Once upon a time, the only option customers had to pay for their purchase was cash. However, the world of payment has come a long way since then, particularly with the rise of online shopping.

These days, your customers have various payment options to choose from, such as bank transfers, credit cards, digital wallets, gift cards, or BNPL (Buy Now, Pay Later). Many customers might even prefer combining several payment methods in a single checkout — otherwise known as split payments.

In this article, you’ll learn what they are, their benefits and drawbacks, and how to implement them in retail. Let’s get started!

What is a split payment?

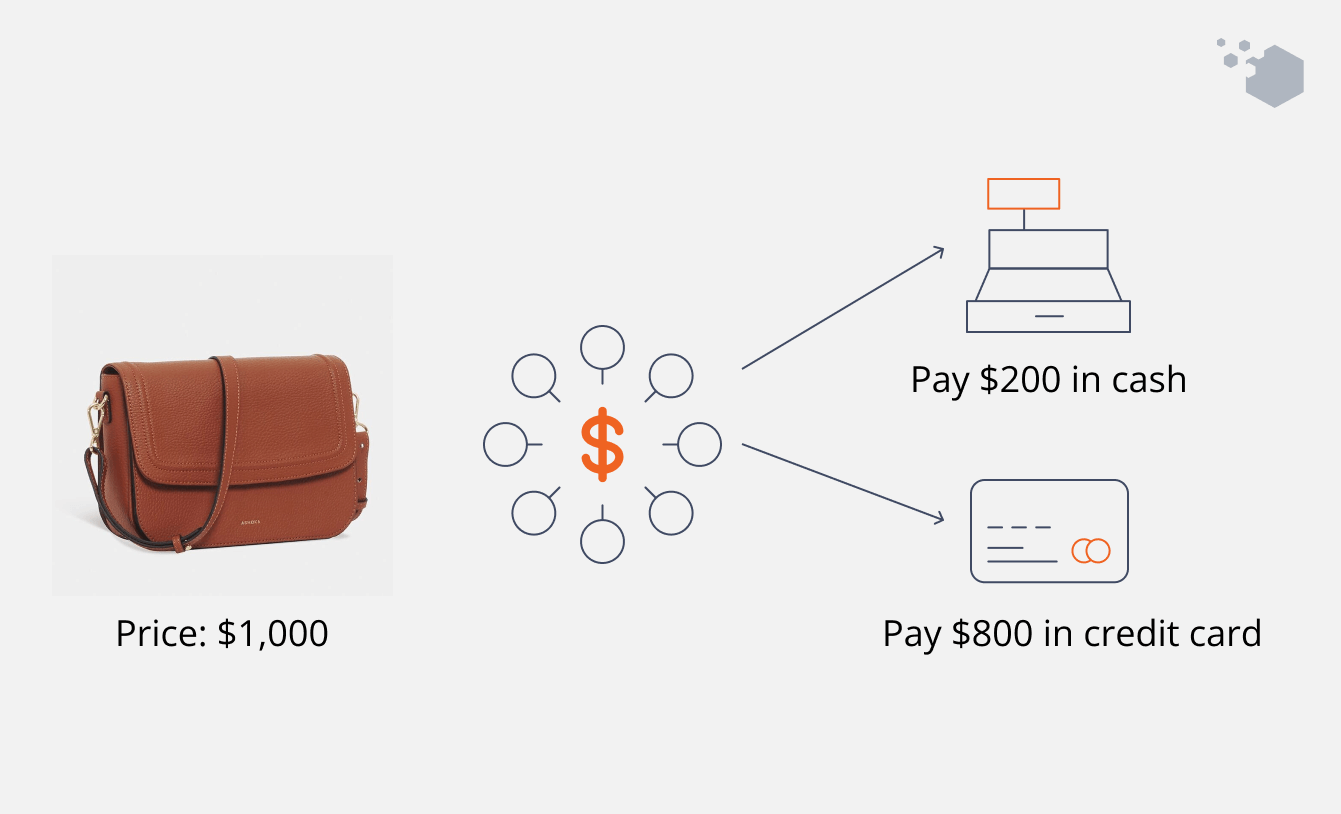

Split payments, or split tender transactions, allow customers to settle a single transaction using multiple payment methods.

For example, your buyer can use a digital wallet and a gift card to split payments online. If they’re in-store, they may opt for cash and bank transfers. This payment method is also not limited to a single buyer. A group of friends who want to split a restaurant bill or pay for their items separately can choose a split tender transaction. A business can also use a split tender to spread their invoices across multiple payments.

Split tender transactions have become much more popular in the last few years. In fact, according to a recent survey, 60% of consumers prefer to pay for their purchases using multiple payment methods. The same survey also reports that about 64% of high-income individuals prefer to pay for their purchases using installment plans. Meanwhile, more than half of millennials use credit cards when buying something expensive, while Gen Z prefers BNPL.

Amazon is among the online stores that allow split payment. Buyers can pay for their orders using a credit or debit card or an Amazon.com gift card. However, Amazon doesn’t accept two credit or debit cards at the same time. This means customers can’t split credit card payments. Other big retailers like Target, BestBuy, and Walmart also have the same policy. So, if you’re wondering how to pay with multiple cards online, you can combine a credit card and a debit card in one transaction.

6 popular types of split payment options

There are many split tender options available nowadays, such as:

- Credit cards and debit cards: Card payment is one of the most popular forms of split tender transaction. However, as we’ve mentioned above, many retailers don’t allow customers to combine multiple credit or debit cards to pay for a single order.

- Gift cards or store credits: Many stores allow customers to combine one credit or debit card with gift cards or store credits. This is particularly useful for those using gift cards with partial balances.

- Bank transfers: This is a great option for those paying for larger purchases or when transactions happen between individuals and businesses.

- Digital wallets (or mobile wallets): Customers can split their bill by paying with different apps (such as ApplePay, PayPal, or Venmo). This option is especially popular for larger groups. According to Forbes, almost half of U.S. adults use payment apps to share their bills at restaurants, supermarkets, and other retailers.

- BNPL: Using Klarna, Sezzle, or Afterpay, customers can opt for installment payments, particularly for larger purchases. If you’re looking for a BNPL with no credit check, Splitit is one of the best options.

- Cash: While digital payment options grow in popularity, cash continues to be a method of choice for many consumers when shopping in physical stores.

How does split payment work?

The split tender payment process usually goes through 5 steps:

1. Checkout

When ready to checkout, the buyers are directed to the payment portal, where they can combine several methods to pay their bills. Some retailers use split tender software to handle this request automatically in their online or physical stores. If the retailers don’t have this feature, buyers need to talk with the cashier or customer service to discuss split tender options.

2. Decide on the payment method

Customers can decide how much they want to pay with each available method. For example, a group of friends who have to pay $600 can divide the bill evenly and use their preferred payment method to cover their part. If it’s a single buyer, they might want to use a credit card to pay for one-third of their order and settle the rest with a gift voucher.

3. Verify payment

After the customers have confirmed their payment details, the payment gateway goes through a verification process to assess the availability of funds or credit limits. Most banks will require card verification if the customers opt for card payment. If one of the payment methods fails, the order might not go through. The payment portal will prompt the customers to adjust the split or use a different option.

4. Complete transaction

Once the customers successfully pay for their purchase, they’ll receive either digital or physical receipts as confirmation. This usually contains information about the items the buyers have paid for, the total amount, how much each payment method covers, the date and time of the transaction, and so on.

5. Settle the payment

This step only applies to online purchases. After the payment comes through, the retailers need to settle the invoices with the financial institutions linked to the customers’ payment methods. This means the financial institutions will transfer money from the customer’s account to the retailers’ accounts.

Benefits and drawbacks of split payments

Split tender transactions can benefit both the customers and the business in various ways. At the same time, you should be aware of several disadvantages to this payment method. Let’s explore the benefits and drawbacks.

Benefits | Drawbacks | |

For retailers | Increase sales: Offering split tender options can boost sales conversion. For example, in the U.S., 56% of online buyers are inclined to buy more if they have more payment options. The flexibility of multi-method payment eliminates many purchase barriers that might prevent a customer from buying something, especially in cases of high-value products. | Higher complexity: Split tender transactions can make the checkout process and backend systems more complicated. You might need to invest more resources to manage multiple payment methods, settle transactions, and handle refunds or disputes. You’ll also need to make sure your payment service provider can handle split payments. |

Reduce cart abandonment: Customers unsure about buying something because of the cost are more likely to check out if they can split the money into more manageable amounts. Split tender transactions also help convert customers who abandon their carts when they can’t pay with their preferred option. In the U.K., that number is as high as 93%. | Costly: You need to invest a lot of time and resources into implementing and maintaining split payment, especially when you already have an existing eCommerce platform. In fact, 28% of retailers see the high investment cost as a challenge. | |

Boost customer satisfaction: Your customers will appreciate the convenience, flexibility, and autonomy of choosing how they pay. This can help you build customer loyalty, as 70% of consumers would buy from stores that offer their preferred payment methods. | Higher transaction cost: You might need to pay higher transaction fees to process split payments, which eats into your profit margin. For example, instead of paying with just cash, your customers want to use a combination of cash and a credit card. This means you’ll need to pay an extra 1.5% to 3% processing fee for the credit card portion, which you wouldn’t have to if you only accept cash. This will have a bigger impact on orders with smaller values. | |

For customers | Better financial management: 74% of consumers choose split payments to manage their budgets better. This is because split tender payments allow customers to choose methods that suit their financial situations and preferences to avoid overspending, which can lead to debt. | Financial issues: It’s tempting to overspend when customers can spread the cost over multiple payments, which is particularly risky when they use credit-based payment methods. Customers must pay interest on outstanding balances, which can negatively affect their credit score. |

More purchasing power: Customers can buy high-value products (luxury goods, electronic gadgets, or household appliances) and pay for them in parts, which gives them more purchasing options. | Payment errors: Customers who use split payment are more likely to misallocate funds or experience authorization issues, which makes the shopping experience less enjoyable and seamless. |

References:

- 56% of U.S. online buyers are inclined to buy more if they have more payment options.

- 93% of U.K. people cancelled up to ten shopping carts because their preferred payment method wasn’t available.

- 70% of consumers would buy from stores that offer their preferred payment methods.

- 28% of retailers see the high investment cost as a challenge.

- 74% of consumers choose split payments to manage their budgets better.

How to implement split payments in retail?

1. Research and select a solution

There are many split payment service providers out there and it can be overwhelming to choose the right one. Aside from cost, the payment processor you choose should be able to support many different payment methods. It also needs to be flexible in configuring payment options to meet the needs of both your customers and your business.

Additionally, you also need to find a suitable POS (point of sale) software that can integrate with your payment gateway to support split tender payments in your store. If you have an eCommerce business, you can choose options like Magestore’s POS with POS for Magento and POS for Shopify to make checkout easier and faster in your physical stores. Magestore also offers integration with various payment terminals to help you easily implement split tender payments in an offline store.

Here are some examples of split payment service providers you can consider:

- Stripe: With a Stripe POS, you can process the split payments in your brick-and-mortar stores. Effortlessly manage all the transaction information in your Stripe dashboard for quicker reconciliation.

- GoCardless: You have access to a wider range of payment methods. You also can offer Direct Debit payment, which means your customers can pay with funds taken directly from their bank accounts.

- Payrails: If you have stores in multiple countries, Payrails offers customizable SDKs (Software Development Kits) to localize your checkout process.

- Adyen: Adyen allows you to automatically implement your billing logic for every transaction, like deducting commission and transaction fees. This means you don’t need to give the payment gateway split instructions for each order.

- Square: You can implement split tender directly via Square’s POS app or its virtual terminal on your online Square Dashboard. Aside from manual splitting, you can use the Smart Split function to automatically divide the transaction into smaller portions.

Further reading:

- 7 POS to integrate with Stripe

- 7 POS to complement Adyen terminal

- 8 Square POS integration

- Buckaroo POS for Magento retailers in the Netherlands

2. Integrate with your retail system

If you have an eCommerce platform, make sure to integrate the split payment system with your Address Verification Services (AVS) so you can verify billing addresses. In an offline store, you also need to consider how the system works with your existing software and hardware infrastructure.

3. Set up payment options

In your checkout process, you’ll need to specify the payment methods you’re supporting, which payment plans you can offer (such as installment or deferred), and other aspects based on your customers’ and business needs. Make sure to align between your online and offline stores to create a consistent shopping experience for your customers.

4. Design user interface (for eCommerce)

Work with UI designers to create a checkout page with instructions on how customers can split their payments. Your checkout page needs to have:

Clear, easy-to-follow information: Use straightforward language and visual cues. Make sure to highlight any limitations, restrictions, or important information.

Security indicators: Use trust badges, security seals, or SSL (Secure Sockets Layer) to show customers your platform is secure and encrypted.

Mobile optimization: Use responsive design to accommodate customers who shop on smartphones or tablets. Choose simple designs that can be adapted to smaller screens.

Split tender customization: Allow your customers to customize how they pay for their purchases — for example, dividing the total amount into equal or unequal amounts or selecting installment plans.

5. Train your staff (for offline stores)

Help your staff understand how to use the POS system to process split tender transactions. You’ll also need to conduct training on when and how to offer customers this option, how to deal with complaints and technical issues, handle different payment methods, and process refunds.

6. Test and optimize

Before the official launch, remember to test your payment system first to identify and resolve any issues. As you roll it out, it’s important to keep improving your system based on customers’ and employees’ feedback.

How to split payments on Magestore POS?

You can process split payments for in-store purchase with Magestore POS effortlessly. Or you can allow customers to buy online and pay at the store with this payment option to increase sales. Let’s see how to process split transactions on Magestore point of sale.

Here’s the main flow:

- Cashier opens a session and check out orders as usual: Log into POS > Checkout > Add Products to Cart

- Cashier clicks on the payment button that has the checkout price.

- Add Discount and Shipping information if needed

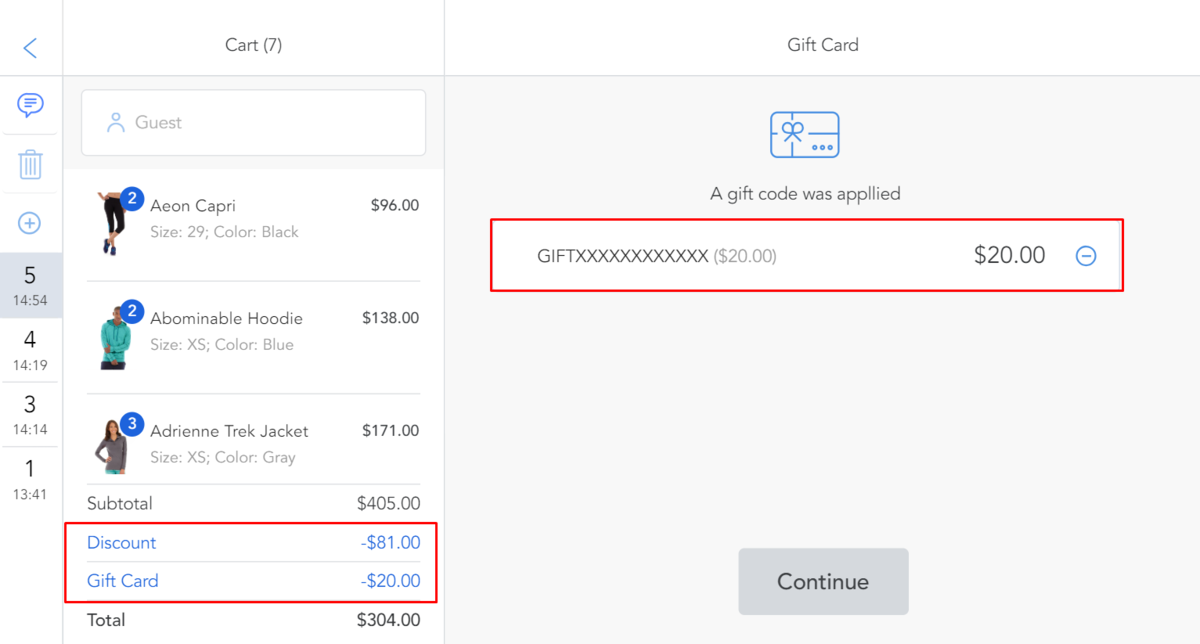

Check out orders with discount and gift card on Magestore POS

We’ll discuss some of the most popular scenarios you may encounter daily in the following.

Case 1: Your customers want to pay with different payment methods for 1 order.

Your staff can choose and fill out the amount of money for each kind of payment method the customer would like to split.

The shopping cart is $304 in total. The customer wants to pay $100 in cash and the remaining amount of $204 with credit card.

- Staff enters $100 for cash and Mark as Partial and $204 for credit card payment.

- Click Complete Order and print Receipt

Split payments with cash and credit card on Magestore POS

Case 2: Your customers want to pay for the order partially now and pay in full later.

- Your staff can choose a payment method and fill out the amount of money the customer would like to pay, then click on Mark as Partial.

- Click Complete Order and print Receipt. The order status will be Processing and Partially Paid.

- When the customer comes back and completes payment, the staff clicks on Take Payment and completes the order.

Customers pay partially now and fully later.

Conclusion

In this article, you’ve learned what split payments mean, how they work, and how to implement them in offline and online stores. Split tender transactions are a great option to offer more flexibility and convenience, build better relationships with your customers, and increase sales. To successfully implement this, you’ll need to make sure you can create a smooth payment experience for your customers and that your staff or platform can handle split tender.

Further reading:

FAQs

1. Is split payment safe?

Split payment is safe when retailers and payment processors apply advanced security measures such as encryption protocols and secure payment gateways and comply with industry standards like PCI DSS Level 1. Most payment processors also have fraud detection and prevention systems to monitor suspicious activities in real time, verify payment details, and enforce additional authentication for high-risk transactions.

2. What does P2P payment mean?

P2P (peer-to-peer) payment is a way to send money directly to another person digitally. Popular P2P systems include PayPal, Venmo, Zelle, and Cash App. These platforms allow users to instantly transfer and receive money from their mobile devices using bank accounts, checking accounts, or credit or debit cards.

3. What does split amount mean?

Split amount means dividing the total purchase amount into smaller portions. Customers might want to split an amount when they want to pay using multiple payment methods, or different people want to pay for their own parts of the bill. These portions can be divided evenly or unevenly.

4. What are the differences between split payments, layaway, installment payment(s), deferred payments, and partial payments?

- Split payment refers to the process of settling a single transaction using multiple payment methods (e.g., cash, credit cards, debit cards, gift vouchers, bank transfers, etc.).

- Layaway is a payment option where customers pay a deposit to reserve an item and complete the rest of the purchase over time through installments. Unlike split tender, the customers only receive the items when they make all of the payments.

- Installment payment(s) is a way for customers to pay for their purchases in small portions over a fixed period. Customers can choose installments as a split tender payment option.

- Deferred payment lets customers buy right away and pay for their purchase later, usually in several installments and without interest. Unlike split tender transaction, which allows payment from multiple options, customers usually make deferred payments with one method.

- Partial payments mean paying less than the total amount of the bill. Customers or businesses would pay parts of the amount due and settle the rest when they receive their order. Unlike layaway, this method doesn’t involve making a series of payments.

5. How does a split payment gateway work?

A split payment gateway allows customers to pay for one transaction using multiple options. At checkout, customers choose how much they want to pay using their preferred payment methods. The gateway will then process the payment, draw the funds from each financial institution, and deposit them into the retailer’s account. The customers receive confirmation when this process is completed.