Connecting Mollie with a POS system endows you with robust tools to operate your business successfully. Mollie POS integration extends the payment offering you can give your customers, from cash to contactless payments. Besides, it helps you closely supervise your entire business operations, including inventory management, order fulfillment, and loyalty programs to simplify business processes, improve efficiency, and elevate customer experiences.

Although Mollie terminals help process customer payments at the stores, they lack practical functions to aid in effective business management. Therefore, choosing a suitable POS to complement Mollie’s point of sale terminals is crucial if you want to leverage the strength of both systems.

In this post, we’ll give you an overview of Mollie and Mollie payment terminals, and explain the difference between their terminals and POS software. After that, we suggest the 4 best POS integrated with Mollie for you to pick out the best one for your business. Keep reading on!

What is Mollie and how does Mollie Payments work?

Mollie is one of the leading companies in the payment industry that primarily provides financial services for European retailers. Since its foundation in 2004, this Dutch service provider has served many businesses of different sizes, from startups to large enterprises. Its customer base has up to 250,000 merchants across Europe, and Mollie’s team is now present all over the continent, from Lisbon to London.

As one of the top-world payment service companies, Mollie has relentlessly improved and expanded its product ranges to suit diverse business requirements, such as online, in-person, and recurring payments. Besides supporting Netherlands payment methods, Mollie allows you to add local payment options to satisfy customers in specific regions. It also equips merchants with an all-in-one dashboard to centralize payment data, view insights, and access other features like fraud prevention and reporting.

Mollie Connect and Mollie Capital are Mollie’s two noticeable products. As a payment solution for platforms and marketplaces, Mollie Connect enables you to onboard and verify customers quickly, set up and monetize payments, control payouts to sellers, and manage customer data. With Mollie Capital, the service provider helps SMEs access the capital they need to drive business growth. In addition, Mollie supplies free plugins and APIs to facilitate Mollie integrations with merchants’ existing tech stack, such as eCommerce platforms (Shopify, Magento) and POS systems (Magestore, Odoo).

Mollie POS terminal vs POS software

Mollie Terminals

Mollie provides different out-of-the-box terminals that can cater to the needs of diverse business sizes and types. Whether you’re an omnichannel retailer, a restauranteur, or a mobile business, you can offer your customers a fast and frictionless checkout experience by using Mollie’s Mobile Terminal or Kiosk Terminal. Mollie’s payment terminals support various point of sale payments, including Tap to Pay on iPhone, QR codes, or digital wallets. Mollie also lets merchants list and manage all payment devices and consolidate payment data in one place via Mollie APIs and Mollie Dashboard.

POS software

Compared to Mollie terminals, POS software is a more comprehensive solution for retailers to monitor many business areas. In addition to processing payments, POS software comes with useful tools to help merchants manage inventory orders, customers, and employees from multiple channels and locations. The POS also syncs and consolidates core business data in one place, thereby providing detailed insights into your business operations for decision-making. POS software often pairs with POS hardware like POS terminals, cash registers, and card readers to conduct in-store transactions.

Take a glimpse at the below comparison table to see the difference between Mollie terminals and POS software.

Mollie payment terminals | POS software | |

Features |

|

|

Pros |

|

|

Cons |

|

|

Best for |

|

|

Top 4 POS software to work with Mollie

POS | Key features | Pricing | Customer reviews |

Magestore POS |

| Magento POS: $69/month or custom pricing with one-time payment Shopify POS:

| 4.8/5.0 on Capterra

|

Shopify POS |

| Sell in person:

Sell everywhere:

| 3.6/5.0 on Shopify App Store

|

Odoo POS |

| Free if Odoo POS is the only app from Odoo that you useFor more than 2 Odoo apps, you can choose one of the two plans:

| 4.2/5.0 on G2

|

Marrello POS+ |

| Contact for detailed pricing | No reviews yet |

1. Magestore POS – Best for fast-growing, midsized, and large omnichannel retailers

While dedicated to different eCommerce platforms, Magestore Magento POS and Shopify POS both connect seamlessly with Mollie terminals to process in-person transactions, unify payment data, and streamline retail operations. Besides, each POS solution has distinctive features to accommodate the specific business requirements of any retailer.

As the #1 Mollie POS system for Magento merchants, Magestore Magento POS can process up to thousands of orders daily as it only takes seconds to complete a transaction. Natively integrated with Magento, Magestore Magento POS can sync orders, customers, products, and inventory from multiple Magento stores and physical locations in real time, thus ensuring data accuracy and consistency for business insights. This Mollie POS also makes it much easier for you to manage multi-channel inventory and provide your customers with varied order fulfillment methods, from in-store pickups to curb delivery. Additionally, Magestore POS is highly flexible and customizable, so you can tailor the POS to your business demands.

Magestore POS for Shopify is a web-based solution that can run on any browser without complicated installation, saving you lots of hardware costs. The POS can work with unlimited payment processors to give customers a wider array of payment choices. Besides moving order, customer, product, and loyalty program data back and forth with the Shopify backend, Magestore’s Shopify POS can sync inventory across physical stores and warehouses regardless of quantity. This POS Mollie also supports click and collect, employee management, gift cards, order holding, and multiple carts to let you bring your customers a top-notch shopping experience.

Key features

- Accept numerous payment methods, including cash, credit and debit cards, gift cards, store credits, buy now pay later, contactless payments, and split payments

- Enable real-time syncs of order, customer, and product information

- Support self-checkout services and customer-facing display for transparent and rapid checkout

- Work in offline mode to handle orders and sync data to the Magento backend when there’s a connection

- Provide omnichannel order fulfillment options like store pickups, buy online pay at the store, or buy online ship to home

- Support returns, exchanges, full and partial refunds by cash, credit cards, or a mix of payment methods

- Monitor inventory across multiple channels and locations, including automatic inventory level updates, inventory adjustment, stock transfer, and purchase order management

- Supply omnichannel loyalty programs like gift cards, reward points, and store credits

- Keep close track of employee working hours, sales performance, and commissions

- Produce reports on sales by products, sales by brands, stock on hand, stock movement, daily or monthly sales, etc.

- Integrate with external software and services, such as payments (Worldpay, Square, Adyen, Stripe, Global Payments, Paymentsense, Buckaroo, Revolut), accounting (Sage, QuickBooks, Xero), CRM (Zoho, Salesforce, HubSpot), shipment (ShipStation, FedEx), ERP (NetSuite, SAP, Dynamics 365), marketplaces (Etsy, Amazon, eBay)

- Work easily with POS hardware devices

- Highly scalable and customizable for business growth and expansion

Pricing

Magento POS

- POS Lite: $69/month (Subscription)

- POS Commerce: Custom pricing, one-time payment

- POS Customization: Custom pricing, one-time payment

Magestore charges flexible one-time pricing for Magento POS Commerce and POS Customization. depending on your business complexity, and level of support and services. You won’t need to pay for additional locations, users, and devices, saving you much money when your business expands.

Magestore POS for Shopify adopts subscription pricing with 30-day free trials.

- Lite plan: $15/ month (1 location)

- Standard plan: $50/ month/ location

Pros and cons

Pros | Cons |

|

|

>>> Might you like: Magestore POS also integrates with other leading payment providers in the Netherlands, such as Buckaroo POS.

2. Shopify POS: Best for Shopify merchants

Shopify POS has a range of useful tools to help Shopify merchants run and manage their retailing. By syncing inventory, orders, customers, and products between online and in-store shops, the POS provides a complete view of your business situations and enables effective omnichannel selling. With Shopify POS, you can offer your customers the option to buy online ship to home, pick up in-store, or return the purchases made online at any physical location. This POS for Mollie Payments also lets you track inventory for different sales channels and locations, from stock adjustments to purchase order creation.

Key features

- Accept payment methods like credit and debit cards, gift cards, and digital wallets

- Sync online and in-store payments, inventory, customers, and orders

- Monitor inventory in real time for different channels and locations

- Update stock levels automatically, transfer stocks, and create purchase orders

- Support local delivery, click and collect, or buy online and exchange in-store

- Assist discounts, returns for online purchases, void orders, and custom sales

- Allow users to assign staff roles and manage staff access and performance

- Provide real-time reports to track sales by employees and locations

- Connect with 3rd-party apps and services

Pricing

Shopify POS has subscription pricing with the details as follows.

- Sell in person:

- Starter plan: $5/ month (1 POS login and limited online store)

- Retail plan: $89/ month if paid monthly and $79/ month if paid yearly (unlimited POS logins and limited online store)

- Sell everywhere:

- Basic plan: $25/ month + $89/ month for each POS Pro location if paid monthly or $19/ month + $79 for each POS Pro location if paid yearly (unlimited POS logins and full-featured online store)

- Shopify plan: $65/ month + $89/ month for each POS Pro location if paid monthly or $49/ month + $79 for each POS Pro location if paid yearly (5 additional staff accounts, unlimited POS logins, and full-featured online store).

- Advanced plan: $399/ month + $89/ month for each POS Pro location if paid monthly or $299/ month + $79 for each POS Pro location if paid yearly (15 additional staff accounts, unlimited POS logins, and full-featured online store).

Pros and cons

Pros | Cons |

|

|

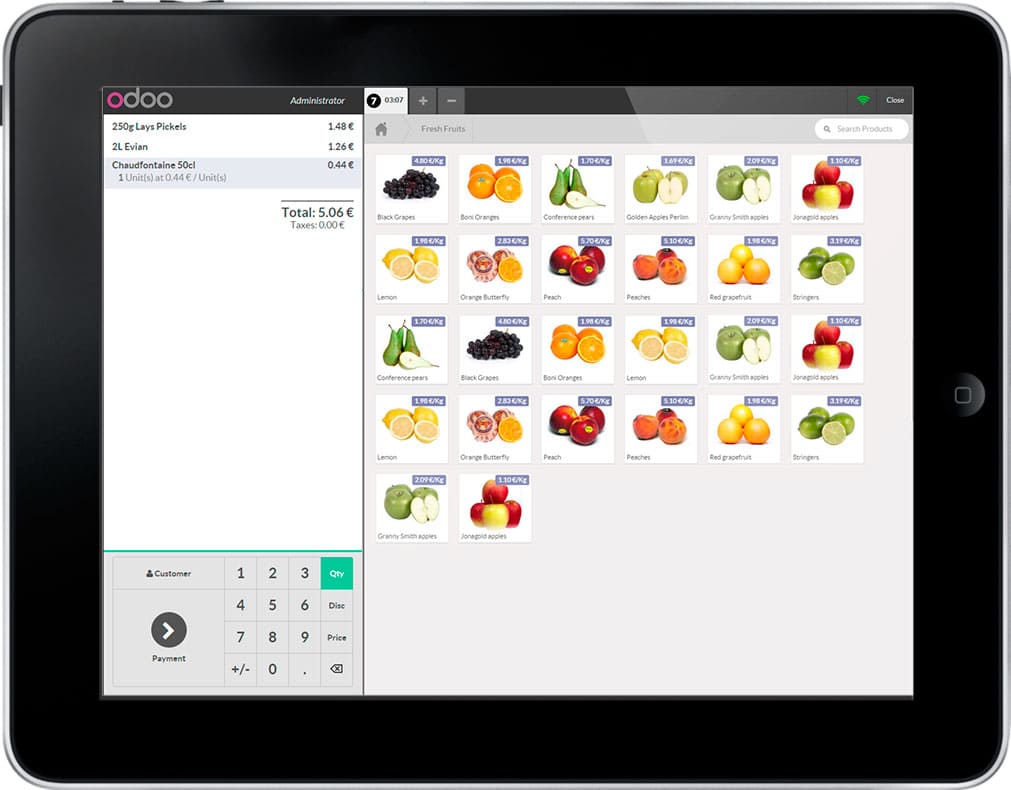

3. Odoo POS – Best for small and midsized retailers

Running well on tablets, laptops, and desktops, Odoo POS gives you great flexibility to serve your customers while still making good use of existing hardware. The POS also works with Mollie’s payment POS machine and other 3rd-party terminals to handle payments of different types like cash, credit cards, and split payments. Besides providing self-service for quick checkouts, Odoo allows users to process many orders at the same time. What’s more, this Mollie point of sale aids in real-time inventory management across locations and lets you reward your customers in many ways, such as permanent or time-limited discounts or gift cards.

Key features

- Accept many payment types, including cash, checks, and credit cards

- Support customized receipts, parallel orders, and multi-step checkouts

- Assist cross-location inventory management in real time

- Offer permanent, seasonal, or time-limited discounts

- Apply discounts on the entire order or a single product

- Provide loyalty programs like gift cards, loyalty points, and rewards

- Enable self-service for faster checkouts and click and collect

- Allow quick product search using names, descriptions, or barcodes

- Identify customers with barcodes on loyalty cards or built-in search functions

- View past orders and search orders by customers, dates, products, or cashiers

- Connect with other Odoo apps and 3rd-party payment processing services

Pricing

The exact costs you must pay for Odoo depend on the number of users and Odoo apps you use with 3 plans as follows.

- Free plan: One app, unlimited users

- Standard plan: $24.90/month/user if you pay yearly or $31.10 if you pay monthly

- Custom plan: $37.40/month/user if you pay yearly or $46.80 if you pay monthly

Pros and cons

Pros | Cons |

|

|

4. Marello POS – Best for small retailers

The partnership with Mollie makes Marello POS Mollie integration workable. The most outstanding feature of Marello POS is the Endless Aisle, which empowers you to present all of your product assortments to your customers, including ones that are physically unavailable in the stores. Moreover, this Mollie POS can also work when there’s no Internet connection and support returns and shipping orders from stores.

Key features

- Keep working when there’s no Internet connection

- Provide Endless Aisle feature that displays all of your products

- Support returns and shipping orders from stores

- Assist cross-selling and upselling based on customer preferences and purchasing histories

- Allow users to find products through the Catalogue or by scanning

- Produce insights so users can provide their customers with expert advice

Pricing

You should contact the Marrello team for detailed pricing.

Pros and cons

Pros | Cons |

|

|

Which is the best POS for Mollie?

The most important criterion for choosing the best POS for your business is its compatibility with Mollie terminals. Your chosen POS should work smoothly with the terminals to accept payments at the stores and deliver customers an uninterrupted checkout experience.

Mollie POS varies by functionality, pricing, customizability, and other factors. Therefore, you should also look into your business requirements, sizes, and budgets to decide which one is the best fit. The POS of your choice should have essential functions to accommodate your current needs and be able to adapt to the changing business landscape. Pricing is another factor worth careful consideration. POS systems often adopt subscription or one-time fees and may come with additional expenses for implementation or customization. To avoid profit loss and extra financial pressure, you should examine the pricing structure of each POS that works with Mollie before making the final decision.

For example, if you’re a fast-growing retailer selling both online and offline, Magestore’s unified point of sale is an ideal option thanks to its advanced features and scalability. If you’re a small business on a tight budget and just need a basic feature set to manage your retailing, the Odoo POS is a go-to solution.

FAQs

Is Mollie Payments safe?

Yes, Mollie is safe. The payment provider is fully PCI-DSS level 1 certified and compliant with available regulations. Besides, the company employs other methods to safeguard customer and payment data, such as fraud protection, encryption, and 3-D Secure.

Does Mollie have a POS system?

No, Mollie doesn’t have a POS system. Mollie only provides POS terminals to let merchants accept in-person payments and partner with other POS software companies to offer a complete POS solution.

Is Mollie a complete POS solution?

No, Mollie isn’t a complete POS solution. Mollie is a suite of payment services you can connect with POS software to take customer payments and monitor your business.

Does Mollie work with Magento?

Yes, Mollie offers free Mollie Magento 2 plugins to integrate their payment solutions with the Magento eCommerce platform. With Magento Mollie connections, you can create, customize, and manage the payments and orders for your Magento stores.

How does Mollie Payments work?

Businesses can incorporate Mollie Payments into their platform using Mollie Payment APIs to start accepting payment methods, such as credit and debit cards, bank transfers, Apple Pay, and more.

Does Magestore POS work with the Mollie terminal?

Yes, Magestore POS works seamlessly with the Mollie terminals to process payments and centralize business data like online and offline payment data, inventory, customers, orders, and products.