To date, a large number of companies across the globe, whether small or large, are using a Worldpay POS to combine the strength of Worldpay with the power of a POS system for effective business management.

With many well-known brands in different industries like British Airways, CocaCola, and Zara making up their customer list, Worldpay has established themselves as one of the most trusted payment processing providers in the world.

Outside of handling payments, using a Worldpay POS system helps streamline the overall operation of your business, from managing orders, and customers to monitoring inventory, and real-time data synchronization between sales channels for centralized management and control. With their widespread popularity, using POS with Worldpay also helps deliver international customers better payment services.

Nonetheless, finding a suitable integrated POS system might pose more challenges than expected. It not only requires a deep understanding of your business requirements but also your considerations of each POS’s functionality, prices, pros, and cons. In this post, we give you a sneak peek into what Worldpay offers their customers and compile a list of the 7 best POS that works well with Worldpay for your reference.

What is Worldpay and what does Worldpay do?

Worldpay is a U.S. merchant services and payment processing company that helps businesses of different sizes in a range of industries to accept and manage in-person and online payments. Worldpay has gained much global preference as they support 300+ payment methods, and 135 currencies in 146 countries. On average, the service provider processes up to 130+ million transactions daily for about 1 million merchants worldwide.

Now in partnership with Fidelity National Information Services Inc. (FIS), a global financial services provider, Worldpay also supplies a range of payment solutions, including virtual payment terminals, SoftPOS, and Pay by Link. More noticeably, the Worldpay team is willing to suggest suitable payment solutions based on their understanding of your business needs and promises to offer 24/7 support.

Does Worldpay have a POS system?

No, Worldpay doesn’t have a POS system.

Instead, the service provider brings to their customers SoftPOS—an Android mobile app to accept card payments—and Worldpay credit card processing terminal solutions for fast and secure payment processing. Merchants who use Worldpay’s services can choose to process payments using standalone terminals, Worldpay SoftPOS, payment gateways, or a complete POS solution depending on specific business requirements.

Let’s discover how Worldpay point of sale terminals, SoftPOS, and POS software are distinct.

Worldpay POS terminal solutions, Worldpay SoftPOS vs POS software

Worldpay POS terminals

Worldpay provides small businesses with point of sale credit card processing terminal solutions to accept card and mobile payments. Worldpay POS terminals come with OmniShield Assure, PCI compliance, EMV assurance, and more to ensure the ultimate protection of your data against fraud. You can use these POS terminals with your chosen point of sale systems as they can work seamlessly with different POS apps to process payments and simplify operations.

Worldpay SoftPOS

Worldpay SoftPOS is a payment app developed for Android mobile devices with NFC capability. With this Worldpay app, merchants can turn any Android device into a point of sale terminal to accept contactless payments via their cards, phones, or biometric devices. However, SoftPOS is not a standalone product, which means you’ll need to integrate your POS software with the Integrated Payment Server (IPS), Worldpay’s Electronic Funds Transfer (EFT) application before using SoftPOS.

POS software

POS software refers to an application that helps you manage your retailing effectively. It often connects with hardware devices like card readers, barcode scanners, and cash registers to process payments.

More than just accepting payments, it empowers you to monitor other components of your business, from managing inventory, sales, and employees to tracking customers and generating loyalty programs. Thanks to the ability to centralize and sync data across channels and locations, POS software can give you a comprehensive view of your business whether you’re selling online, in store, or across online and offline channels.

Let’s compare the key features, pros, and cons of Worldpay terminals, SoftPOS, and POS software to see which one best serves your business.

Worldpay terminal | Worldpay SoftPOS | POS software | |

Features |

|

|

|

Pros |

|

|

|

Cons |

|

|

|

Best for |

|

|

|

Top 7 retail POS software to integrate with Worldpay

Below we list the 7 best Worldpay POS in the ascending order of prices. Let’s take a look!

Point of sale | Key features | Pricing | Customer reviews |

Magestore POS |

| Magestore POS for Magento

Magestore POS for Magento

| 4.8/5.0 on Capterra

|

Bindo POS |

| Custom pricing | 3.8/5.0 on Capterra

|

RetailEdge POS |

| Starting from $495 | 3.8/5.0 on Capterra

|

ACE Retail POS |

| $1,175 | 4.4/5.0 on Capterra

|

Loyverse POS |

| From $0 – $25/ month | 4.8/5.0 on Capterra

|

Hike POS |

| From $59/ month | 4.0/5.0 on GetApp

|

Lightspeed POS |

| From $69/ month | 4.1/5.0 on Capterra

|

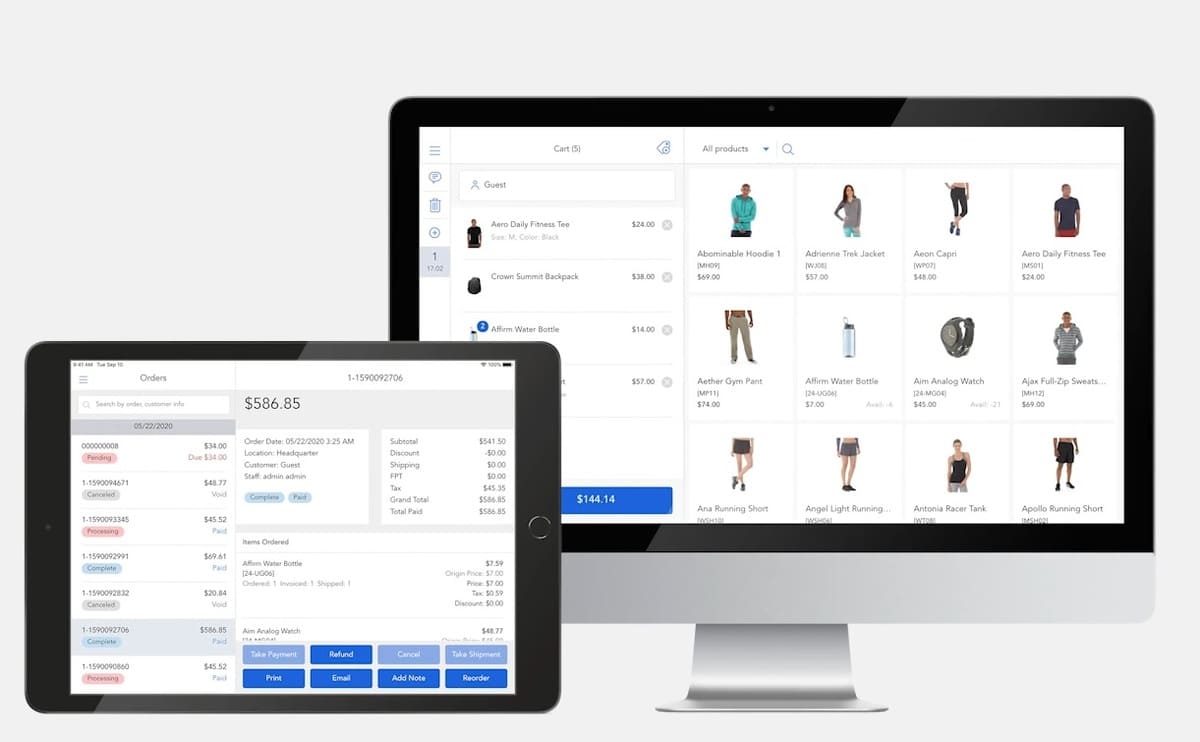

1. Magestore POS: Best for Magento omnichannel retailers of all sizes

Magestore Magento POS not only has robust built-in functionality but also a strong ability to customize and integrate with 3rd-party services, including Worldpay and other payment service providers. This is what makes the POS an optimal choice for retailers of all sizes, especially the ones wishing to elevate customer experience and expand business in the future.

This Worldpay POS stands out from other competitors with its capability to generate and process orders within 1 minute, thus reducing customers’ waiting times and allowing merchants to make more sales. In addition, the POS provides a wide range of useful tools to help you run and manage your retailing with great ease. Most noticeable features include multi-location inventory management, real-time data sync, omnichannel order fulfillment, and loyalty programs, to name but a few.

Magestore also develops a POS system compatible with Shopify with impressive functions at affordable prices dedicated to Shopify merchants. The POS works well on tablets and desktops and can integrate seamlessly with Shopify platform to sync inventory and provide omnichannel loyalty programs. Magestore’s Shopify POS also supports fast checkouts, refunds, discounts, and employee management.

Key features

- A web based POS that can work on any device and in offline mode

- Facilitate fast checkout by creating and processing orders within 1 minute

- Allow real-time sync of customer, order, and product data across channels

- Manage inventory across locations and channels

- Support multiple payment methods such as cash, debit cards, credit cards, split payment, layaway, buy now pay later, reward points, store credits, gift cards, etc.

- Support refunds, returns, exchanges

- Offer self checkout services and customer facing display mode for swift checkout

- Manage employee working schedules and performance

- Provide omnichannel order fulfillment options like store pickup

- Enable omnichannel loyalty programs like reward points, store credits, gift cards

- Connect easily with plenty of POS hardware

- Deliver real-time reports for detailed business insights

- Easy to scale and customize to your changing needs

- Integrate with 3rd-party services providers, including payments (Worldpay, Adyen, Stripe, Square), marketplaces (Amazon, eBay, Etsy), accounting (Xero, QuickBooks), ERP (NetSuite, SAP), shipment (ShipStation, FedEx)

Pricing

Magento POS pricing:

- POS Lite: $69/month

- POS Commerce: Custom pricing, one-time payment

- POS Customization: Custom pricing, one-time payment

The custom quote is subject to your business size, needs, and goals. You don’t have to pay for extra locations, users, and devices.

Shopify POS pricing:

- Lite: $15/month for 1 location only

- Standard: $50/month per location

Pros and cons

Pros | Cons |

|

|

2. Bindo POS: Best for small retailers or restaurants

Bindo POS is a Worldpay POS app that equips you with a variety of tools to supervise inventory flow and sync inventory data between stores. The POS also enables you to upload products in bulk using CSV or Excel spreadsheets. Additionally, Bindo POS offers smart registers to facilitate upselling and apply discounts automatically if specific conditions are met. Integrating well with Worldpay and other payment systems, the POS gives your customers the chance to choose their preferred payment options.

Key features

- Manage inventory transfers between warehouses and outlets

- Sync inventory data across multiple stores

- Give reorder suggestions and generate inventory replenishment alerts

- Retrieve all product information by scanning barcodes using Simple Scan

- Offer smart registers to facilitate upselling and automatically apply discounts

- Track daily sales, revenues, and profits in a single location

- Support gift cards, reward points, and discounts

- Deliver many retail reports for thorough analysis to increase revenues and profits

- Provide payment terminals, customer display screens, and other hardware

- Accept many payment types, including cash and mobile payments

- Integrate with payment processing services like Worldpay, eCommerce, and more

Pricing

You should contact the Bindo team for pricing details.

Pros and cons

Pros | Cons |

|

|

3. RetailEdge POS: Best for multi-store retailers

Aiming at retailers of different types, RetailEdge has many to offer. Using the POS allows you to manage inventory from multiple locations, track critical sales data, and gather important customer information for marketing. RetailEdge also automatically generates purchase orders based on stock quantity, thus saving a great deal of time and labor.

With RetailEdge’s ability to integrate with 3rd-party services, this Worldpay POS integration is as easy as pie. Other retail features like split payments, layaway orders, and loyalty programs also contribute to making RetailEdge a worthwhile option for business owners.

Key features

- Accept different payment methods like mobile payments and credit cards

- Support multi-location inventory management

- Automatically create purchase orders based on inventory quantity

- Support gift cards, store credits, time-based discount rules, and more

- Track sales performance by items, vendors, and departments

- Monitor and provide sales data like saved sales, layaways, and daily totals

- Offer mobile POS that can work in offline mode

- Sync customer, sales, and inventory data across locations

- Integrate with external services like payment processing, eCommerce platforms

Pricing

RetailEdge POS has a one-time price of $495. Besides, you can also choose a technical support plan as follows.

- Bronze plan: Free

- Silver plan: $5.00/workstation/month

- Gold plan: $45/month/location

Pros and cons

Pros | Cons |

|

|

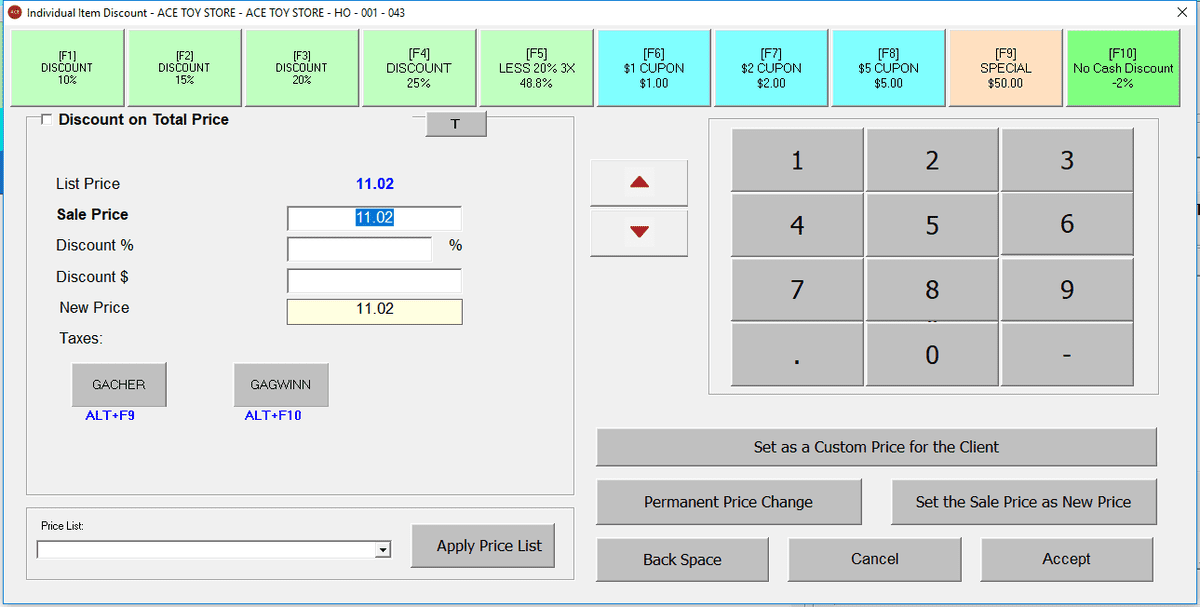

4. ACE Retail POS: Best for small and medium merchants

ACE Retail POS embodies numerous features to help you improve the operational efficiency of your business. With this POS, you can manage sales and inventory across locations from one place. Furthermore, ACE POS tracks and captures customer information, syncs data between online and offline stores, and offers detailed reports that assist in monitoring and operating your business productively. This Worldpay POS also integrates well with Worldpay to handle and manage payments.

Key features

- Generate multiple purchase orders based on minimum stock levels

- Track and manage purchase orders from start to inventory receiving

- Assign many barcodes for each item, including serial numbers, vendor barcodes

- Sync sales, customer, inventory, and payment data between online and offline stores

- Integrate with Google Ads to drive more sales

- Capture and organize customer data on purchase history, transactions

- Support customer loyalty programs like loyalty points, store credits, and discounts

- Manage sales and inventory across locations from one place

- Provide many customizable and detailed reports

- Integrate with payment services, accounting, and eCommerce

Pricing

ACE charges $1,175 for each of its software as a one-time fee. If you want to integrate with accounting, eCommerce, or payment services, you’ll have to pay integration fees. For example, you’ll have to pay $300 for QuickBooks or Sage integration.

Pros and cons

Pros | Cons |

|

|

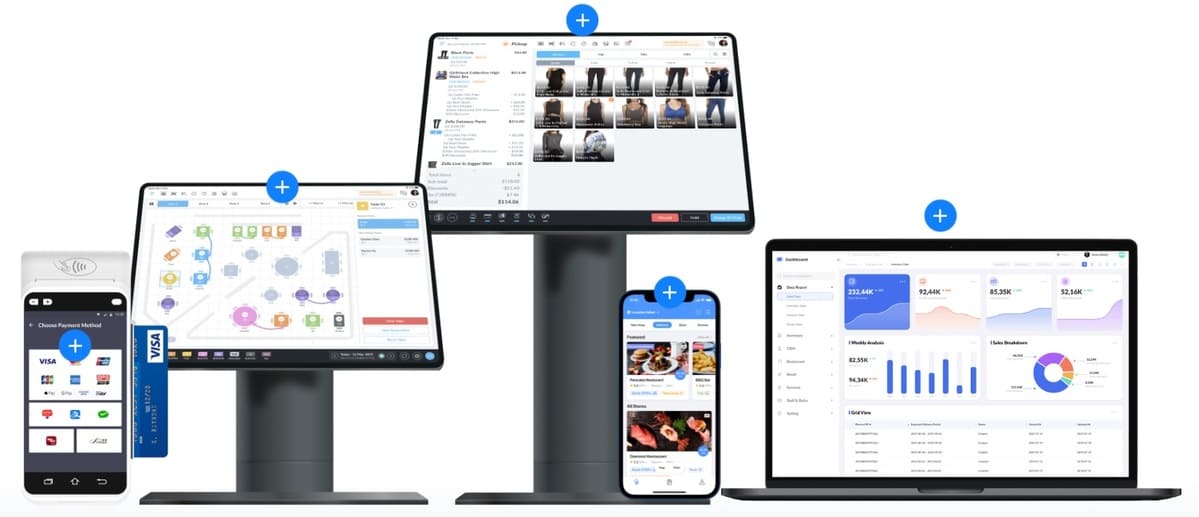

5. Loyverse POS: Best for small retail, restaurants, and coffee shops

Considered one of the most loved POS by many, Loyverse is a Worldpay POS that allows users to manage multiple stores from a single place in real time. The POS tracks sales and provides sales analytics to assist purchasing decisions, and supports cash flow control and loyalty programs. Besides, Loyverse POS can help you provide your customers with many Worldpay payment options by connecting smoothly with the service provider.

Key features

- Accept different payment methods, including cash, cards, cheques

- Enable users to find items, add notes, and apply taxes and discounts quickly

- Manage multiple stores from one account

- Manage employee working hours and sales performance

- Control cash flow with views on the history of pay-ins and payouts

- Let users set access rights for cash register users

- Track stock levels and notify of low-stock quantity

- Monitor sales over time and analyze sales by items for purchasing decisions

- Operate on Android and iOS smartphones and tablets

- Run in offline mode and auto sync data when the connection is back

Pricing

Loyverse POS is free. The POS only charges you fees if you use its addons whose prices are listed below.

- Unlimited sales history: $5/month per store

- Employee management: $5/month per employee

- Advanced inventory: $25/month per store

Pros and cons

Pros | Cons |

|

|

6. Hike POS: Best for growing retailers

Hike POS integrates well with Worldpay, together with other retail payment solutions like Square and PayPal, to provide your customers with more payment choices. Besides syncing products, customers, and orders between sales channels, this electronic POS makes it easy for you to keep stock levels, inventory movement, and purchase orders in check, thereby giving you complete control over your inventory. With Hike POS, you can also upload customer and product data in bulk using CSV files, collect buyers’ data, and offer them different loyalty programs.

Key features

- Integrate with many payment providers, including Worldpay, Square

- Accept many payment methods like contactless payments and loyalty points

- Monitor stock levels and inventory transfer between stores

- Enable importing and exporting products in bulk

- Support cross-channel order, customer, and product data syncs

- Enable refunds using customer’s original payment methods

- Enable importing customer data in bulk from CSV files

- Track customers’ purchase history and offer loyalty rewards programs

- Deliver reports on sales and transactions with powerful analytics

- Work in offline mode and on many devices

Pricing

Hike charges fees based on your region, the number of locations, and registers. The fees for 1 location and 1 register in the U.S. are as follows.

- Essential plan: $59/month if billed yearly and $69/month if billed monthly. The Essential plan doesn’t support integration with marketplaces, eCommerce platforms, customer loyalty programs, etc.

- Plus plan: $99/month if billed yearly and $119/month if billed monthly

- Enterprise plan: Custom pricing

Pros and cons

Pros | Cons |

|

|

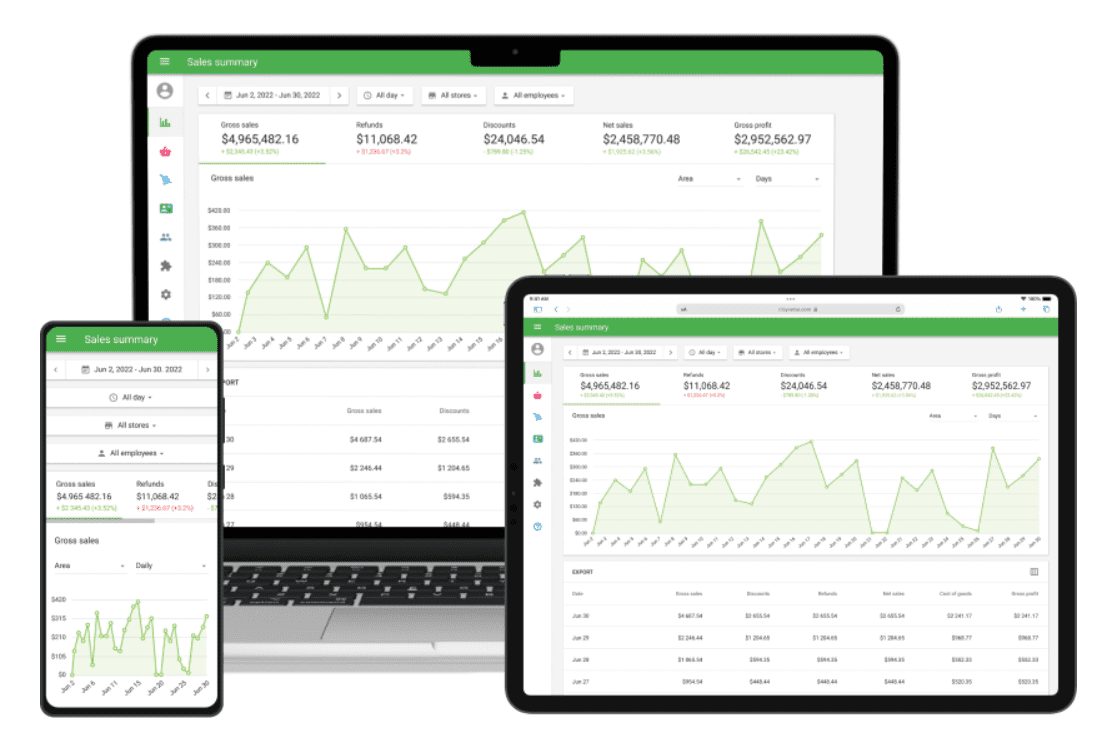

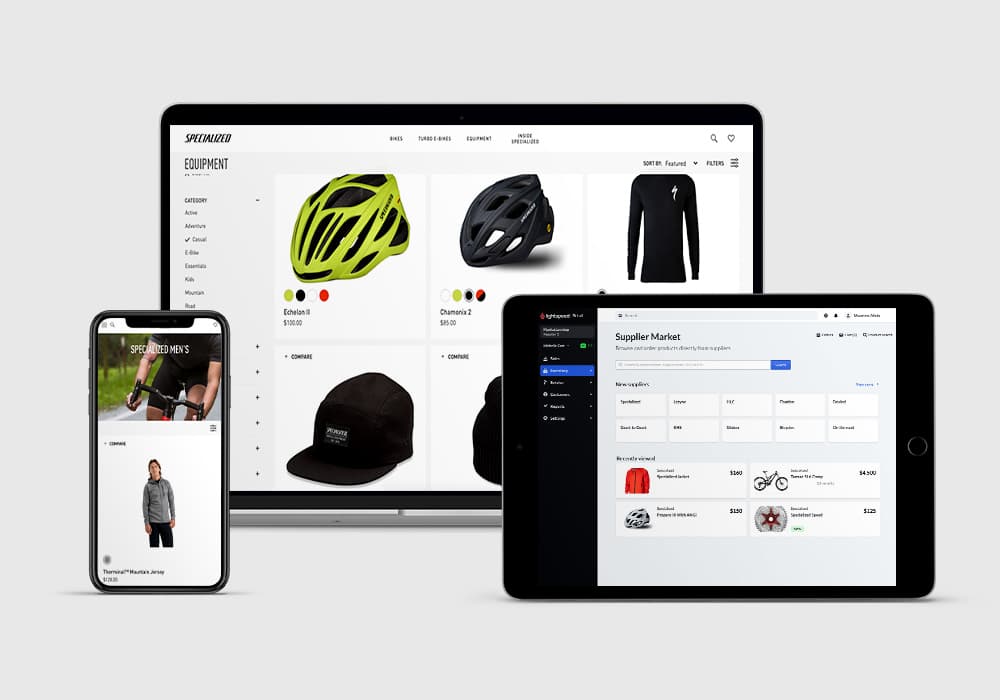

7. Lightspeed POS: Best for small and medium omnichannel retailers

Many business owners are no stranger to Lightspeed POS — a popular POS integrated with Worldpay. The POS has a rich feature set to help business owners operate their retailing, restaurants, and more with greater ease. Lightspeed POS lets you monitor stock levels from different locations, adjust product prices in bulk across channels, and add product information from suppliers using the B2B Catalog. Plus, this unified point of sale supports tracking customers’ purchase history and gathering their feedback for effective marketing.

Key features

- Manage customers, sales, and inventory across channels and stores

- Support managing purchasing for multiple locations

- Automate key product data from suppliers with B2B Catalog

- Support product import tools and bulk pricing changes across channels

- Provide diverse payment options like cards and digital wallets

- Offer omnichannel loyalty programs

- Deliver reports that can be customized and updated in real time

- Assist advanced marketing like automated customer segmentations, email marketing

- Enable selling products on social media platforms and online marketplaces

- Integrate with 3rd-party payment services and retail apps

Pricing

Lightspeed Retail POS costs change depending on your region, number of locations, and number of registers with 4 plans. Each plan fee consists of the base plan cost, additional location, and register fees.

For example, if you’re in the U.S. with 2 locations and 2 registers, then the 4 pricing plans are as follows.

- Lean: $138/month if paid annually and $178/month if paid monthly

- Standard: $238/month if paid annually and $298/month if paid monthly

- Advanced: $398/month if paid annually and $538/month if paid monthly

- Enterprise: Custom pricing

Pros and cons

Pros | Cons |

|

|

Which is the best POS for Worldpay?

The best POS for Worldpay is the POS that can integrate seamlessly with the payment service provider while having the necessary functionality to simplify your business operations and enhance your customer experience. Each of the above POS has their strengths and weaknesses that you should consider before making the final decision.

An ideal Worldpay POS can accommodate your business needs and fit your budget. In addition to determining what functions can help your business operate effectively, it’s worth looking into whether the POS is scalable and customizable enough to satisfy your changing demands in the future.

FAQs

What is POS integration?

POS integration refers to the connection between POS software and other external services, which ensures those systems can work smoothly with the POS and sync data.

What is a virtual terminal for processing credit cards?

A virtual terminal is payment software that allows you to process payments without using a physical POS terminal. Customers can use credit card virtual terminals to make payments via email, phone, or fax.

Is Worldpay secure?

Yes, Worldpay is highly secure. The service provider implements tokenization and offers many fraud protection solutions like OmniShield Suite to ensure data security and prevent data breaches.

What are Worldpay fees?

Worldpay does not publish their payment processing fees, so you need to contact them for pricing details. However, once you use Worldpay services, you can access fee reports to see Worldpay processing fees by category, payment methods, and presenter.

What companies use Worldpay?

Many companies in retail, airline, travel, and more are using Worldpay. The most popular names include Expedia, Lenovo, Qatar Airways, Agoda, and Amazon.

Meet the experts

Eden D.

Eden is a seasoned Magento expert and software solution architect with 10 years of experience. As a Magento Maintainer, his expertise extends to a profound understanding of cross-platform solutions. He creates high-quality solutions tailored to the exact needs of the customers, ensuring that the systems operate smoothly, efficiently, and securely.

Sophie H.

Sophie is Growth Manager at Magestore with over 5 years of experience in managing Magento and Shopify projects. She works directly with customers to understand their needs and challenges when integrating systems. Therefore, more than anyone else, she understands the intricacies involved and provides effective solutions for seamless integration.

Luna H.

Luna is Project Manager at Magestore with over 10 years of experience. She holds a Master's degree in Information Technology and leads the forefront of Magestore's solutions. Her extensive understanding of product values, customer demands, and the pros and cons of various solutions on the market provides practical insights for Magestore's product development to align with the evolving customer needs.