What is a payment gateway, you may ask? A payment gateway works similarly to a digital cashier. This cashier takes card and mobile payments from your customers. Plus, it guarantees that the payment process runs smoothly and securely.

Statistics show that merchants might lose over $362 billion in 2023–2028 due to online payment fraud. As a result, retailers should understand what a payment gateway is and how it operates to protect themselves from these losses and ensure quick payment processing.

In this article, we’ll learn about the payment gateway definition, its functions and distinctions between payment processors and terminals. So, are you ready? Let’s get started.

What is a payment gateway?

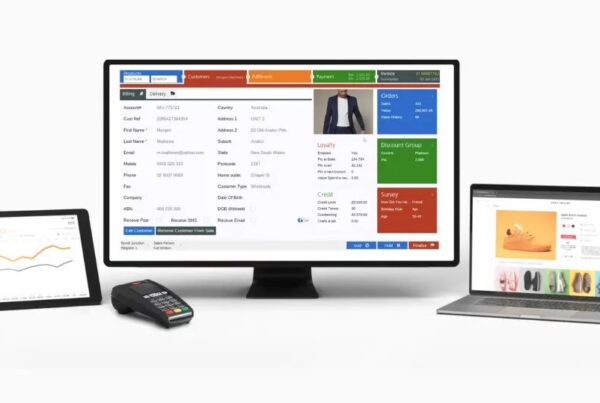

A payment gateway is a technology that enables businesses to accept customer payments online or in-store. It securely collects, encrypts, and sends payment data to payment processors for verification, ensuring that transactions go quickly and safely.

In physical stores, it covers point of sale (POS) terminals where consumers may swipe or tap their cards or smartphones to pay for items. In the online environment, it refers to “checkout” portals where clients submit their payment information.

A payment gateway supports a variety of payment methods to enhance shopping experiences for customers, including:

- Debit cards

- Credit cards

- Digital wallets

- QR codes

- Near-field communication (NFC)

Nowadays, there are many retail payment gateways available to suit a variety of business needs and sizes. PayPal, Stripe, Square, and Authorize.net are a few examples. We’ll discuss them in detail later.

How does a payment gateway work?

Here’s a step-by-step explanation of how a payment gateway operates in a transaction:

1. Customers start a transaction.

When consumers shop in a physical store, they need to put the card into the POS terminal and then enter their personal identification number (PIN) to pay for the item.

If buying online, they must submit their card information on the checkout page. This information contains the cardholder’s name, card number, card expiration date, and card verification value (CVV) code.

2. The payment gateway encrypts and transmits the data.

After receiving customer payment information, the payment gateway encrypts transaction data and conducts fraud checks with various technologies, such as the Luhn algorithm, to ensure the validity of PINs. This technique safeguards data against unwanted access or theft. After encryption, the gateway transmits the data to the payment processor.

3. The payment processor validates the transaction.

The payment processor takes transaction data from the integrated payment gateway, verifies it, and transmits it to the customer’s bank via an appropriate card network.

4. The customer’s bank (issuing bank) authorizes the request.

The issuing bank checks the transaction details, account balance, and payment method validity.

- If the issuing bank says yes, it sends an authorization code back through the card network to the payment processor and the payment gateway.

- If it declines, the bank sends a decline code and reason.

5. The merchant’s bank (acquiring bank) authorizes the response.

The payment gateway transmits the authorization answer to the merchant.

- If accepted, the merchant fulfills the order.

- If refused, the merchant requests a different payment method.

6. The transaction is done.

Once the issuing bank approves the transaction, the merchant delivers the products or services to the customer, completing the transaction.

7. Payment settlement

After authorization, the payment processors facilitate transferring funds from the customer’s bank to the merchant’s bank through the card network. This process often takes a few hours or one to two business days.

What are the 4 main types of payment gateways?

The 4 main types of payment gateways are:

- Hosted payment gateways

- Self-hosted payment gateways

- Application programming interface (API) payment gateways

- Local bank integration gateways

Let’s explore the distinctions between these sorts.

Type | Description | Pros | Cons | Use case | Example |

Hosted payment gateways | This kind leads customers away from your site during payment to the host or payment service provider (PSP) page. This means, your customers will complete payment on the PSP’s page. | These gateways help ensure your transactions are secure with PCI-DSS compliance, are easy to set up, and don't need your integration and maintenance efforts. | You cannot entirely manage your buyers' checkout procedures. | Small eCommerce enterprises | PayPal, Amazon Pay, Stripe, Square, Authorize.net |

Self-hosted payment gateways | Unlike hosted payment gateways, this type keeps consumers on your site throughout the whole transaction. The payment details are then encrypted and transmitted to the third-party payment gateway for authorization. | The payment process happens quickly, and you can fully control it. Moreover, self-hosted payment gateways offer great customization to your brand. | This kind necessitates technical skills to handle payment data securely and follow data security regulations such as the Payment Card Industry Data Security Standard (PCI DSS). | Large or established businesses | Authorize.net, Braintree, Stripe |

API payment gateways | API payment gateways link to your site or application via an API. This sort of gateway handles payment verification directly on your website or application. | As compared to prior varieties, the variant provides a more frictionless payment experience with greater customization. | To comply with data protection regulations, API payment gateways need organizations to maintain a secure cardholder data environment. | Medium- to large-sized organizations | Stripe, Square, Authorize.net, PayPal |

Local bank integration gateways | This option directly connects with local banks. | Transaction fees for this kind may be lower. | These gateways necessitate more development work and continuous maintenance. | Firms targeting a specific region or country | Local banks |

Examples of payment gateways

Here’s a list of seven popular payment gateways, along with their standout features:

Payment gateway | Outstanding features | Starting price | Best for |

PayPal |

| 1.99% plus fixed fee | Small to medium-sized online organizations |

Stripe |

| 2.9% + $0.30 per successful transaction with domestic cards | Established eCommerce companies |

Square |

| 2.6% + $0.10 | Retail stores, restaurants |

Adyen |

| Custom pricing including a fixed processing fee + a predetermined payment method fee | International businesses |

Authorize.net |

| $25/ month | Small to medium-sized firms |

Stax |

| $99/ month | Growing businesses |

Worldpay |

| 1.5% + £19.95 per month for online gateway fee | Large enterprises, eCommerce platforms |

How much does it cost for a payment gateway?

Typically, a payment gateway charges 3 types of fees.

- Setup fees can range from $0 to several hundred dollars, depending on the payment gateway provider and the complexity of the setup.

- Monthly fees may vary from $0 for simple plans to $100+ for more comprehensive plans that include extra features and support.

- Transaction fees typically consist of a percentage of each sale (ranging from 1% to 3+%) plus a predetermined price per transaction (usually between $0.20 and $0.50). These fees can also vary depending on the kind of card used (credit or debit), the location of the transaction (domestic or international), and the number of transactions handled.

For example, Authorize.net doesn’t charge setup costs and offers 3 pricing plans:

Payment gateway | Payment gateway, eCheck | All-in-one (payment gateway, eCheck, merchant account) | |

Monthly charge | $25 | $25 | $25 |

Processing rates per transaction | $0.10 + daily batch fee $0.10 |

| 2.9% + $0.30 |

In this regard, it’s fundamental to compare several payment gateway providers to find the best match for your business’s needs and budget.

Payment gateway vs payment processor

In a payment transaction, the payment gateway and payment processor collaborate but play different roles.

The payment gateway securely gathers and transmits client payment information to the payment processor. The processor then works with the card network and banks to authorize and transfer money between the customer’s and merchant’s accounts.

Payment gateway vs payment terminal

A payment gateway and a payment terminal serve different roles in the payment process.

As mentioned above, a payment gateway is a technology that handles card and phone-based payments from your clients. It acts as a virtual POS in the digital world.

Meanwhile, a payment terminal is a physical POS device used in brick-and-mortar stores to process in-person payments.

Key takeaways

We hope this article has helped you understand what payment gateways are, how they work, and what role they play in the payment process. Let’s spend some minutes reviewing the key points of the article.

- A payment gateway is a technology that accepts your customers’ preferred payment methods and protects your transactions in both online and offline operations.

- Payment processing has several stages. First, the payment gateway encrypts and sends payment information to the payment processor. The processor then confirms the transaction with banks, authorizes the payment and facilitates the movement of money between the client and merchant accounts.

- There are 4 main types of payment gateways: Hosted payment gateways, self-hosted payment gateways, API payment gateways, and local bank integration gateways.

- Payment gateway vs payment processor: The payment gateway securely encrypts and transmits payment information, whereas the payment processor authorizes and transfers payments between banks.

- Payment gateway vs payment terminal: The payment gateway is the digital interface for payments, whereas the terminal is the physical device used in stores.

FAQs

1. How do I know the payment gateway of a website?

You’ll know the payment gateway of a site once you reach the checkout portal. Here, you can see the logo, trademark, or mention of the payment providers like PayPal, Authorize.net, Stripe, or Square. This is the simplest way.

Other options include looking at the page’s source code for hints. This requires some technical skills. Alternatively, you can directly contact the merchant website’s customer service for help.

2. Is PayPal a payment gateway?

Yes, it is.

PayPal features an eCommerce payment gateway and a virtual terminal for mobile payments.

Moreover, PayPal’s ease of use and trustworthy reputation make it a popular choice for both small and large merchants.

3. Is Stripe a payment gateway?

Yes, Stripe is a white-label payment gateway. This means it provides a fully-functioning payment gateway interface that supports numerous currencies, languages, and payment methods.

Additionally, Stripe works well with the majority of eCommerce systems, including Magento, Shopify, WooCommerce, and Wix.

Related article: Magento Stripe integration: 5 alternatives to Stripe connectors