Nowadays, more and more businesses are expanding globally and digitally. Their customers expect convenient payment options such as multi-currency and localization when shopping both in-person and online. To satisfy customers and ensure a streamlined payment experience, businesses should select a suitable payment processor.

In this article, we’ll answer the essential question, “What is a payment processor?”, help business owners understand the payment processing system, and suggest key criteria when choosing a payment processor plus 7 top payment processing companies for your consideration.

Let’s dive in!

What is a payment processor?

A payment processor is a system that accepts and manages financial transactions via credit cards, debit cards, and bank accounts.

Payment processors serve as a bridge between the customer’s bank (the issuing bank) and the merchant bank, authorizing and transferring data to ensure secured and smooth transactions.

Utilizing payment processors to handle transactions in-store and online helps businesses to:

- Achieve industry standards, such as the PCI-DSS certification, to ensure the security of financial transactions

- Satisfy customers’ needs for flexible and convenient payment options, as well as international payment

- Integrate payments with other business operations to streamline management, such as accounting, billing, and customer relationship management (CRM) systems.

Some payment processor examples include Square for retailers, PayPal for low-traffic businesses, Adyen for small businesses with simple operations, and Clover for niche industries such as food and beverage. This article will provide an overview the largest payment processor companies, so keep reading!

Understand 7 key terms related to payment processing

What is an acquirer?

An acquirer, also called an acquiring bank or a merchant bank, allows merchants to process card payments securely and quickly. In payment processing, an acquirer provides merchant accounts that hold onto funds for verification before transferring them to the business bank account.

Examples of acquirers are JPMorgan Chase, Bank of America, FIS (Worldpay), Fiserv (First Data), and Global Payments.

What is an issuer?

An issuer, also an issuing bank or card issuer, is a bank that issues credit and debit cards to customers. In payment processing, the issuing bank acts as the gatekeeper, approving or declining transactions based on customer credits and funds and verifying payment method legitimacy to prevent fraud.

JPMorgan Chase, Bank of America, and Capital One are among the largest issuers in the U.S.

What is a merchant account?

A merchant account is a bank account for businesses to accept customer payments, usually by credit card, debit card, or other electronic transfer. In the payment processing flow, a merchant account serves as a middleman who securely holds onto funds briefly for verification before transferring them to the business bank account.

Note that a merchant card is different from a standard business bank card. While a business bank account handles daily business operations such as payroll or rent, a merchant account focuses solely on securing and speeding up credit card transactions. With a merchant account, it only takes minutes to complete all the security checks and verifications necessary, compared to several days with direct transfers from a customer’s bank account to a business bank account.

Some types of merchant accounts include mobile, eCommerce, and retail merchant accounts.

What is a payment gateway?

A payment gateway transmits payment information when a customer taps their card or enters their card details at the point of sale to the acquiring bank for credit card processing. It ensures the encryption and security of sensitive data during the card transaction process. The term includes both card readers and online payment portals.

There’s a wide range of payment gateway options, such as Stripe, PayPal, Apple Pay, and Square.

What is a card network?

A card network is an organization that facilitates card-based payments by providing the communication system that issuing banks and businesses use to process credit card transactions.

Some popular card networks are American Express, Mastercard, Visa, China UnionPay, and JCB.

What is PCI compliance?

PCI compliance, or Payment Card Industry Data Security Standard (PCI DSS) compliance, is a set of 12 security standards ensuring credit card transaction security and reducing data breach risks.

What are EMV chip credit cards?

EMV cards (also called chip cards or IC cards) are smart credit, debit, or prepaid cards with an embedded microchip that stores data and generates a unique code for each transaction. This makes EMV chip cards safer than magnetic stripe cards, which rely on static data.

You may have heard of some common EMV chip credit card brands, such as JCB, Mastercard, and Visa.

How does a payment processor work?

“What does a payment processor do?” is a great question to start learning about the world of payment processing. To answer this question, merchants should take a closer look at the payment transaction flow.

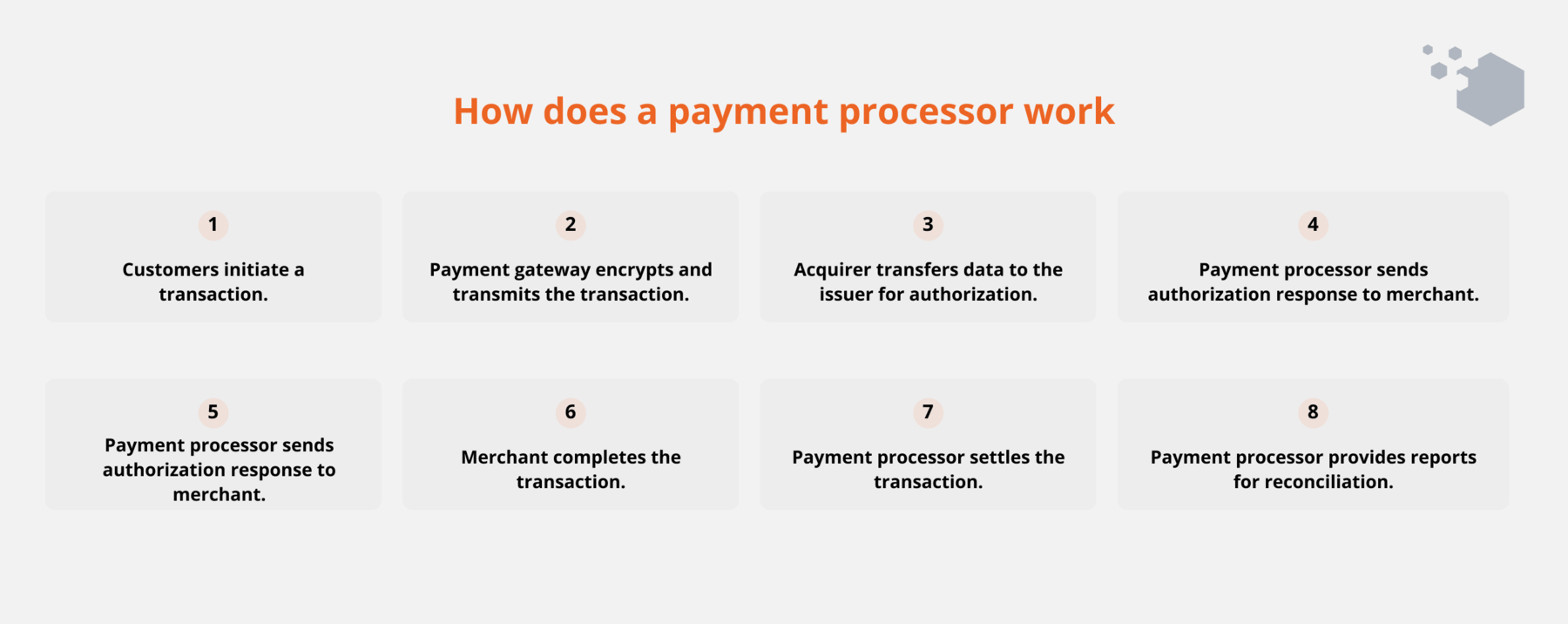

1. Customers initiate a transaction.

Customers make payments for their purchases, whether in-store at the POS or online, by giving the businesses their credit card details.

2. The payment gateway encrypts and transmits the transaction.

The payment gateway encrypts transaction data to prevent data abuse and sends the data to the payment processor.

3. The payment processor validates the transaction data.

After receiving the transaction data from the payment gateway, the payment processor validates the transaction details and then forwards them to the acquirer.

4. The acquirer transfers data to the issuer for authorization.

The acquirer continues to send the transaction details to the issuer through a card network to request authorization.

The issuer reviews the transaction and decides if the customer has enough credit or money for the payment. It also verifies the legitimacy of the payment method and the customer’s identity to prevent fraud.

When the issuer accepts the transaction, it sends an authorization code back to the acquirer via the card network, which then forwards the response to the payment processor. Otherwise, it sends a message with a decline code and the reason for the decline.

5. The payment processor sends the authorization response to the merchant.

The payment processor receives the information from the acquirer and forwards it to the business. If approved, the business can proceed with the sale. Otherwise, the business should ask customers for an alternative payment method.

6. The merchant completes the transaction.

Once the issuer approves the transaction, the company delivers the products or services to the customers. At this point, we can consider the transaction complete, although the actual money transfer has yet to occur.

7. The payment processor settles the transaction.

Typically, the business sends a batch of authorized transactions to the payment processor for settlement at the end of every business day. The payment processor then submits this batch to the acquirer, initiating the fund transfer from the issuer to the merchant bank, which often takes one to three business days.

8. The payment processor provides reports for reconciliation.

This is the stage where the merchant reviews all settled transactions to ensure they align with the company’s sales records. The business reconciles settled transactions using reports from the payment processor and other sources, such as internal accounting systems and bank statements.

How do payment processors make money?

Payment processing services make money through transaction fees, which is a commission as a percentage of the transaction between the merchant and the customer.

Typically, the percentage and fixed fee are combined into a discount rate, including interchange rates, assessment fees, and payment processor markup. For example, a 3.5% + $0.15 discount rate means each transaction grants the merchant acquirer $0.15, and the merchant must also pay 3.5% of the total payment volume (TPV) per dollar.

Pricing structures for payment processors include:

- Flat rate pricing: The merchant pays a fixed percentage per transaction, regardless of the actual expenses. Let’s say the discount rate is 3.5% + $0.15. A $1,000 sale will cost you $35.15.

- Interchange plus pricing: The interchange fee set by the card network plus the markup set by the payment processor. For instance, 2.5% + $0.10 over 1.5% interchange fee means a $1,000 sale will cost you $40.1.

- Tiered pricing: This structure divides transaction rates into qualified, mid-qualified, and non-qualified tiers according to various features, such as the card type and payment method. Each tier has a different processing rate.

How to choose a payment processor? 7 vital criteria to consider

1. It’s secured.

Ensuring the security and compliance of your customers’ financial information needs to be your top priority. Therefore, make sure that your in-person and online payment processor adheres to PCI DSS and possesses fraud detection and prevention systems. Besides, it should utilize both encryption and tokenization for an extra layer of security.

2. It supports payment methods customers prefer.

42% of U.S. customers won’t complete a transaction if they don’t see their preferred payment option at checkout.

Thus, make sure your payment processor supports different payment methods that customers may prefer, such as digital wallets, debit cards, credit cards, buy now pay later, and any other local payment methods.

3. It’s compatible and able to integrate with your system.

For a smooth operation, merchants should choose a payment processor compatible with their existing eCommerce platform, POS system (such as POS for Magento and POS for Shopify), or other business software. Most processors provide easy-to-use APIs, plugins, or SDKs that enable seamless integration with various platforms.

4. Its pricing aligns with your budget and transaction volume.

Consider your budget and investigate the available pricing options of the credit card payment processor. To find the most cost-effective solution, businesses should understand the pricing structure as discussed above. Then, opt for a pricing model that aligns with your business’s transaction volume and anticipated growth.

5. It supports international payments.

Choose a payment processor that accepts a variety of currencies and common local payment options if your company operates or intends to grow internationally. Remember to check for international transaction and currency conversion fees as it’ll add up your sale costs.

6. It enables frictionless transactions and a smooth customer experience.

You should evaluate both the customer checkout flow and the user dashboards your payment processor offers. The checkout flow should have clear instructions and efficient input fields. The user dashboard interface should also be easy to understand, use, and navigate.

7. It’s scalable and flexible.

Your needs for payment processing will change as your company expands. Choose a processor that can adapt to your growth and supports features like subscription billing, invoicing, and recurring payments.

What are the top payment processor companies?

Now that you’ve learned what is a payment processor. It may get tricky to pick the most suitable one because of the overwhelming number of payment service providers on the market. Moreover, each payment processor has different rates and features and caters to specific business types.

To help you choose the perfect fit with ease, we’ve compiled a list of the 7 top payment processing companies in the below table.

Payment processor | Customer location | Processing fees | Monthly fee | Best for |

Stripe | In-person, online |

| No monthly fees | Omnichannel businesses |

Square | In-person, online |

| No monthly fees | Mobile transactions and retail businesses |

PayPal | In-person, online |

| No monthly fees | Small businesses that value versatility and simplicity |

Helcim | In-person, online | On average:

| No monthly fees | Startups and seasonal businesses |

Elavon | In-person, online |

Transaction fees are subject to card turnover. |

| Global businesses |

Merchant One | In-person, online |

| Custom, starting at $13.95 per month | Beginners who need low monthly pricing and 24/7 customer support |

Clover | In-person, online |

| From $14.95/month to $89.95/month | Food service providers |

FAQs

What is payment processing in banking?

Payment processing meaning stays the same across such industries as banking, retail, and eCommerce. It refers to the series of actions that safely move money from a payer to a payee. It typically involves using electronic payment systems for transaction authorization, verification, and settlement.

What is a payment processing fee?

When a consumer pays with a credit or debit card to purchase goods or services, a business has to pay a predetermined amount. These costs are deducted from the merchant’s sales revenue and called payment processing fees or merchant acquirer service fees.

What is batch payment processing?

Batch payment processing, or bulk payment processing, allows you to combine several payments into one batch and send them all at once from the same business bank account.

Processing payments in batches is more efficient for retailers than making several single payments when paying several recipients, such as for supplier bills, payroll, or overseas payments.

Is PayPal a payment processor?

Yes, PayPal is among the most common payment processors in the world.

Is Stripe a payment processor?

Yes, Stripe is a scalable, secure, and flexible payment processor that allows businesses to manage online payments.