Nowadays, more and more customers prefer to pay by credit card because it’s more convenient and beneficial than cash. Retailers that accept online payments and credit card payments need to pay a fee for each transaction, called a payment processing fee.

The credit card processing fee of a transaction accounts for a tiny proportion of the transaction value. However, when combining all the transactions, the total amount isn’t small. When you add in the monthly fee, authorization costs, and assessment fee, the total monthly amount you have to pay for credit card processors can be enormous. Therefore, this article will introduce to business owners 6 effective ways to reduce credit card processing fees.

What is the credit card processing fee?

Payment processing fee is the cost that payment service providers charge store owners to process the payments from their customers. This cost covers the fees for:

- Card issuer

- Card network

- Payment processor

Contributing to your credit card processing costs, there are 5 main parts:

1. Interchange fees

Interchange fees are the fee that the card processor charges you for issuing bank to:

- Handle the transaction from your bank to your customer’s bank

- Eliminate transaction risks like card fraud

As the card networks set this fee, it’s non-negotiable for all merchants. This fee has different rates which depend on:

- Sale volume

- Card acceptance method

- Business industry

- Type of customers’ cards

2. Assessment fees

Assessment fees are the fee that card brands charge the merchant to:

- Enable the use of a particular card brand

- Process the card provider’s transactions on the payment network

This fee is non-negotiable and is lower than the interchange fee.

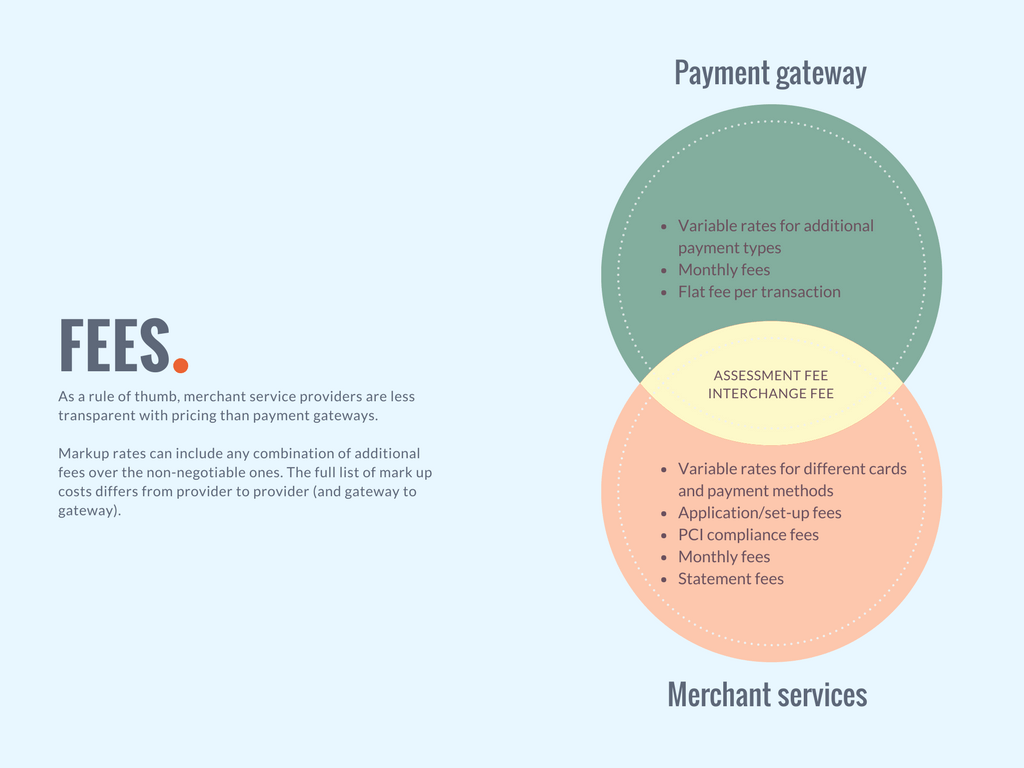

3. Payment processor markup fees

Payment processing services like PayPal or Square charge you this fee to accept credit cards. This fee can be negotiable, which includes:

- Processor operating costs

- The margin of each transaction on the credit card processor

4. Incidental fees

Some of your certain actions will trigger incidental fees, such as:

- Batch fees: A small daily fee for your deposits

- AVS fee: A fee for an anti-fraud solution to verify your customer cardholder’s zip code and address. It costs you only some cents for each transaction.

- Voice authorization fee: Another fee for anti-fraud solution. If you pay for that, the POS terminal will remind you to contact the card-issuing bank. This bank will collect your information before they process, decline, or approve the transaction.

- Chargeback fee: If your customers dispute a transaction, payment processors will charge you this fee. In case you can resolve your dispute, the processor will refund the charged amount to you.

5. Account service fees

The processor charges an ongoing service fee to maintain the merchant’s account. This fee is negotiable, depending on your services:

- Payment gateway fee: pay monthly for using the payment gateway to accept online credit card payment

- Monthly minimum fee: pay in case you can’t generate a certain value or process a certain number of transactions each month

- Monthly statement fee or monthly fee: pay to payment processors to cover their customer services like preparing monthly statements

- PCI non-compliance fee: pay for any month when you can’t meet any PCI requirements

- PCI compliance fee: pay for the processor’s PCI DSS complying service so you don’t have to certificate with PCI standards yourself

What factors determine credit card processing fee?

The amount of fees depends on various factors:

- Type of business: Payment processors apply different credit card processing rates for different business types based on your registered Merchant Category Code (MCC) such as supermarket, retail, travel, and fuel.

- B2B businesses: B2B companies, such as large-volume or government suppliers can get Level 2 and Level 3 processing for lower credit card processing rates. However, this kind of discount isn’t applicable for companies that have traditional eCommerce or physical terminals.

- High-risk level businesses: If the payment processors classify your business as high-risk level due to the nature of your products and services, or high chargeback history, you’ll have to open a dedicated account for high-risk sellers. This will add up to your credit card processing fees.

- Type of transaction: Card-present transactions (swipe cards or hovering NFC/chip at POS terminals) often come with lower processing fees than card-not-present transactions (online and telephone orders). The higher risk, the higher the fees.

What is the average credit card processing fee?

The average credit card processing fee is 1.5–3.5% per transaction.

- For in-person transactions, the average fee is closer to 2%.

- For card-not-present and online payments, the average fee is around 3%.

In addition, the average credit card processing fee can vary between different credit card networks. We’d like to provide a comparison table of credit card processing rates of major brands.

Brand | Average credit card processing fees |

Visa | 1.29% + $0.05–2.54% + $0.10 |

Mastercard | 1.29% + $0.05–2.64% + $0.10 |

Discover | 1.53% + $0.05–2.53% + $0.10 |

American Express | 1.58% + $0.10–3.20% + $0.10 |

(*) Note: This fee hasn’t included the processor markup fee, which depends on the processor you use.

While large retailers with high volume transactions can get discounts and lower rates, small retailers suffer higher ones. Lowering the rate just by some minor percent can save you a lot.

For example, your rate is 2% and your total credit card transaction value is $500,000, you need to pay $10,000 for processing fees. However, this fee is down to $8,000 if your rate is 1.6%.

Although merchants can’t avoid it entirely, we’ll discuss 6 ways that you can reduce the credit card processing fee.

6 best practices to reduce credit card processing fees

1. Choose the right pricing models

In general, payment service providers will offer you 3 main pricing plans. There is no best option for all cases. It depends on your business growth, transaction type, and volume to choose the right pricing model.

Flat rate or blended pricing

Regardless of your customer card type, you’ll pay a fixed fee for each transaction. This fee structure makes an affordable, reasonable, and transparent budget – a suitable choice for small and start-up businesses.

Interchange-plus or cost-plus pricing

This model has 2 parts: the markup determined by the credit card processor and the interchange fee set by the card network. You can choose to pay a flat markup fee by a fixed amount or percentage. This is suitable for most companies and easier to budget options for scale-up and large businesses.

Subscription or membership pricing

Like interchange-plus, merchants only need to pay a flat monthly fee, which covers assessment and interchange fees. For markup fee, you’ll pay 5–10 cents per transaction. This model is a great option for small and growing businesses.

We summarize the credit card processing fee comparison by pricing model in the table below, which considers the most popular payment service providers in the market.

Company | Pricing model | Credit card payment processing rates |

Square | Flat rate | 2.6% + $0.10 (retail) |

Stripe | Flat rate | 2.9% + $0.30 (online) |

PayPal | Flat rate | 2.7% (retail) |

Payline Data | Interchange-plus | Interchange + 0.2% + $0.10 (retail) |

Dharma | Interchange-plus | Interchange + 0.15% + $0.07 (retail) |

Fattmerchant | Subscription | Interchange + $0.08 (retail) |

Payment Depot | Subscription | Interchange + $0.15 |

Let’s analyze an example to distinguish the credit card processing fees of these pricing models better. Imagine that you have monthly transactions as follows:

- 100 transactions of $200

- 100 transactions of $100

- 100 transactions of $50

- 100 transactions of $10

Here is how you pay for the processing fee according to your chosen pricing model.

Flat rate | Interchange plus | Subscription | |

Sample interchange rate | N/A (included) | 1.81% | 1.81% |

Processor markup (retail) | 2.6% + $0.10 | Interchange + | Interchange + $0.15 |

Monthly service fee | $0 | $10 | $49 |

Processing fee for one $10 transaction (100x) | $0.36 | $0.30 | $0.33 |

Processing fee for one $50 transaction (100x) | $1.40 | $1.11 | $1.05 |

Processing fee for one $100 transaction (100x) | $2.70 | $2.11 | $1.96 |

Processing fee for one $200 transaction (100x) | $5.30 | $4.12 | $3.77 |

Total monthly processing fee | $976 | $774 | $760 |

This clearly proves that:

- Flat rate is suitable for small retail, but not good for a high volume of transactions.

- SMEs with higher transaction values may prefer subscription or interchange-plus pricing.

Choosing the right payment solution is essential to optimize payment processing fees for your business. If you operate your business on eCommerce platforms, you should carefully understand how they support payments.

For instance, Shopify encourages merchants to use Shopify Payments, and if merchants choose third-party payment solutions for online transactions, extra fees are applied. For in-store transactions, Shopify POS only accepts Shopify Payments. Opting for a third-party POS solution can provide more flexibility, as some POS systems integrate with other payment options.

Magestore’s Stripe POS enables you to process payments with Stripe. And of course, in addition to Stripe, Magestore POS also can integrate with multiple local payment gateways based on your country and region, such as Square, Adyen, Verifone, Authorize.net, etc.

2. Negotiate the markup fee with credit card processors

As mentioned in the previous part, while you can’t negotiate interchange and assessment fees, the markup fee determined by the merchant account provider is negotiable.

Basically, a higher volume usually comes with a lower rate. Presenting yourself as a value-added merchant with high transaction volume is the best way to negotiate.

Thus, you should propose your expected sales in the coming years and demonstrate your annual growth. The payment processors can offer you a discount if your volume is large enough for them to negotiate with their suppliers.

The next thing to negotiate is how to calculate the markup fee. For larger value transactions, the percentage effect is larger than the flat fee per transaction. Let’s compare 2 transactions with the markup fee of 0.5% + $0.15:

- $100 transaction: $0.50 + $0.15

- $10 transaction: $0.05 + $0.15

It means that:

- With low-value transactions, you should negotiate the fee per transaction and can reduce it from $0.05–0.10 per transaction. It sounds small, but after 2,000 trades, you’ll reduce $100–200.

- With high-value transactions, you should negotiate for a lower percentage fee. Assuming the fee goes from 0.5% to 0.4% you will reduce $0.10 per transaction.

3. Reduce the risk of credit card fraud

Part of the processing fee is to cover the risks for your issuing bank and payment processor.

If you’re a high-risk merchant, your payment processors will charge you higher credit card processing fees. On the contrary, processors will reduce rates when you can demonstrate that your business is less prone to fraudulent activity and credit risk.

It’s a good idea to highlight some anti-fraud methods in your negotiation proposal:

- Demonstrate a clear refund and return policy

- Comply with PCI standards

- Swipe credit cards instead of keyed transactions

- Enter the security information to validate the payment and protect the cardholder

- Request a CVV for card-not-present transactions

- Request signatures for delivered orders

- Fill in the ZIP code in the billing address

- Save receipts and keep transaction history

- Use EMV card readers

- Stay updated with the latest technology and equip the right POS terminal

Not only will it reduce your credit card processing fee, it also lowers the risk of retail fraud, putting less strain on your business.

4. Use an address verification service

To increase your security level and reduce payment processing fees, you should use an address verification service (AVS) to verify the card issuer of the cardholder’s billing address.

- Customers enter their address during the checkout process.

- The AVS system compares if the filled in information matches with the registered address in the customer’s file at the issuing bank.

- After completing the comparison, the bank will send the merchant an AVS code.

The merchant uses that code to decline or complete the transaction.

This anti-fraud system reduces the rate of chargebacks or refunds for both in-store and online purchases. It’s especially beneficial for eCommerce businesses. MasterCard and Visa both support AVS and encourage all businesses to use AVS.

5. Set up your merchant account and terminal properly

Credit card processing fees depend in part on the characteristics of your business. As a result, setting up your account wrongly and providing incorrect business information will affect the structure of your credit card processing cost and increase credit card processing fees. You should set up properly and standardize your account information from the beginning:

- Choose the right business type, transaction type, and frequency

- Set a credit card minimum, around $10 for credit card purchase to avoid high fees per transaction for small order value

- Add a credit card surcharge, in which their customers pay the processing fee for their credit card transaction

Also, the settings of your terminals affect the processing fee. The more transactions and the longer the waiting time, the higher the credit card processing rates and fees. Here are some ways to reduce the cost:

- Proceed transactions within 24 hours to reduce the number of transactions

- Perform a transaction batch every day instead of every few days or weeks

6. Get payment processing from your POS provider

To reduce credit card processing costs for small businesses, you might consider working with one provider for both credit card processing and POS solutions to:

- Simplify your payment processing

- Eliminate additional costs like integration fees or fraud prevention fees

You’ll have seamless integration and if your business qualifies for credit cards processing discounts, you can lower the overall fees.

Conclusion

For any business, the credit card processing fee isn’t a small expense. You can negotiate the markup fee, increase your security level, set up standard accounts and terminals, and implement some rules for credit cards to minimize your credit card processing cost.

Each processor has a different pricing model so it’s important that you understand where the charges come from and what factors affect the rates.

- If you’re a seasonal and small business, you should go with the flat rate pricing model and choose a payment service provider who doesn’t require a long-term contract.

- If you’re a medium business and handle a high monthly transaction volume, you should opt for an interchange-plus pricing model.

- If you’re a large business, you may prefer the membership/subscription model to reduce credit card processing fees.

I really like this blog. It is really informative and useful for me. I am looking for more updates in the future.

Pretty! This was a really wonderful post. Thank you for providing such valuable information.

Reducing credit card processing fees can boost profitability for retailers. Great tips here! Implementing these strategies will definitely help optimize costs.