POS systems that integrate with Shopify include Shopify POS, Magestore POS, Square POS, Lightspeed POS, Clover POS, and ConnectPOS.

These systems differ in their integration capabilities with Shopify, feature sets, payment options, compatibility with POS peripherals, and pricing—topics we’ll cover in detail later in this article.

- Choosing a POS integration with Shopify: Understanding integration levels

- General comparison of 4 popular Shopify POS integrations

- Shopify POS: Best for seamless Shopify integration

- Magestore POS for Shopify: Best for multiple local payment integration and flexible customization

- Square POS: Best for small Shopify merchants using Square Payments

- Lightspeed POS: Best for comprehensive inventory management

- Methodology

Choosing a POS integration with Shopify: Understanding integration levels

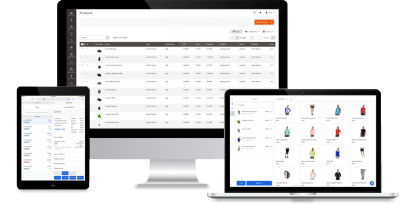

Before diving into the reviews of each POS option, it’s important to understand what to expect in terms of data with the Shopify POS integration.

The key factor is whether a POS system shares a single, unified database with online Shopify store or operates on a separate one.

POS systems like Shopify POS and Magestore POS share Shopify’s database, enabling seamless, real-time updates for sales, inventory, and customer data directly within Shopify. This setup requires no connectors, ensuring high data accuracy and streamlined operations.

In contrast, POS systems with independent databases—like Square and Lightspeed—use connectors to sync data with Shopify. These connectors only enable partial data sharing and can introduce delays, errors, or inconsistencies in inventory, orders, and customer records.

Additionally, using these connectors comes with extra monthly fees, adding to the ongoing costs for businesses.

- Using POS systems with separate databases, such as Square and Lightspeed, increases the risk of data mismatches and inconsistent inventory records across sales channels.

- For the most reliable and real-time data synchronization with Shopify, merchants should choose POS systems that share Shopify’s database.

General comparison of 4 popular Shopify POS integrations

This table provides an overview of the top 4 POS systems that integrate with Shopify, covering their integration capabilities, features, payment options, compatibility with POS peripherals, and pricing. Detailed evaluations of each criterion will follow in the article:

POS systems | Database | Key features | Payment options | Pricing | Ratings |

Shopify POS | Shopify database |

| Shopify Payments |

| 3.6 on Shopify App Store |

Magestore POS for Shopify | Shopify database |

| Integrate with various payment solutions |

| 4.7 on Trustpilot |

Square POS | Square's own database |

| Square |

| 4.6 on Software Advice |

Lightspeed POS | Lightspeed's own database |

| Lightspeed Payments |

| 4.2 on Trustpilot |

1. Shopify POS: Best for seamless Shopify integration

Who should use Shopify POS?

Shopify POS is ideal for merchants with basic in-store operations who prioritize seamless integration with Shopify and are comfortable using Shopify Payments and hardware.

Pros and cons

Pros | Cons |

First-party POS with tight integration with Shopify, eliminating the need for connectors or middleware to sync sales data | Payment processors:

|

Seamlessly integrates with over 100 third-party apps that extend the capabilities of Shopify POS | POS Hardware: Only compatible with Shopify-specified hardware. Migrating to Shopify POS often requires replacing most hardware, leading to additional costs. |

Compatible devices:

| |

POS Peripherals: Connects via Bluetooth, but signal interference can cause frequent disconnections and slow reconnections, leading to inconvenience during checkout. | |

Features: Offers limited built-in features, often requiring third-party apps for extended functionality. These third-party apps usually incur extra monthly fees. | |

Customization capabilities: Not open to customer requests for new features or customizations. | |

Reporting: Limited reporting capabilities. No close-of-day report. | |

Pricing plan: offering only a 3-day free trial | |

Customer support: Lack of direct tech support | |

Other missing features/ functionalities include offline mode, save cart, multiple carts, reorder, case breaks, preset modifiers, etc. |

Shopify POS pricing plans

Package 1: Sell in person – Simple features for building an online presence.

- Starter: $5/ month (1 POS Lite location included)

- Retail: $89/ month (1 POS Pro location included)

Package 2: Sell everywhere – Advanced tools for selling in person and online.

- Basic (for solo entrepreneurs): $25/ month (+ $89/ month for each POS Pro location)

- Shopify (for small teams): $65/ month (+ $89/ month for each POS Pro location)

- Advanced (for businesses looking to scale): $399/ month (+ $89/ month for each POS Pro location)

Shopify Payments processing fees:

Since Shopify POS exclusively supports Shopify Payments, here are the associated payment processing fees for your reference:

- Basic Shopify Plan: 2.9% + 30¢ per transaction

- Shopify Plan: 2.6% + 30¢ per transaction

- Advanced Shopify Plan: 2.4% + 30¢ per transaction

A detailed assessment of Shopify POS

What it does well

- Seamless integration with Shopify

As Shopify’s native POS solution, Shopify POS uses the same database as the Shopify online store, offering the tightest integration with the platform. This setup makes it the best POS system for Shopify for omnichannel sellers who need to manage inventory and sales data seamlessly in one place.

With no need for third-party connectors, merchants save time and money, avoiding the ongoing costs of middleware and minimizing data mismatches between online and physical stores. Shopify POS also supports a range of omnichannel features, such as redeeming Shopify gift cards, and enhancing the customer experience across channels.

- Free inventory management app

Pro users of Shopify POS gain access to Stocky, Shopify’s inventory and purchase order management app, at no additional cost. Stocky is designed to help merchants with essential inventory management tasks, such as tracking stock levels, managing suppliers, and creating purchase orders to restock low-inventory items. The app also offers demand forecasting based on historical sales.

Where it falls short

Shopify POS may offer the best integration with Shopify, but as a POS system, it remains a work in progress and lacks several key features many merchants need. Compared to competitors like Magestore POS for Shopify, Square, and Lightspeed, it falls short in some areas.

- Lacking POS features

To be fair, Shopify partners with several third-party developers to extend the functionality of Shopify POS, and Shopify is actively working to enhance the system. However, while Shopify’s updates are free, they often don’t arrive quickly enough to meet the needs of merchants managing various in-store scenarios.

The alternative to extend Shopify POS functionality right away is through third-party apps, but these often come with additional subscription fees, further increasing the cost of using Shopify POS.

Merchants with basic in-store operations may find Shopify POS sufficient, but those with larger inventories or who aim to create a more streamlined in-store experience often need more than what Shopify POS currently offers.

In terms of the feature set, a major issue is the lack of a ‘Save Cart’ function, which can complicate high-volume shopping. Instead of a simple one-click save, users must complete six steps to save and retrieve a cart.

Other missing features, such as price overrides and a streamlined refund process, create significant pain points for in-store users. Without a price override option, merchants must resort to custom sales, which complicates accounting or requires investing in a third-party app that costs around $10/month.

Notably, Shopify POS also lacks a close-of-day report, which can be challenging for brick-and-mortar businesses handling significant cash transactions, as they are unable to reconcile income and expenses at the cash register at the end of the day.

- POS hardware and payment limitations

Shopify POS requires Shopify Payments for card processing, which is only available in certain countries and mandates the use of Shopify’s card readers.

These readers can disconnect if signal interference occurs and require an internet connection to process credit card transactions.

Shopify POS also limits compatible hardware to Shopify-approved devices, which may lead to additional costs for merchants switching from another system.

- Mobile-only restrictions

Shopify retail POS software is primarily a mobile app, requiring up-to-date tablets or smartphones, which may be inconvenient for merchants who prefer a PC-based setup.

Recent restrictions on mobile emulators for desktops add further limitations. While a recent September 2024 update improves tablet functionality, users still report that Shopify POS has a more complex checkout interface compared to systems like Magestore POS and Square.

- Inefficient interface for high-volume sales

Although visually streamlined, the Shopify POS app interface can slow down checkout, especially for larger inventories.

Recent tablet improvements display more data on a single screen, but users still find Shopify POS less efficient for handling high-volume transactions than other systems.

>>> Might you like: Can you use Shopify POS on desktop?

Magestore POS for Shopify: Best for multiple local payment integration and flexible customization

Who should use Magestore POS for Shopify

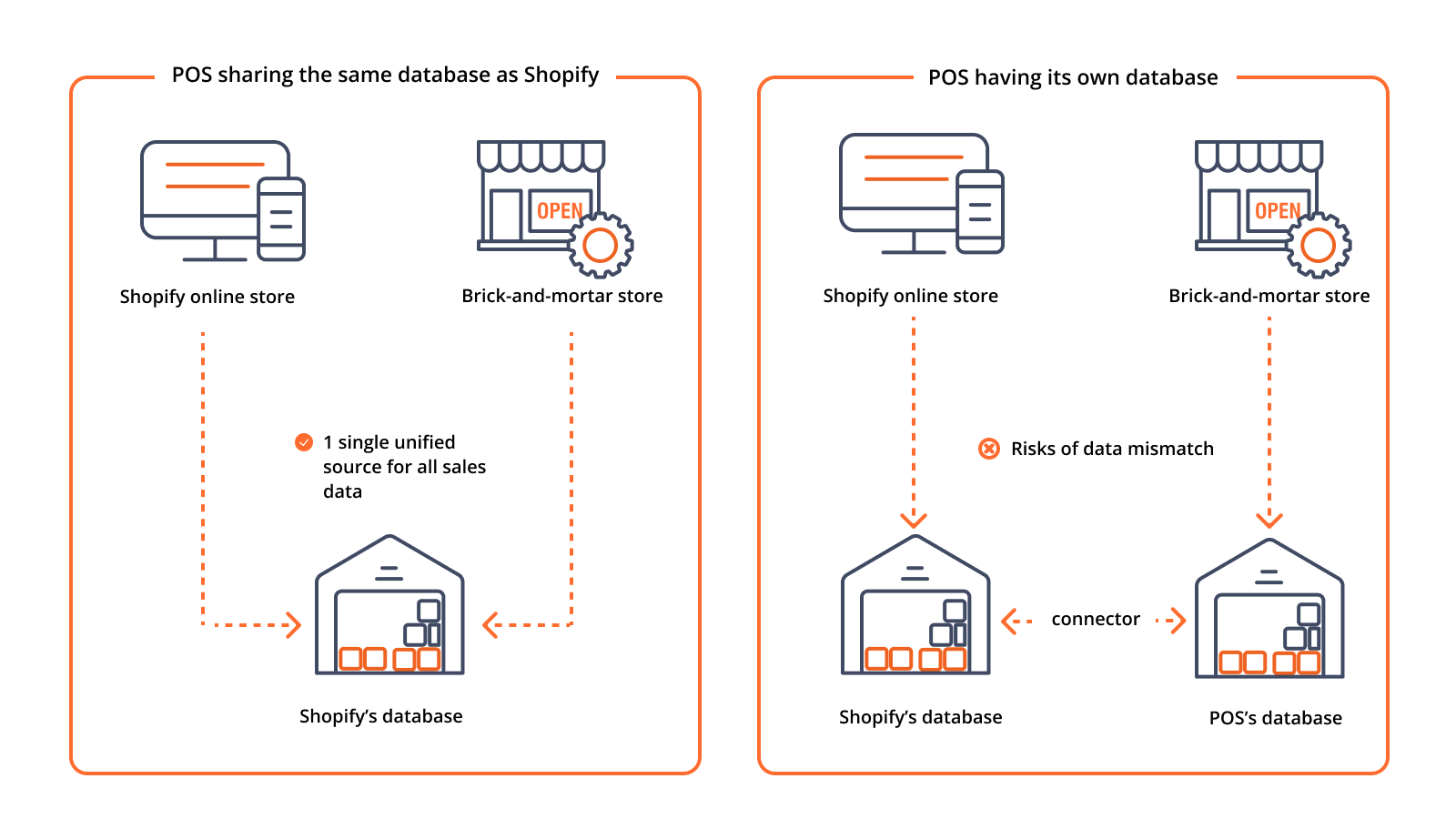

Magestore’s Shopify POS integration is ideal for merchants seeking a level of integration close to what Shopify POS provides while enjoying more flexibility in payment processors, hardware, and device compatibility.

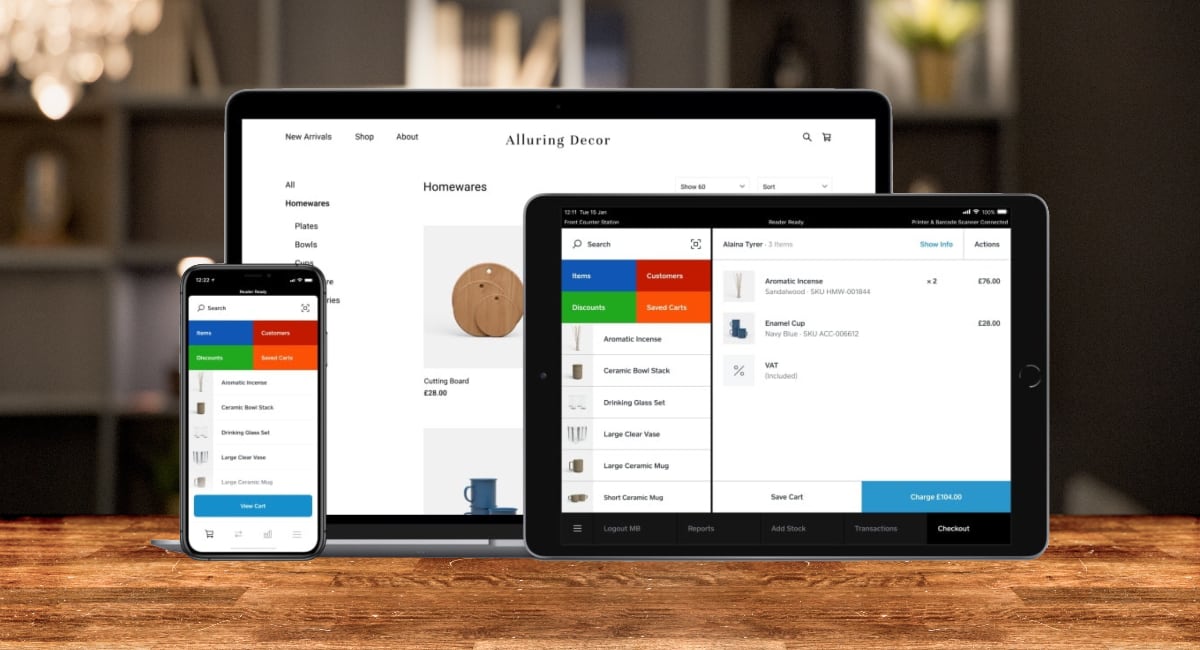

Magestore POS integrates seamlessly with a wide range of payment processors, including Stripe, right out of the box. As a web based POS powered by Progressive Web App (PWA) technology, it can run on any device with a web browser and supports a variety of POS peripherals, as long as they are browser-compatible.

Pros and cons

Pros | Cons |

Integrates with Shopify to sync sales data without third-party connectors. | Does not show all payment processor options in the interface; requires contact with the Magestore team for specific integrations |

Integrates with multiple payment options like Stripe, Square, Authorize.net, Dojo, and Tyro | May need Magestore team support during setup |

Offers multilingual translation | Lacks certain features due to Shopify’s API restrictions, such as omnichannel gift cards. |

Compatible with various POS hardware | |

Compatible with any device that supports a web browser, be it a PC, laptop, or tablet | |

Processes checkouts in seconds | |

Allows customization to meet specific business needs. | |

Offers affordable pricing with no transaction fees or hidden charges | |

Offers various in-store payment methods, including cash, credit/debit cards, checks, and more | |

Offers a 30-day free trial | |

Provides real-time support in the SEA region |

Magestore POS pricing plans

Magestore POS for Shopify offers 02 pricing plans, including:

- Lite: $15/ month (1 location only)

- Pro: $50/ month/ location

*Magestore POS for Shopify requires a subscription to the Shopify plan or higher*

A 30-day free trial is available before committing to a monthly subscription. For more specific customization requirements, contact the Magestore team directly for the pricing.

A detailed assessment of Magestore’s Shopify POS integration

What it does well

Where Shopify POS falls short in device compatibility, hardware options, payment flexibility, and customization, Magestore POS stands out as the top alternative without sacrificing real-time data sync or risking data mismatches.

- Tight integration with the Shopify platform

As a POS system designed to work exclusively with Shopify, Magestore POS for Shopify shares the same database with the Shopify online store, eliminating the risk of data mismatch and late data sync of the POS options that maintain their own databases and inventory.

- Flexible payment integration

Magestore POS integrates with a broad range of payment processors, including Stripe, Adyen, Verifone, and Authorize.net, making it the best POS for Shopify for merchants seeking options beyond Shopify Payments.

With built-in Stripe support and the option to request additional payment integrations, Magestore POS accommodates diverse payment needs, whether merchants choose to use multiple processors or switch providers entirely.

- Broad hardware compatibility

Magestore POS supports any POS peripherals compatible with your browser, giving merchants flexibility in choosing devices. This includes various cash drawers, barcode scanners, and receipt printers.

- Customizable for your needs

Magestore custom POS is highly adaptable, with a responsive team ready to handle customization requests. Merchants can tailor POS features, admin interfaces, and language settings to suit their unique operations. From feature adjustments to customizing receipt and email language, the system can adapt to specific needs.

- Compatibility with desktop

Magestore’s Shopify POS integration offers seamless desktop compatibility, allowing merchants to use any device with a web browser as their POS, eliminating the need to purchase or upgrade dedicated hardware for each store location.

This flexibility not only saves costs but also allows retailers to streamline in-store operations by using one device for both checkout and backend Shopify admin tasks.

The larger desktop screen provides cashiers with an expanded view of essential information, making it easier to navigate, manage customer interactions, and speed up the checkout process. This all-in-one setup is especially beneficial for high-traffic stores looking to enhance efficiency and reduce device clutter.

- Comprehensive in-store toolkit

Magestore POS offers a comprehensive feature set tailored for efficient in-store sales. Its detailed end-of-day reports cover sales, cash flow, and payment methods, with support for multiple denominations to simplify cash management.

Saving and retrieving carts is streamlined with a one-touch save function, accessible from the main checkout screen and retrievable on a dedicated page. Designed for use on desktop and tablet screens, Magestore POS supports managing and checking out multiple carts simultaneously, ideal for fast-paced retail environments.

Discounting is flexible, offering both automatic and custom discounts, and merchants can even request unique discount rules. For gift cards, Magestore POS allows partial redemption, letting customers save remaining balances for future purchases.

Additionally, Magestore is highly adaptable to local markets, offering accurate translations for POS interfaces and receipts, ensuring compliance and convenience for cashiers.

- Broad integration with leading retail systems

Since Magestore POS for Shopify is designed to work exclusively with the Shopify platform, it leverages Shopify’s extensive integration capabilities with retail systems like QuickBooks, Xero, and Avalara.

Where it falls short

- Feature gaps due to Shopify limits

As a POS built specifically for Shopify, Magestore POS for Shopify is limited by some inherent restrictions within Shopify’s platform. Key features like price overrides and case break support are currently unavailable, which may impact flexibility for merchants handling complex pricing needs.

A significant limitation is the lack of omnichannel gift card functionality, meaning customers cannot redeem gift cards both online and in-store, which may affect unified shopping experiences.

- No offline mode

Additionally, Magestore POS does not offer an offline mode, making it less ideal for stores in areas with unreliable internet connectivity.

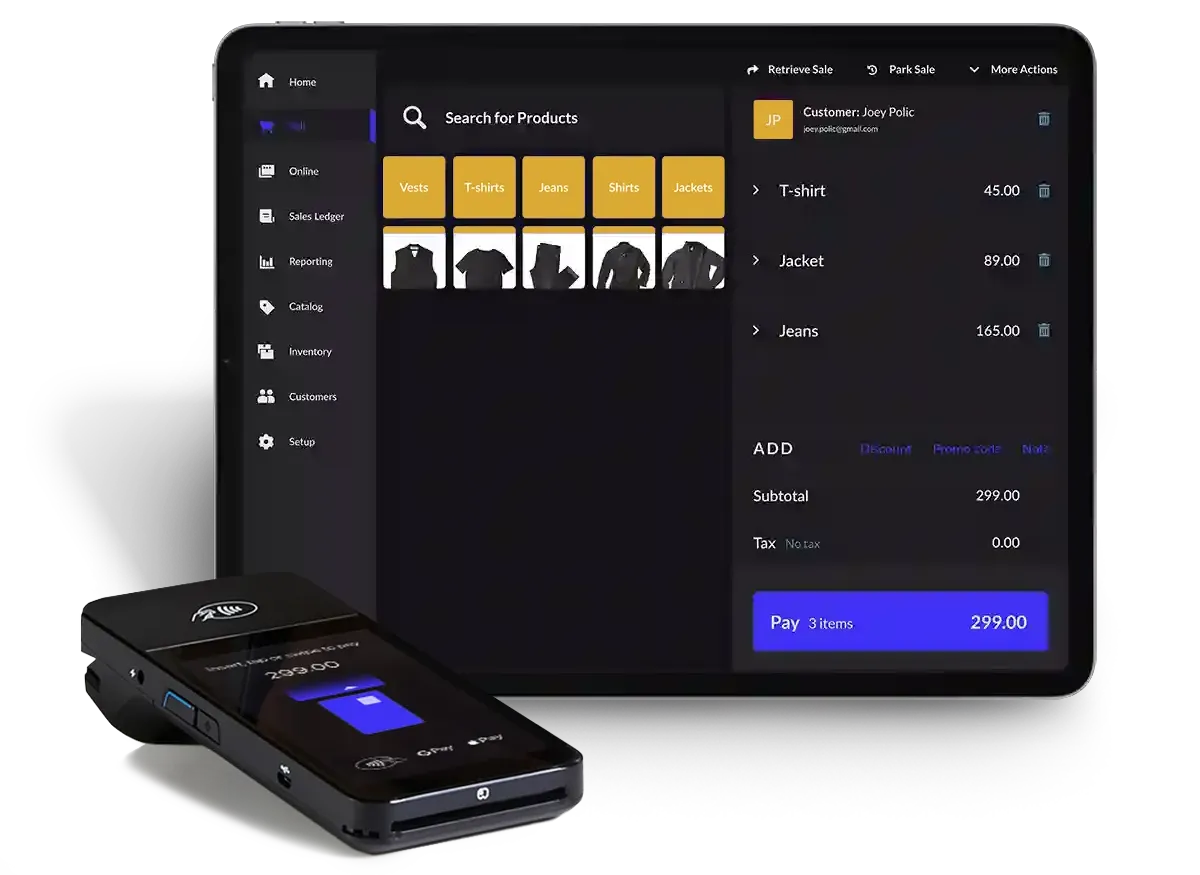

3. Square POS: Best for small Shopify merchants using Square Payments

Who should use Square POS

Square POS is a solid choice for small Shopify merchants with low-ticket sizes who prioritize affordability, simplicity, and ease of use.

Its flat-rate model, robust POS features, integrations, and reporting tools make it ideal for new merchants looking for a straightforward setup.

However, the processing fees can become costly as businesses scale. Additionally, Square’s limited integration with Shopify—covering only inventory and requiring a third-party connector—means manual data transfers are still necessary for full Shopify functionality.

Pros and cons

Pros | Cons |

Offer a comprehensive free plan with the standard features that meet the basic needs of merchants:

| Only accept Square Payments, not integrate with other payment processors |

Not require a long-term contract | Require a connector or middleware to integrate with Shopify, which increases the risk of data being lost during the syncing process |

Provide a simple and intuitive interface | Impose high payment processing fees |

Not run on the window desktops (Only available on iOS and Android) |

Square POS pricing plan

Software: $0/ month (conditional on using Square Payments, as Square POS cannot function independently of Square Payments)

Processing fees:

- Card present: 2.6% + 10 cents/ transaction

- Card not present: 2.9% + 30 cents/ transaction

- Keyed in: 3.5% + 15 cents/ transaction

Merchants can enhance the capabilities of Square POS with a range of free and paid extensions, including loyalty programs, email marketing, shift management, and payroll services.

A detailed assessment of Square’s Shopify POS integration

What it does well

- Budget-friendly POS solution (When paired with Square Payments)

Square POS stands out as a budget-friendly option, offering a comprehensive feature set without a monthly subscription fee—a rarity among POS systems, which typically charge both subscription and transaction fees.

Although Square’s transaction fees are slightly higher, the absence of a monthly fee makes it particularly appealing for businesses with tight budgets, allowing them to access a powerful POS solution without added costs.

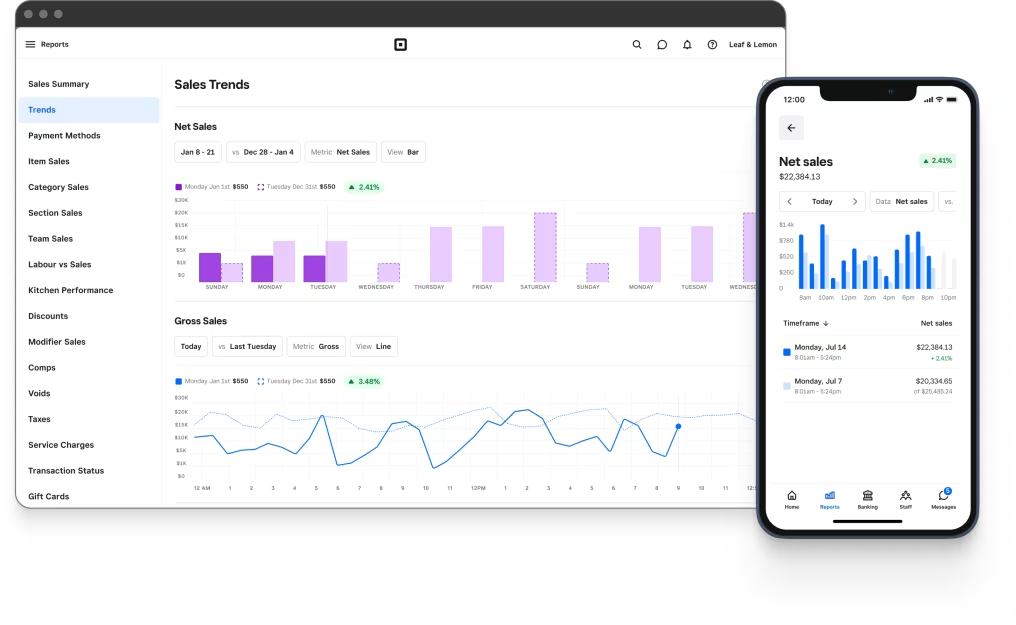

- Comprehensive reporting tools

One of Square’s key advantages is its robust reporting and analytics tools, even on the free plan.

These tools cover sales, payment methods, product and category performance, employee productivity, gift card usage, cash handling, and customizable reports for taxes and disputes.

This analytics suite helps business owners make data-driven decisions by tracking sales trends, understanding customer behavior, and monitoring team performance, all of which can drive smarter business strategies.

Square Analytics also supports CSV exports for bookkeeping and integrates directly with popular accounting software like QuickBooks and Xero.

- Streamlined checkout efficiency

Square POS enhances in-store efficiency with a streamlined checkout process, reducing transaction steps compared to systems like Shopify POS. This efficient flow helps staff complete transactions faster, improving the experience for employees and customers alike.

The system also offers flexible features, such as automatic discount settings and POS-only discounts or service fees. It can automatically save customer emails for digital receipts, simplifying follow-ups and boosting customer engagement.

- Extensive integration capabilities

Square POS excels at integration, smoothly connecting with essential systems like QuickBooks, MailChimp, and Klaviyo. This compatibility enables businesses to unify their POS with accounting and marketing tools, creating a cohesive, streamlined operational environment that supports growth.

- Quick start with Square payments

Paired with Square Payments, Square POS allows merchants to start selling quickly, with transparent, negotiable flat rates for easy budgeting.

It also includes offline mode, enabling merchants to take payments without an Internet connection, ideal for areas with spotty Internet or during outages.

Square’s affordable payment hardware further makes it an attractive choice for smaller merchants seeking a reliable, low-cost solution.

Where it falls short

Using Square POS alongside Shopify can seem like a powerful combination, with Square’s affordable in-store setup paired with Shopify’s online sales capability.

However, merchants should be aware of key challenges that arise from trying to run both systems seamlessly, as they often come with added costs, limitations, and integration hurdles.

- Complex integration issues with Shopify

Integrating Shopify with Square POS can be challenging, as Square operates on an independent database, which can lead to data discrepancies between the two systems.

Both platforms use separate inventory management systems, meaning that keeping inventory synced requires a third-party integration tool. These tools, often subscription-based, add an extra cost that can accumulate over time, particularly impacting small businesses.

Even with a third-party integration, data syncing is typically limited. While basic inventory and product data may sync, customer information, order histories, and sales details often must be manually transferred from Square to Shopify, a process that is not only time-consuming but also prone to human error.

Additionally, because Shopify and Square handle and store data in unique formats, certain data types are incompatible across systems. This difference can lead to data mismatches, especially with complex sales or customer data, requiring extra time and effort to resolve errors.

The challenges of continuously converting, transferring, and aligning data between these two platforms lead many merchants to consolidate their operations on a single system to reduce the risk of costly data inconsistencies and administrative overhead.

- Payment processing limitations

Square POS’s exclusivity with Square Payments presents another challenge.

Square POS requires using Square’s payment processing, which can be a drawback for merchants who have already established relationships with other payment providers.

For those unwilling to switch to Square Payments, the alternative involves having staff process orders and payments separately—a time-consuming workaround that increases the risk of transaction errors and potential customer frustration during busy periods.

Square’s flat-rate fees benefit businesses with lower ticket sizes but become costly for higher-ticket or higher-volume merchants as the rates add up.

- Barcode scanning limitations

For merchants needing barcode scanning, Square POS adds yet another constraint.

The ability to scan UPC barcodes is only available through the Square for Retail app, which is compatible only with Apple devices. This forces merchants to choose between compatibility and functionality and can complicate operations for those using Android-based hardware or requiring a streamlined setup.

- Unexpected fees

Square’s additional fees on paid plans can also take merchants by surprise.

Users on these plans report frequent fee increases and sudden charges for essential features, such as gift card processing or refunds, where transaction fees are no longer refunded on returns. These incremental fees can erode profitability, especially for merchants with tight margins.

4. Lightspeed POS: Best for comprehensive inventory management

Who should use Lightspeed POS?

Lightspeed POS is ideal for medium to large-sized established businesses handling high order volumes and requiring advanced capabilities beyond basic POS features.

With powerful inventory and reporting tools, Lightspeed easily manages extensive SKU counts and offers tailored modules for various industries, making it adaptable to diverse business needs.

However, Lightspeed encourages users to adopt its own payment solution; businesses that prefer third-party payment processors must either switch or pay a monthly fee per location, which can add up in the long run.

Pros and cons

Pros | Cons |

Offer powerful inventory management compared to Shopify POS (Some inventory management features that Lightspeed POS offers, but Shopify POS does not: view the average cost of inventory items; manage serialized inventory; sell boxed and assembly items; handle vendor returns and work orders; etc.) | Higher subscription fees compared to other POS systems and no free trial |

Provide multiple reports and analytics for merchant (Over 40 customizable reports, filtered by day, week, or month, covering sales orders, customers, inventory, employees, and more.) | Charge high fees for third-party payment processors other than Lightspeed Payments |

Provide a simple and intuitive interface | Complicate processes with a complex setup, interface, and functions, requiring a long learning curve |

Require long-term contracts |

Lightspeed POS pricing plans

For retail:

- Basic: $109/ month/ location/ register

- Core: $179/ month/ location/ register

- Plus: $339/ month/ location/ register

A detailed assessment of Lightspeed’s Shopify POS integration

What it does well

- Powerful inventory management and analytics

Lightspeed POS offers exceptional inventory management capabilities, making it a strong choice for retail operations with complex stock requirements. Advanced features like minimum and maximum stock thresholds and seasonal inventory control allow businesses to maintain optimal stock levels without manual oversight.

The system also supports efficient inventory uploads and management, even across eCommerce channels, offering a cohesive and streamlined solution for businesses managing both in-store and online stock.

Another standout feature is Lightspeed’s customizable sales and service menus, which enable the smooth integration of retail and service operations within a single POS system. This flexibility simplifies the checkout process for businesses that offer both products and services.

While Lightspeed’s analytics add-on requires an additional monthly fee, it provides a powerful suite of reporting tools that allow for highly customizable data pulls.

This feature enables businesses to track nearly any metric, giving them in-depth insights into customer behaviors, sales trends, and operational efficiencies.

- Broad integration capability

Lightspeed offers first-party integrations with popular systems like Xero, QuickBooks, Shopify, WooCommerce, and BigCommerce, ensuring seamless data synchronization across merchants’ retail systems.

Where it falls short

- Hefty penalty for using a third-party payment solution

A notable drawback of Lightspeed POS is its restrictive payment policy.

Lightspeed strongly encourages merchants to use its own payment processing solution, Lightspeed Payments, limiting flexibility for businesses accustomed to other processors.

While Lightspeed has offered to match current rates, many merchants worry about potential rate increases over time as they become further integrated into Lightspeed’s ecosystem.

This requirement can be particularly challenging for international businesses or those needing specialized payment options tailored to their sales volume, as Lightspeed Payments may not always align with regional needs or preferred processors.

If merchants choose to use their preferred payment solution, they may incur additional monthly fees that can total several hundred dollars per location.

- Poor customer service

Although Lightspeed advertises 24/7 phone and chat support, many customers report unresponsiveness when they need assistance. Customer support quality has declined over recent years, leading to growing frustration among Lightspeed users.

- Discrepancy between Lightspeed and Shopify

Lightspeed and Shopify operate on different systems and store data in distinct formats, which can make data syncing challenging.

One common issue involves barcodes: Lightspeed-generated barcodes aren’t compatible with Shopify’s format, meaning they often aren’t recognized in Shopify’s system.

To address this, merchants typically need to reach out to both Lightspeed and Shopify support to implement a custom script that converts Lightspeed barcodes into a format compatible with Shopify. For businesses with large inventories, this ongoing barcode conversion is both inefficient and time-consuming, complicating inventory management across platforms.

Methodology

As a company that develops POS solutions for businesses ranging from small startups to enterprise retailers with multiple locations, we have the opportunity to test numerous POS systems and interview a wide range of merchants as part of our market research.

Additionally, we’ve delved into review sites and forums to gather firsthand insights from real users about their experiences with the POS systems we reviewed.

This extensive research puts us in a unique position, equipped with substantial POS-related data and expertise, to evaluate each system’s Shopify POS integration levels, strengths, weaknesses, and suitability for businesses of different sizes and needs.

FAQs

Question 1: Does Shopify integrate with other POS?

Yes, Shopify can integrate with other POS systems such as Magestore POS, Square POS, and Lightspeed POS.

However, the extent of data exchange between Shopify and the POS system depends on whether they share a database or operate independently. This also impacts the level of data integrity.

Question 2: How to integrate a POS with Shopify?

Integrating a POS with Shopify depends on the system you choose.

For example, with Magestore POS, you can create a custom app in your Shopify admin to enable communication between the two systems.

For Square and Lightspeed POS, a paid third-party connector or middleware is typically required to establish the connection.

Question 3: Does Shopify POS take a percentage of sales?

Shopify charges transaction fees for online sales when merchants use a third-party payment provider.

These fees depend on the merchant’s plan: 2% for Basic, 1% for Shopify, 0.6% for Advanced, and 0.2% for Shopify Plus. Merchants can avoid these fees by using Shopify Payments, Shopify’s in-house payment solution.

For in-store sales, merchants using Shopify POS with Shopify Payments only pay the standard processing fees for Shopify Payments. If they use another POS system with a third-party payment processor, Shopify does not charge additional fees.