Customers are gradually reducing cash payments and switching to pay by cards or e-wallets. Thus, it’s important for retailers to equip their stores with a high-quality credit card reader.

There are certainly a lot of things to consider when choosing a credit card reader brand, whether it’s your first time buying a credit card processor or you’re upgrading your old credit card readers. If you want to know what are the best credit card processors for retail in 2025, we’ve compiled a list of the top 5 card readers for your business based on their popularity and specifications.

Let’s keep reading our reviews to understand the pros and cons of each brand.

What is a credit card reader?

A credit card reader is a device that can decode the debit and credit card information stored in a microchip or a magnetic stripe of the cards to accept payments, including:

- Cardholder information

- Account number

- Authorization code

- Card expiration date

Today, credit card readers can electronically scan that information. In the past, you had to rely on a physical copy in a “knuckle cracker” to extract the necessary information from a customer’s card. As the name implies, users will have to scrape their knuckles onto the device to create their copies. Today, merchants still use this type of device as a backup when the electronic credit card processor fails.

How do credit card readers work?

Credit card readers are the connection parts in the payment networks, which are normally used at the ATMs of the banks or the POS terminals of retail stores.

- When customers dip or swipe their cards, the credit card reader will decode the encrypted information and transmit it to the customer’s issuing bank for authorization.

- The issuing bank will review if the card is involved in fraud or qualifies for the transaction (whether the account has sufficient cash or credit to complete the payment).

- If the cardholder’s account has no problem, the issuing bank will pass their approval to the POS system and authorize the transaction.

The transaction process sounds complicated and involves many parties, but the modern card reader technology helps merchants complete these steps instantly in just a few seconds.

Types of credit card readers

1. Countertop credit card readers

Countertop credit card reader is ideal for retailers that sell products and accept payments in-store.

Pros

These are the cheapest kind of credit card processors and have the fastest payment processing speeds.

- Connected to your broadband line or phone, it can process the payment in a second.

- Connected to the mains power, it’s always ready to go and no need to worry about the device running out of battery or recharging them.

Cons

- The only disadvantage of the countertop credit card readers is that due to the wired connection, you can’t move them. Depending on your business operations, this may or may not be an issue.

2. Portable credit card readers

A portable credit card reader is the best choice for merchants who want to accept payment at the customer’s desk. As a result, customers can continue to enjoy their quality time like dinners or romantic dates without interruption. Portable credit card readers are not much more expensive than countertop credit card readers – a reasonable choice for small and medium businesses.

Pros

Portable credit card readers give merchants more room to move around when accepting payments.

Cons

To process payments, you need to be within scope because there is still a limit of mobility from the device’s Bluetooth connection.

You need to monitor the battery to ensure it doesn’t run out of power at a critical moment.

3. Mobile credit card readers

Without a cable or wired network connection, mobile credit card readers can accept payments anywhere as long as there is a 3G mobile signal. These are great options for:

- New businesses who haven’t got a merchant account yet

- Small businesses who need a lightweight and simple POS

- Mobile businesses like personal trainers, mobile dog groomers, and food trucks

- Any service businesses that need to visit their customers at home and perform services like delivery, contractors, exterminators, and plumbers

Pros

Flexibility and convenience are clear benefits of mobile credit card readers for the following sales situations:

- Mobile sales such as occasional craft fairs, farmer’s markets, and pop-up shops

- Event sales

- Traveling sales

- Selling floor

Cons

Compared to desktop and portable devices:

- The price of a mobile credit card reader is significantly higher.

- The payment processing speed is slightly slower depending on mobile network speed.

Things to consider to choose the best credit card readers

There are some important aspects to consider the best credit card reader for your business:

- Ease of use

- EMV and NFC compatibility

- Reliability and seamless integration with your existing POS

- Payment security and PCI compliance

- Trial period and warranty

So in the next sections, we’ll discuss the best credit card readers based on the following 3 criteria:

- Features

- Prices

- Integrations with POS solutions and other software

Top 5 credit card readers for retailers

1. Verifone credit card readers

Verifone is the hardware provider with the main focus on card reader devices. With its longevity, Verifone is the best option for traditional credit card processors and famous for:

- Having a wide array of pin pads that are easy to use

- Working with the most popular POS software and merchant account providers

- Being compatible with iOS, Android, Windows, and Linux

- Providing options for wireless and USB connections

- Offering “fall back mode” to process payments offline

- Giving great customer services with 24/7 technical support via live chat, phone support between 9 a.m–6 p.m. (Eastern Time), and email support SLA between 1–2 business days

Features

(*) Features depend on the services available for your merchant account.

- POS payments: support all payments, especially for value-added products and services such as electricity, cash vouchers, and airtime

- Business management: have real-time reports in backend portals

- eCommerce features: provide an omnichannel portal for data and analytics, omnichannel reports, fraud prevention, and customized checkout pages

Integrations

Verifone credit card readers are compatible with the most widely used POS software on the market.

Pricing

(*) Bestsellers and pricing based on Amazon as Verifone doesn’t disclose their plans.

Verifone Pin Pad Vx520 (start at $90)

- A standalone terminal (not require a tablet or phone)

- Connect via dial-up or Ethernet

- Accept magstripe (swipe), EMV (chip), and NFC payments (Apple Pay)

- Include a built-in receipt printer

Verifone Touch Screen Pin Pad Vx280 ($234.95)

- Resistive touch screen pin pad for countertop POS

- Connect via USB or Ethernet

- Accept magstripe (swipe), EMV (chip), and NFC/CTLS (contactless)

Verifone Countertop V200c ($189.99)

- A non-touchscreen credit card processor

- Connect via Ethernet, Wi-Fi. Bluetooth, USB, and dial-up

- Accept contactless (NFC), magstripe, and EMV payments

2. PayPal credit card readers

PayPal is the best-known payment service provider and its credit card readers are most suitable for PayPal merchants. Also, it’s a great and affordable option for any small businesses with low transaction volume or average transaction value under $10.

Features

- Instant transfers to PayPal accounts or bank accounts

- Process tap, swipe, and chip payments

- Accept Google Pay and Apple Pay payments

- Scan QR codes to take Venmo and PayPal and payments

Integrations

- Have partnerships with the most popular POS system

- Work well with mobile devices

Pricing

PayPal offers a wide range of card readers:

- For magstripe credit card readers: they limit the number of weekly transactions without incurring holds. In that case, you can consider Bluetooth swipe and chip card readers (start at $24.99) instead.

- For mobile wallets and contactless payments using NFC technology, you can choose Chip and Tap readers (start at $79.99).

3. Square credit card readers

Square is best for small businesses in any industry and the most powerful credit card reader as it keeps updating and innovating its functions.

Features

- Mobile credit card processing

- Advanced reporting

- Invoicing

- Instant or same-day transfer to merchant bank account (require additional fees)

Integrations

- Square credit card readers can work well with Square POS and be a backup to the primary POS.

Pricing

- Both mobile card reader and app are free.

- For magnetic stripe credit card payments: Square offers a free lightning port/headphone jack reader.

- For contactless payments and chip cards: You can choose Square’s Bluetooth card readers (start at $49).

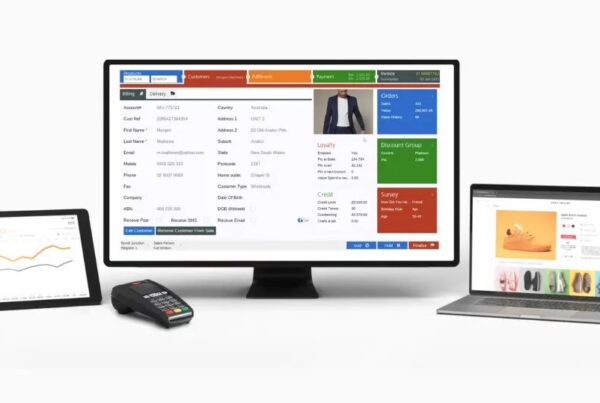

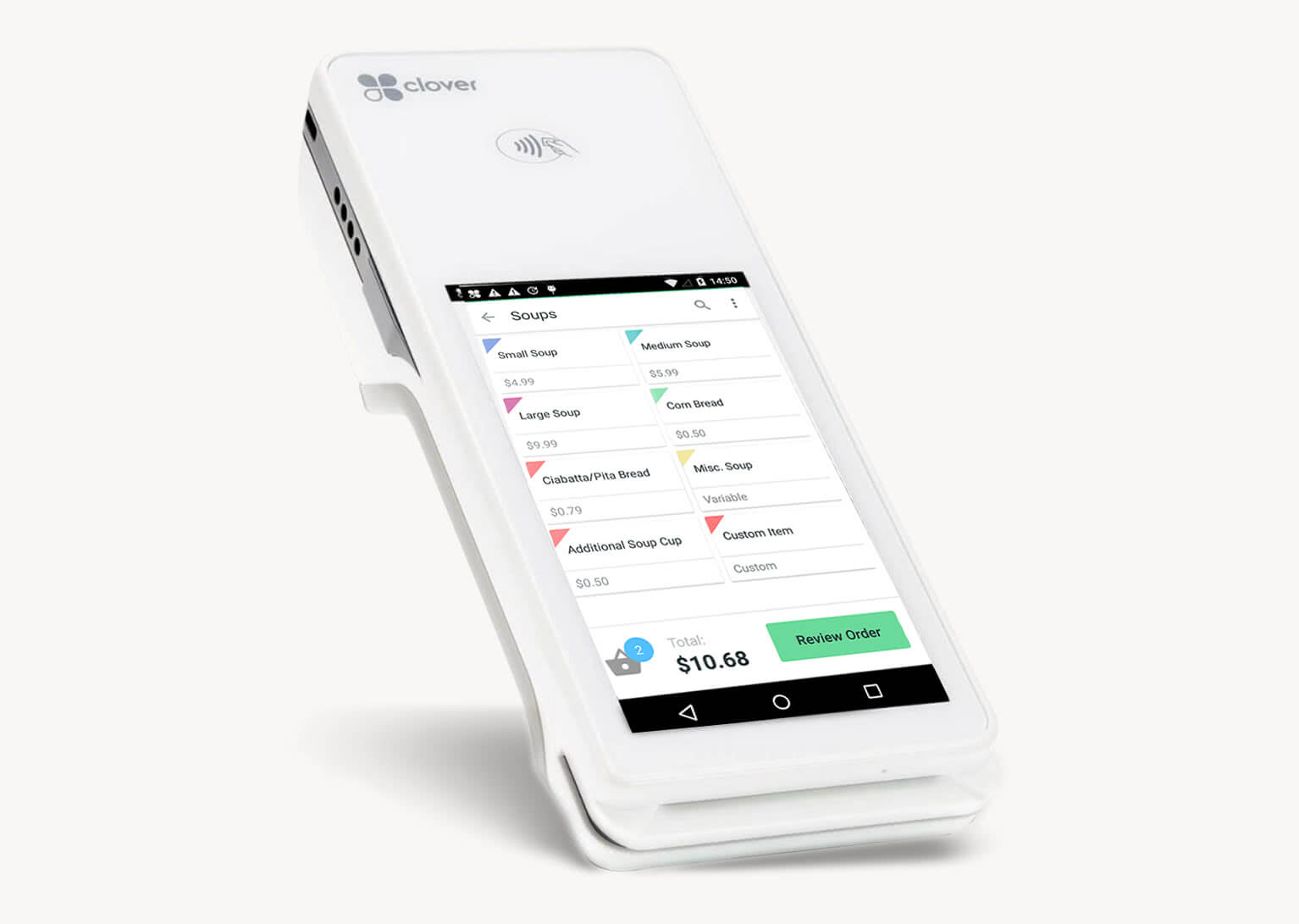

4. Clover credit card readers

Clover is the best option for businesses processing over $20,000 monthly and retailers who use Clover POS.

- Clover stands out for its extraordinary support services. Email and phone support are available Monday–Friday (7 a.m.–7 p.m. Eastern time).

- If you choose Clover, we recommend you open your merchant account at Payment Depot, Dharma Merchant Services, or National Processing.

Features

- Accept online payments

- Accept payments with on-screen signatures, email receipts, and tips (available with Clover mobile credit card readers)

- View a customer database

- Generate reports

Integrations

- Using the payment gateway Authorize.Net, you can integrate Clover with most popular eCommerce systems and POS solutions.

Pricing

Clover mobile readers (start at $99)

- Connect to a tablet or phone via Bluetooth

- Accept magstripe (swipe) and EMV (chip) payments

Clover Flex ($499 + $4.95/month)

- Connect via 3G or Wi-Fi

- Accept EBT (food stamp cards), Apple Pay, Chip and Pin, EMV (chip cards), and magstripe payments

- Adjust EMV sales for tips

5. MagTek credit card readers

We recommend MagTek for merchants who want the traditional swipe technology.

- MagTek doesn’t develop its own POS solution but it offers QwickPAY, which is a standalone kiosk and a touch-free invoicing online platform for merchants to accept mobile payments.

- Technical support is available via email and phone on weekdays (5:30 a.m.–5 p.m).

Features

- Accept payment fast

- Allow swiping cards from either direction

- Sales reports

- Fraud identification and alerts

Integrations

- Work well with all Windows-based POS

- Plug and play on most countertop POS (plug it at the same keyboard you connect with your POS devices and it’s ready for use)

- Operate with Mac and Android in keyboard mode

Pricing

MagTek has mobile credit card readers for contactless and chip payments.

MagTek Dynamag ($85)

- Get power and connection via USB

- Plug and play (additional device driver not required)

- Compatible with Mac OS, Android, and Windows

iDynamo ($101)

- Connect via USB type C cable or lightning connection

- Work with iOS devices for swipe payments

MagTek eDynamo ($160)

- A mobile credit card reader for magstripe card and EMV chip payments

- Connect via USB or Bluetooth

- Accept chip card, EMV, and swipe payments

- Work with Windows, Android, and iOS devices

Comparison table of top 5 credit card readers for retailers

Device brand | Pros | Cons |

Verifone |

| Expensive and undisclosed pricing |

Paypal |

|

|

Square |

|

|

Clover |

|

|

MagTek |

|

|

Conclusion

No credit card readers can be right for all businesses. Therefore, you should look at your specific business requirements and understand the payment process. That makes it much easier to find the right types of devices. To shed light on the top credit card reader brand in this article, you should list which features can address your retail-specific needs.

We suggest a few questions to shape your choice:

- What is your monthly transaction volume? What is your business industry? Remember, payment processors can offer discounts on fees for large transaction volumes and certain business industries.

- Do you sell in-person or online, or both?

- What is the technology of the card reader?

- How much does it cost for the monthly payment processing fee?

Having the answers to these questions, you will determine the best-fit credit card processors for your retails.