With the shift of shopping habits and especially the effect of the COVID-19 epidemic in 2020, eCommerce businesses are dominating the global market. However, the exploding number of online purchases has led to an increase in fraudulent activities. In the digital age, online businesses are quickly becoming easy targets for cybercriminals. Scammers have a greater opportunity to create fake websites to disguise genuine online businesses or hack customer personal information if your eCommerce store doesn’t take security measures. In this article, we’ll discuss 3 types of eCommerce fraud and how to prevent them.

What is eCommerce fraud?

Purchase fraud or eCommerce fraud are illegal payment transactions that criminals or fraudsters make on a website without the account owner’s knowledge, by using:

- False identity

- Fake or stolen credit card

Statistics on eCommerce fraud and trends

According to a Juniper Research report:

- The value of online fraud will increase from 17.5 billion USD in 2020 to 20 billion USD due in 2021, which is an increase of 18%.

- Account takeovers, “silent” fraud, chargeback fraud, and identity theft are the most common fraud threats with online retailers.

- By 2025, China will be the largest market suffering from eCommerce fraud in the world with over 12 billion USD, accounting for more than 40% of the value of global eCommerce fraud.

All forecasts warn retailers to invest in cutting-edge solutions now to protect their bottom line. eCommerce fraud is constantly evolving and becoming increasingly sophisticated. Fraudsters adopt more advanced tactics every year. Thus, before coming to fraud prevention strategies, it’s important to understand the nature of the most popular types of fraud on the online store.

What are the 3 most common types of online frauds?

Out of the many scams that hackers can use, there are 3 types of fraud that most eCommerce websites encounter:

- Credit card fraud

- Affiliate fraud

- Phone fraud

Identifying them right away is a step to help you avoid falling victim to them. Let’s explore them in more details.

1. Credit card fraud

Identity theft

Identity fraud or identity theft occurs when fraudsters gain access to customer details by purchasing or hacking the user’s account, then implement their phishing schemes. The stolen information and data include:

- Personally identifiable information

- Financial information

- Passwords and security codes

- Account takeover

This doesn’t only affect the card owners but also the retailer as the buyers may request a refund. Also, it reduces the reputation of the seller because customers feel their personal and financial data on your eCommerce site is vulnerable.

Chargeback fraud

Chargeback fraud or friendly fraud takes place when the buyer keeps the online purchased items but still requests a refund for the following reasons:

- Item wasn’t received

- Payment was made twice

- Purchase was never made

To mitigate this “friendly” fraud, it’s a good idea to have a clear shipping tracking system and a strict refund policy in place for your online store.

Clean fraud

Clean fraud is much similar to legal payments made by legitimate customers because the impostor uses a stolen credit card and cardholder information.

Phishing

Phishing is the practice of collecting personal information of genuine users, including:

- Credit card information

- Card number

- User ID and password

Then, fraudsters use this information to make illegal online purchases without the owner’s awareness.

- Scammers often pretend to be a trusted source or a large company to request such information.

- Users receive fraudulent emails or SMS that request to send their data or lead to false links with malware to obtain such data.

Triangulation fraud

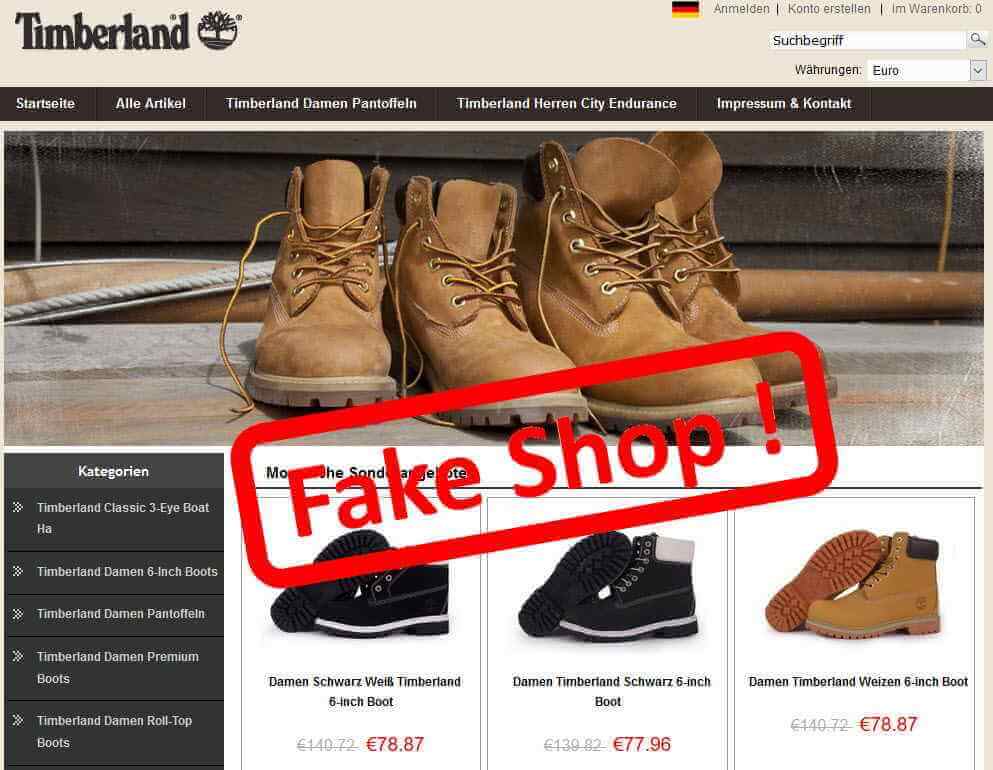

In triangulation fraud, scammers create a fake eCommerce website that sells products and services at incredibly competitive prices.

- When a customer places an order, the scammer collects the credit card data of the cardholder.

- The scammer uses the stolen information to place another order to the real online merchant or store and still sends the product to the customer.

In that way, the customer had to pay twice, once for the actual price to the real seller and once to the fraudulent store.

2. Affiliate fraud

Violating the terms and conditions of an affiliate marketing program, affiliate fraud is the practice of manipulating registration and traffic statistics to generating commissions by either way:

- Ask real customers to log into the merchant’s online store with a fake account

- Use a fully automated process

3. Phone fraud

Telephone fraud or communication fraud is the use of telecommunications products or services to illegally obtain money from a customer’s payment while not paying that amount to the telecommunication companies.

The scammer pretends to be a government agency or someone you trust to convince you by being friendly and helpful, or conversely, threatening and trying to scare you off. Below are the most common examples of phone fraud:

- Extended warranty: Scammers know when your customers bought the car and the type of car to urge them to buy worthless services at a price.

- “Free” trials: Scammers promise free trials but use the information to sign you up for one or more other products or services. You will have to pay monthly fees until you find out and cancel them.

As a store owner, you’ll incur costs and negatively affect your revenue when fraud occurs on your online store. First, you’ll have to process a chargeback for real customers and a chargeback fee (including transaction and processing fees). While the chances of you getting that product and transaction amount back from the scammer is very low, you lose both revenue and customers.

That’s why detecting online retail fraud as early as possible is the highest priority.

How to detect eCommerce fraud in online transactions

One of the reasons eCommerce fraud is so common today is that business owners rarely prosecute it. There are many limitations including evidence, resources, time, and money to pursue the cases. Thus, you should integrate a high-quality fraud detection and management system to minimize fraud in your online store to reduce the bad impacts.

Here are some red flags for you to consider if a transaction is fraudulent:

- Large quantities of products from first-time customers on an eCommerce website

- Multiple transactions in a short amount of time

- Using multiple cards on a single IP address

- The contradiction between IP address and shipping address

- Shipping to an unusual location or incomplete address

How to minimize losses from eCommerce fraud with modern tools

You can try modern tools to minimize the damage caused by fraud. These tools analyze transactions that take place over time to produce new fake patterns with lightning speed and accuracy. In addition, you should combine using eCommerce information security methods to create a robust fraud detection system for your business, such as:

- Card Verification Value (CVV) codes

- Two-factor authentication

- Address verification service (AVS) tools

- Payment card industry data security standard (PCI compliance)

How to prevent eCommerce frauds

Credit card fraud preventions

When you run an online business, you cannot completely avoid fraud, you can only reduce it. You can follow the following best practices for fraud prevention to protect your eCommerce business and your customers:

- Use high-quality platforms with regular updates like Magento eCommerce

- Score transaction risk with fraud detection and management software

- Choose a trusted third-party payment processor

- Ensure HTTPS securities for all pages of your eCommerce website

- Comply with applicable laws, regulations, and rules throughout the online payment process

- Increase fraud awareness for customers and internal employees

- Analyze and assess fraud risk factors

Affiliates fraud preventions

Similar to general security rules, the approach to affiliate program fraud prevention is:

- Screen and validate carefully each of your new affiliates: Individual check-ups can take time but are worth it to avoid any future losses. You may get the initial clues from observing the difference.

- Remove unethical affiliates: Check their profiles, social media pages, and website brand to see if they fit with your program.

- Monitor traffic and program analytics closely: Keep an eye on metrics growth like quick surges in referred transactions or sudden traffic increases.

- Block suspicious IP addresses: You need to suspect and verify immediately when there are multiple transactions from the same IP address.

Phone fraud preventions

If one of your customers reports a party spoofing your business to scam them, you should take this information seriously and do the following:

- Announce the phone fraud case on social media channels and blogs: This affirms your business did not commit such fraud and prevents your other customers from falling into the same scams.

- Report phone scams to the authorities: This helps phone service providers and law enforcement parties release fraudulent phone numbers to the public and identify the people behind the illegal calls. In addition, they can use the data to research new call-blocking and call-labeling solutions.

Future trends for online frauds

Store owners are increasingly concerned with and eager to reduce online fraud. In the same way, there have been more and more advances and technology innovations that help eCommerce merchants fight fraud while ensuring a smooth buying journey for customers. We can name some rising future trends for you to leverage:

- Artificial intelligence (AI) for automated behavior analysis and security testing will be key factors to save customers from fraud and maintain user experience.

- Digital interface know-your-customer (KYC) to evaluate your customers

- AI-powered behavioral biometrics to check the security

Conclusion

Knowing the most common fraud types and why they happen in the first place is the best way to combat fraud. Then, we recommend you develop strategies to protect your eCommerce website and prevent these types of fraud.

You can start by understanding which types of fraud are most common in your online store and tackle each one. Moreover, implementing a high-quality fraud detection system from reputable providers and integrating advanced scam management strategies will take your eCommerce website into a higher level of security.

Finally, you shouldn’t ignore the PCI standard and general privacy policies that make your online store more trustworthy and secure in the eyes of your customers.