges a flat rate of 2.9% + 30¢ per domestic transaction. Large eCommerce businesses can request a custom quote.

Additional fees include:

- 0.5% for manually entered cards

- 1.5% for international cards

- 1% if currency conversion is necessary.

- 1% for instant payouts and an extra 1% for instant payouts of international payments

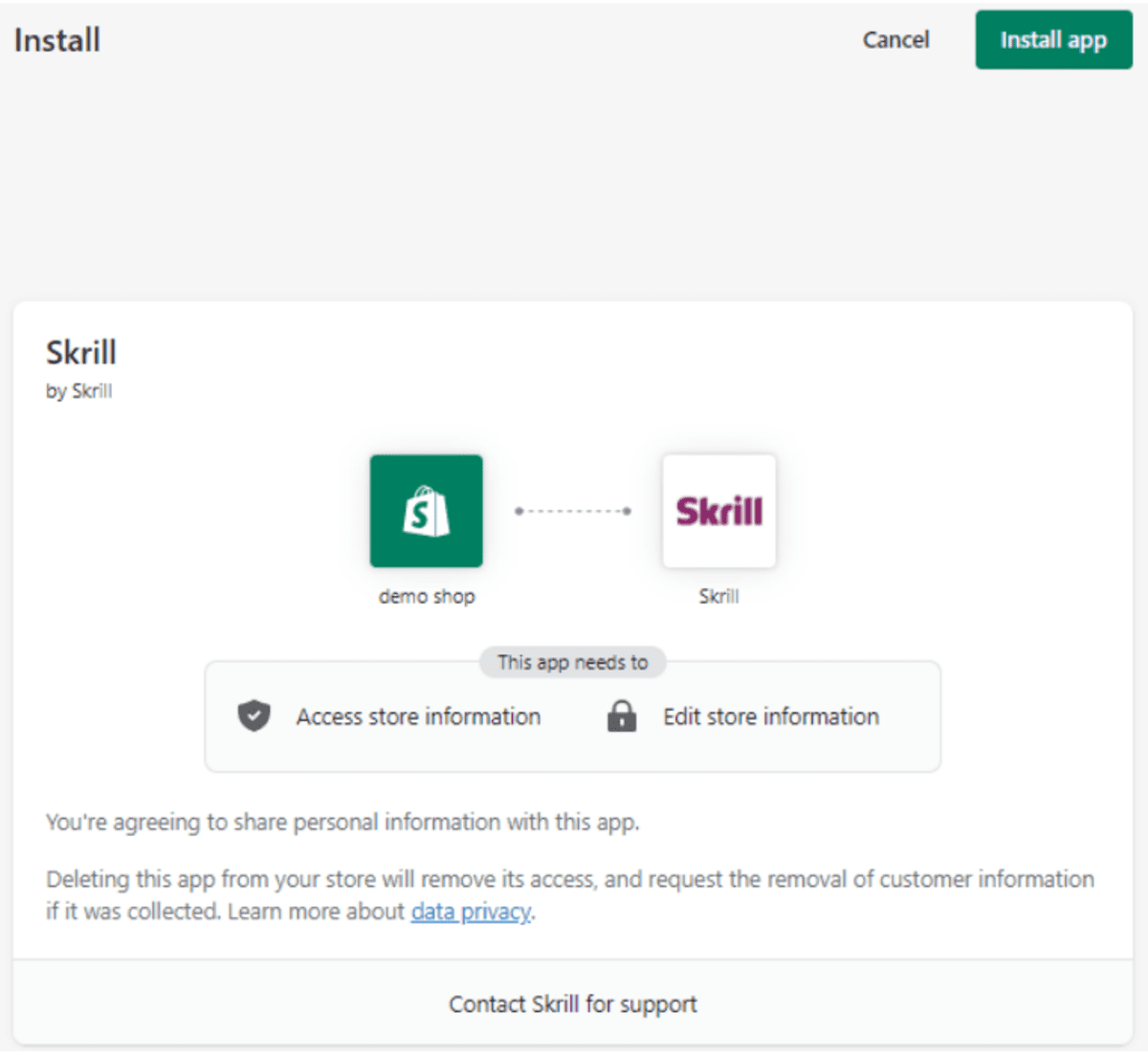

3. Skrill

Skrill is the most popular payment provider in Europe and is also available in 40 other countries. The Shopify payment processing option is well-known for its affordable pricing, low international payment fees, and instant deposit and payout options.

Key features

- Accept over 40 currencies and 100 local payment methods

- Provide you with chargeback protection on all payments, excluding credit and debit cards

- Allow your customers to make repeat payments in one tap

- Integrate easily with one account, one contract, and one single Shopify payment gateway API

Pros and cons

Pros | Cons |

Simple integration with only one contract and a single API | Offer a low withdrawal limit that may hinder customer spending |

Chargeback protection with payment indemnification | Provide unsatisfactory customer support |

Competitive processing rates and fees | May terminate your account abruptly |

Enhanced fraud management |

Fees

Skill doesn’t charge any setup fees or service fees unless your account is inactive for longer than 6 months.

Transaction | Skrill fee |

International transfer by bank transfer | Free |

International transfer by debit card, Paysafecash, Bank transfer via Sofort, Klarna | Up to 1% |

International transfer by credit card | Up to 2.99% |

International transfer in the same send and receive currency | Up to 4.99% |

Domestic transfer | Up to 2% |

Send money to other Skrill users | 2.99% |

4. Adyen

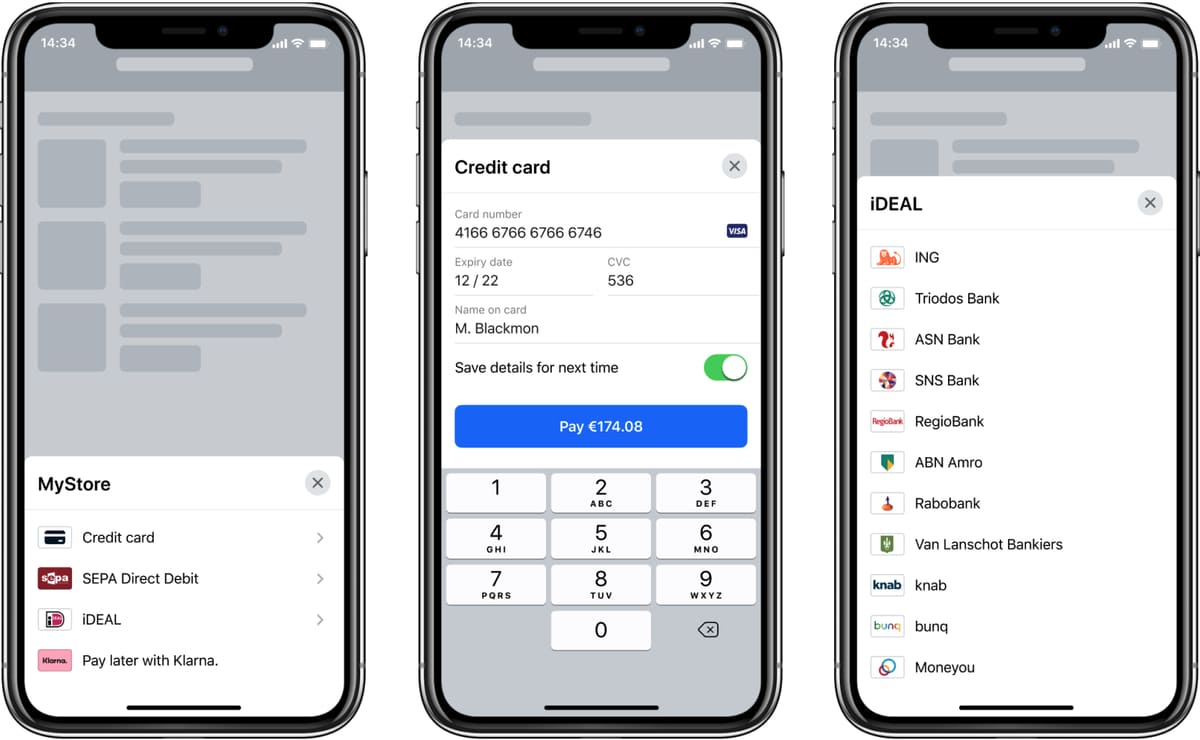

Partnered with startups and giants worldwide, Adyen helps businesses accept and process payments locally and globally in 30+ currencies via diverse payment methods. The payment gateway shines for its seamless mobile payment option, dynamic card validation, and advanced security technology.

Key features

- Facilitate a smooth omnichannel payment experience, including eCommerce, mobile apps, and physical stores

- Allow customers to checkout in your branded checkout environment without any redirections to other websites

- Utilize 3DS 2.x technology to provide secure and reliable 3DS challenges and authentication

Pros and cons

Pros | Cons |

Need only one API to connect and one contract for almost 100 markets | Require a minimum monthly invoice, posing issues for low-volume businesses |

No setup or monthly fees | Their pricing system is rather complex because the transaction fee depends on both payment method and location. |

Utilize advanced fraud detection and prevention tools | Require complex setup and integration with existing systems

|

Offer an all-in-one payment service, from payment gateway to payment processor for Shopify |

Fees

Merchants can enjoy zero setup, integration, monthly, or closure fees if using the Adyen payment gateway.

The gateway charges a Shopify payment processing fee of €0.11 per transaction plus a payment method fee which varies depending on payment methods and locations. For example:

- JCB (Global): €0.11 + 3.75%

- ACH Direct Debit (U.S.): €0.11 + $ 0.27

- WeChat Pay (China): €0.11 + 3%

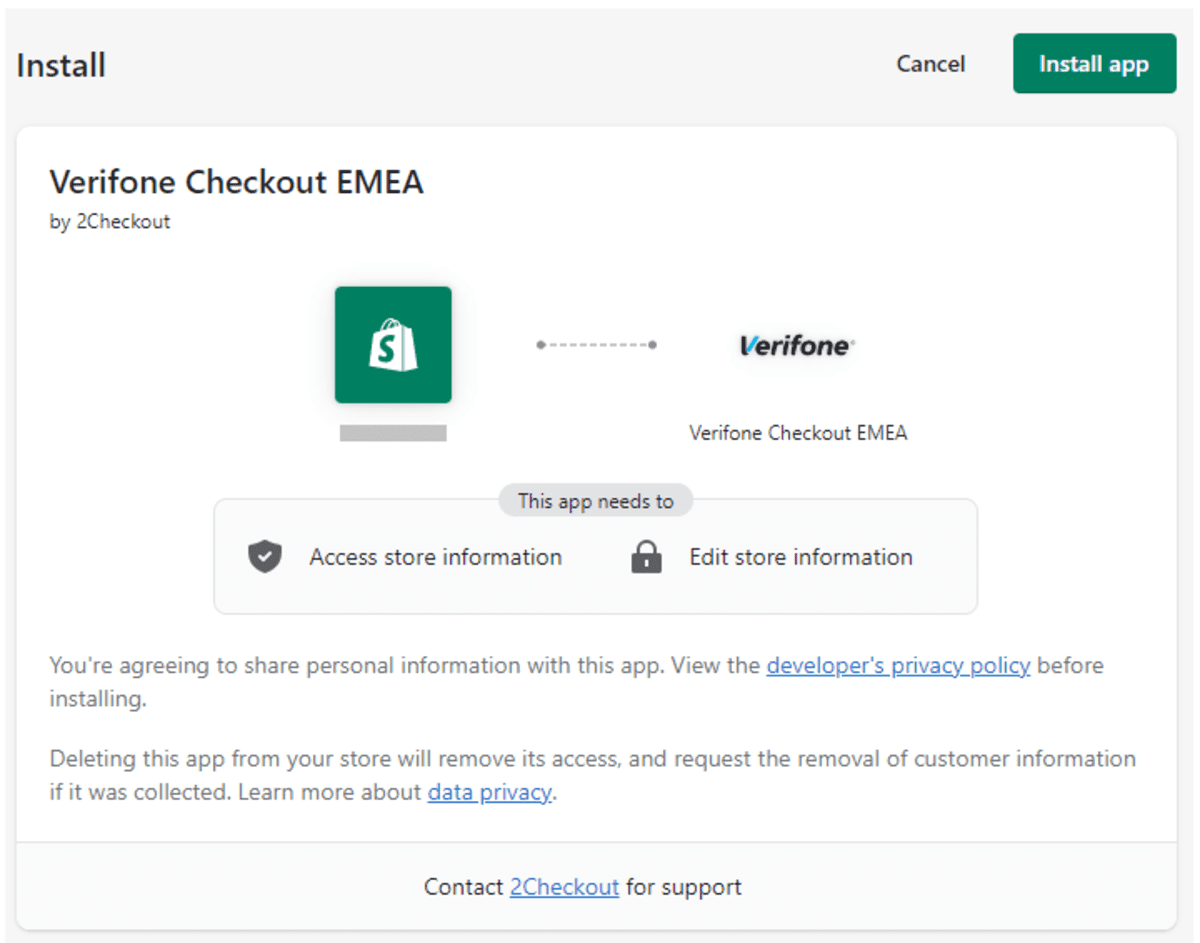

5. Verifone

Verifone, established in 1981, is a long-standing leader in the payment gateway industry, operating in more than 165 countries.

Verifone offers great flexibility for merchants to choose and pay for only the features they need. Moreover, the payment gateway has various value-added features, such as advanced risk management and compliance, tax calculation, etc.

Key features

- Accept card payments and emerging payment methods such as digital wallets including PayPal, Apple Pay, Google Pay, Alipay, buy now pay letter, and crypto coins

- Provide real-time fraud scoring and automated risk assessments

- Combine in-house and third-party payment fraud detection services

- Generate fraud management, transaction, authentication, and settlement reports

Pros and cons

Pros | Cons |

Offer flat-rate pricing | Inconsistent support staff |

Support diverse payment methods | Only accept online payment |

Enable mobile checkout | |

Provide advanced fraud protection | |

Process up to 99 currencies in over 30 languages |

Fees

For Verifone’s users, there’s no monthly payment gateway fee. The transaction processing fees vary depending on the seller’s country, industry, business model, and subscription plan, ranging from 2.4% + 30¢ to 3.9% + 45¢.

The payment gateway also charges an additional cross-border fee of 2%.

If your business processes more than $50,000 per month, you can opt for volume-based pricing.

6. Authorize.net

Established in 1996, Authorize.net has become a worldwide recognizable payment gateway provider. This Shopify payment gateway integration prioritizes safety with a reliable customer management system, automatic fraud detection, and card tokenization features.

Other features contributing to their competitive position include Account Updater and Recurring Payments.

Key features

- Accept payment methods that modern customers prefer, such as digital wallets, credit cards, debit cards

- Offer the Account Updater feature, which allows merchants to keep customer card information up to date

- Offer customer information management features to ease the payment process of returning customers

- Provide advanced fraud protection with tools and filters tailored to your business

- Handle recurring or installment payments

Pros and cons

Pros | Cons |

Support multiple currencies and payment options | Receive several complaints about occasional technical glitches during transactions |

Offer robust fraud prevention and security features tailored to specific business needs | Offer inadequate customizability for those with unique business models |

Provide excellent customer service | May overwhelm small businesses or beginners with their comprehensive set of tools |

Fees

For all plans, there’s a $25 monthly gateway fee but no setup fees. However, the processing fees vary for different plans.

Plan | Skrill fee |

All-in-one (a payment gateway, a merchant account, and eCheck) | 2.9% + 30¢ per transaction |

Payment gateway and eCheck | eCheck: 0.75% Credit card: 10¢ per transaction + 10¢ per daily batch |

Payment gateway | 10¢ per transaction + 10¢ per daily batch |

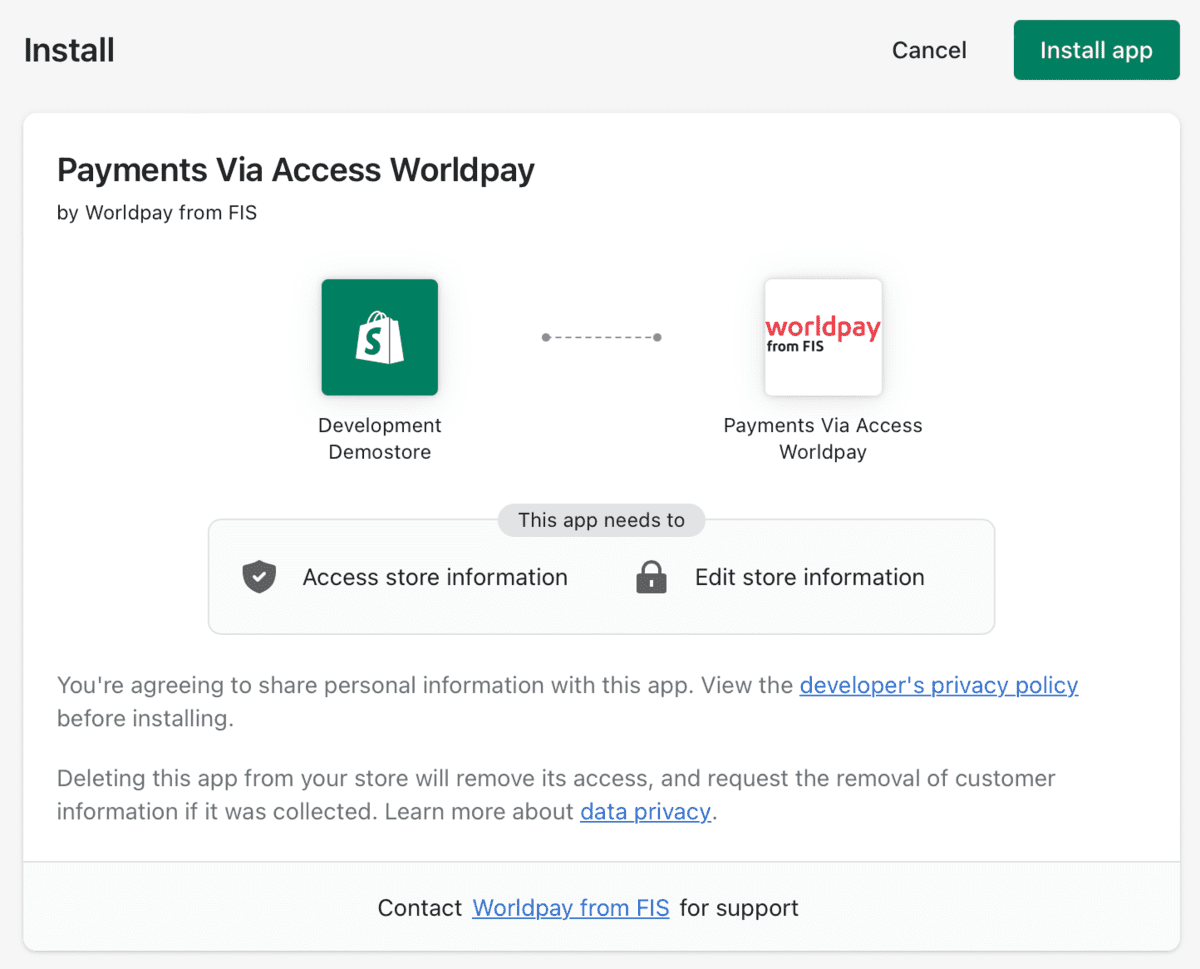

7. Worldpay

Worldpay is a trusted payment gateway with a highly global presence in more than 120 countries. This gateway allows merchants to receive payments in multiple languages, currencies, and payment methods. Their international adaptability makes it one of the best payment gateways for eCommerce businesses with international operations.

Besides, it’s also a reliable, secure, and efficient platform for businesses of all sizes, with advanced security measures and customizable options.

Key features

- Offer advanced fraud protection features tailored for merchants with or without an in-house fraud operations team, such as Fraud Management Essentials and FraudSight

- Accept various payment methods, such as credit cards, debit cards, digital wallets, and cryptocurrency

- Allow you to customize your payment page: Choose your logo and stylesheet, add your branded fonts, and whitelist a custom URL

- Provide pre-built plugins, extensions, and direct partner integration

Pros and cons

Pros | Cons |

Outstanding fraud protection features | Stringent policies for emerging markets |

Available in over 120 countries | Non-refundable chargeback fee |

Clean UX and worldwide trusted brand name | Inconsistent customer service |

Consistent, flat-rate pricing system | |

Multiple payment options, including Venmo and cryptocurrency | |

No refund fees |

Fees

Worldpay charges Shopify merchants 1.5% for each Visa and Mastercard card transaction and £19.95/ month for the online gateway. There are no upfront fees or premium charges.

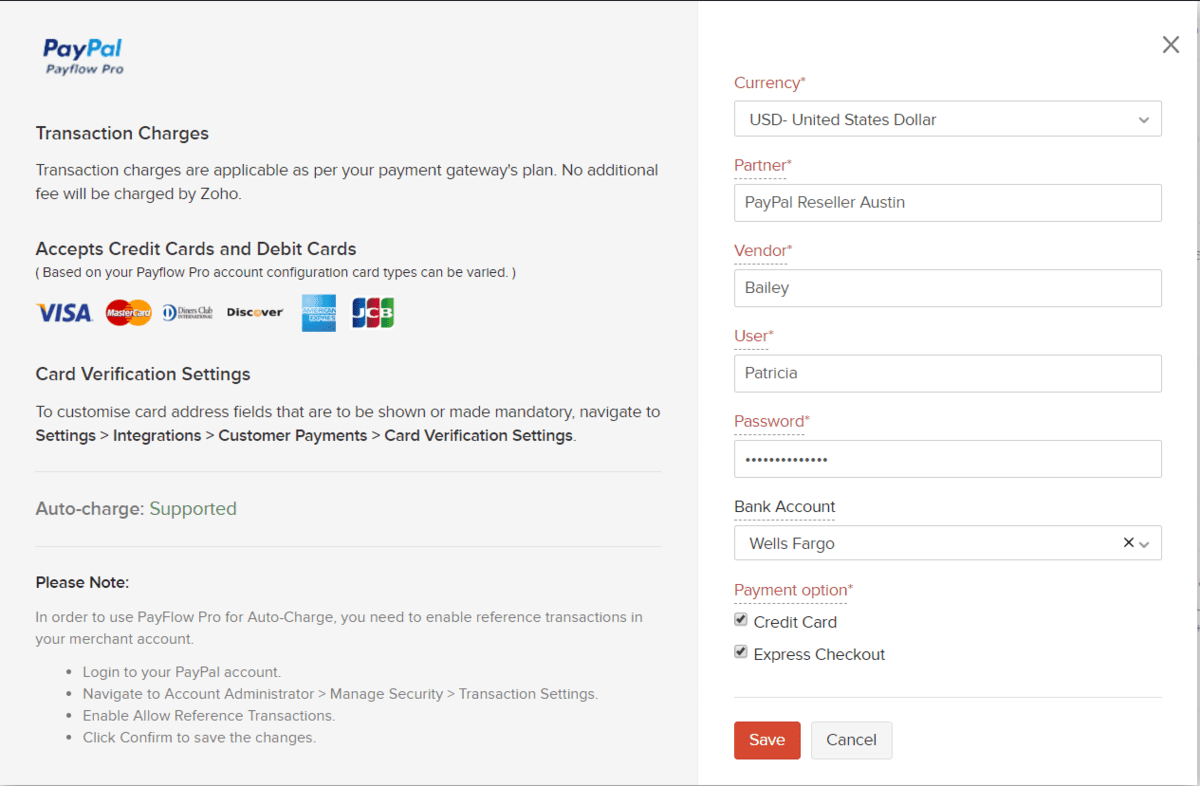

8. Payflow by PayPal

Trusted by over 220 million users globally, PayPal is among the best Shopify payment gateways. Payflow, PayPal’s payment gateway service, is well-known for their superior customizability, easy cart integration, advanced mobile checkout, and international payment option.

Key features

- Accept all major credit and debit cards, PayPal payment, and PayPal Credit payment options

- Offer a mobile-optimized checkout experience where customers can pay in one click

- Allow customers to pay without redirecting them to another site, increasing customer trust and minimizing cart abandonment rate

- Let merchants design custom and branded checkout page with the paid version, Payflow Pro

- Provide a pre-built checkout template for merchants to embed into the checkout page with the free version, Payflow Link

- Integrate with major shopping carts and almost every processor

Pros and cons

Pros | Cons |

Offer both paid and free payment gateways for Shopify | Inconsistent customer service |

Offer a transparent flat-rate pricing structure | May place holds on your funds unexpectedly |

No cancellation fees, monthly minimums, or other hidden fees | |

Have an intuitive mobile interface | |

Accept payments in more than 200 countries and 25 currencies |

Fees

Add New | Payflow Link | Payflow Pro |

Processing fee | 10¢ per transaction | 10¢ per transaction |

Monthly fee | No monthly fee | $25/ month |

Recurring billing service | 10¢/ month | 10¢/ month |

Regarding fraud protection service, you can use the free Basic Package or pay $10/ month for the Advanced Package. Other fees when using Payflow include international payment, chargeback, and dispute fees, depending on your location.

Shopify Payments doesn’t support certain countries and regions (UAE, Cuba, Iran, North Korea, etc.) and restricts specific types of businesses (adult services, online pharmacies, age-restricted goods or services, etc.). If your business falls under these restrictions, you will need to find a third-party payment gateway to process payments for your online store. As mentioned earlier, there are several key factors that a merchant should consider when selecting a payment gateway, including the location of your business, the fees involved, your target market’s shopping preferences, and your store’s eligibility. Be sure to thoroughly research these factors before making a decision.

Additionally, if you not only sell online but also own brick-and-mortar stores with a need for synchronized payment data across channels, you should consider using a POS system. However, Shopify POS only accepts Shopify Payments, so if Shopify Payments isn’t suitable for your business, you should look into third-party POS solutions. For example, if you use Stripe as your online payment gateway and want to maintain a unified payment experience for your customers in-store, Magestore Stripe POS with Stripe integration by default is a solution for you. Simply connect your Stripe account and card reader to start accepting the payment with Stripe.

>>> Might you like: Can you use Shopify POS on desktop?

Conclusion

Payment gateways for Shopify benefit both merchants and online customers, ensuring a smooth payment experience, transaction security, and streamlined business operations. We’ve covered the basics of payment gateways, suggested key criteria to choose one, and recommended the 8 best payment gateways for Shopify.

Which eCommerce payment gateway is most suitable for you depends on your budget and business needs. To save transaction fees, you can opt for the native gateway of Shopify, Shopify Payments. Otherwise, a third-party payment gateway will be ideal if you seek flexibility and more advanced functionalities.

For example, if your store operates in Europe, Skrill could be a great option. Meanwhile, if you prioritize secure international payments and global presence, you should consider PayPal and Worldpay.

You can bookmark this list of Shopify payment gateways and refer to it anytime you want. Happy selling!

FAQs

Which payment gateway is best for Shopify?

Which payment gateway is best for Shopify depends on your business needs.

For your reference, we’ve compiled a list of the 8 best payment gateways for Shopify: Shopify Payments, Stripe, Skrill, Adyen, Verifone, Authorize.net, Worldpay, and Payflow.

To know how to select Shopify payment gateways that match your business, please refer to the 7 factors discussed above.

Does Shopify have a built-in payment gateway?

Yes. Shopify’s built-in payment gateway is Shopify Payments.

Does Shopify charge for external payment gateways?

Yes. While integrating a third-party payment gateway with Shopify is free, you need to pay a transaction fee of 0.6%–2% (depending on your Shopify plan) when using a third-party provider. You can eliminate this cost by using Shopify Payments.

Is Shopify payment gateway good?

Yes, it’s a good idea for merchants to utilize payment gateways in Shopify, either their in-house Shopify Payments or third-party payment gateways Shopify supports. Shopify payment gateway integration enhances payment security and streamlines the payment process for both Shopify merchants and shoppers.